Investment platform Freetrade has been acquired by FTSE 250 firm IG Group Holdings plc in a deal worth £160m.

The acquirer, a derivatives trading firm, said the transaction – all-cash and funded by existing resources – will strengthen its UK trading and investments offering.

Both firms are headquartered in London.

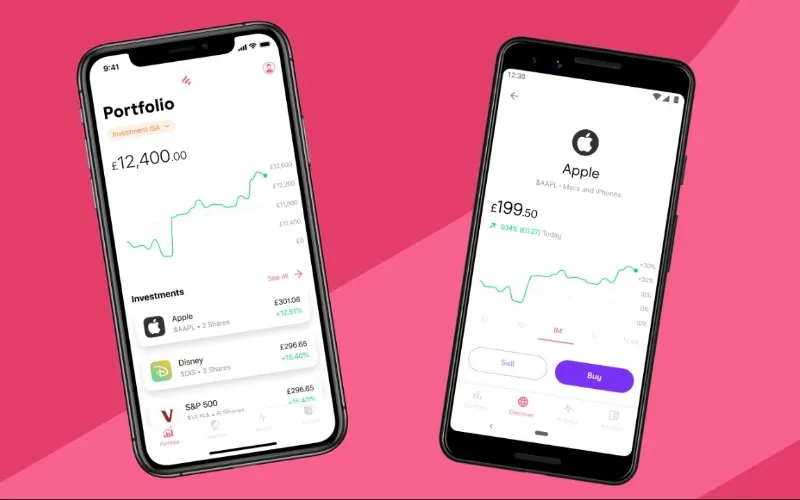

Freetrade – which was said to be coveted by JP Morgan in 2022 – gives investors access to more than 6,200 global stocks and ETFs, fractional shares, UK Treasury bills, ISAs, SIPPs, securities lending and proxy voting via a subscription platform.

IG Group pointed to the growing popularity of self-directed investing, greater individual responsibility for retirement planning, increased pension freedoms and growing financial literacy in a notice to the London Stock Exchange announcing the deal.

“This is an exciting opportunity to accelerate our growth and delivery of new products and features on our award-winning platform,” said Viktor Nebehaj, CEO and co-founder of Freetrade.

“IG’s vision for Freetrade is closely aligned with our own and its backing will be of huge benefit as we continue to scale the business.”

Launched in 2018, Freetrade has become one of the most successful emerging players in the UK market with 720,000 customers and Assets Under Administration of £2.5bn.

In 2024, its revenue increased 32% year-on-year to £27.5m, with positive EBITDA for the first time.

“This is a rare opportunity to strengthen IG’s UK trading and investments offering and broaden our target addressable market,” said Breon Corcoran, CEO of IG.

“Freetrade is one of the most successful emerging players in the UK direct-to-customer investment market, with a strong brand, highly scalable technology and delivering rapid growth.

“I am delighted that Viktor and his team will join IG and continue to lead Freetrade.”

IG said it will operate Freetrade as a standalone business with its own brand, existing management team and operational platform.

Completion is subject to customary conditions including regulatory approvals and currently expected in mid-2025.

Synthesia raises huge £146m to become UK’s most valuable GenAI firm