Matt Moulding is not the sort of parent to have a favourite child.

The 52-year-old family man is a proud father-of-four and regularly posts updates about his offspring on social media.

However, if he was asked to identify the favourite member of his THG family, most people believe he’d choose THG Ingenuity.

Ingenuity is the ‘digital commerce solution’ arm of the business and is built around the three pillars of ‘technology, digital marketing and operations’.

THG Beauty and THG Nutrition might be the profitable bits of the business but it’s Ingenuity – the cash-burning digital tech commerce platform – that really gets Moulding’s beans jumping.

That’s why THG’s announcement last week to the London Stock Exchange that it plans to demerge Ingenuity from its eCommerce business was so seismic.

Moulding told the LSE: “After extensive discussions with shareholders over the past 12 months, THG is progressing options to demerge THG Ingenuity, leaving our highly profitable and cash generative global Beauty and Nutrition businesses within THG plc.”

The announcement did nothing to reverse the company’s share price – which currently stands at 52p and a market cap of £700m – but it did prompt a slew of headlines and fresh speculation.

Will the move appease investors? What is the future of Ingenuity? Is Moulding preparing to say goodbye to his problem child – or is it all part of his masterplan?

To try to find the answer I’ve spent the last week getting into the heart of THG, canvassing the views of staff (past and present) and speaking to several well-placed analysts.

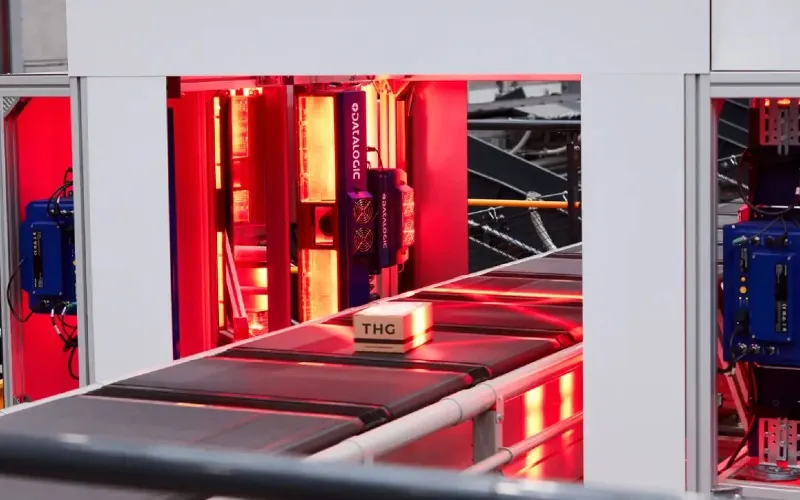

THG have partnered with Norwegian robotic giant Autostore

For the record, I also reached out to Moulding but he’s not commented beyond his statement to the LSE. Even his LinkedIn platform, famous for his punchy posts, has remained unusually quiet.

According to the people I’ve spoken to, Ingenuity is either a global game-changer ripe for take-off or a ‘poor man’s Shopify’.

What’s more clear-cut is that last week’s announcement to the LSE came as no surprise to anybody within THG.

“Internally Ingenuity has been treated as a separate business for 18 months,” I was told by one Ingenuity source.

There’s even a special project internally to separate the three businesses and run them independently.

It’s also clear that the plan to split Ingenuity off from the core business makes a lot of sense.

Ex-Betfred finance director Barry Nightingale, who was the only person I interviewed who agreed to be named on the record, said: “Classic sum of the parts [being] greater than the whole.

“THG have been juggling two disparate shareholder communities and suffered from lowest common denominator syndrome.

“It’s obvious when you look at their markets: tech services and solutions B2B; branded digital B2C retail.

“Split management will be focused on each end goal = happy shareholders (when they execute).”

However, to fully understand the Ingenuity story, we need a quick recap by going back to 2004 when Moulding and John Gallemore co-founded the business – then called The Hut Group.

According to the official blurb at the time, the startup “offered a variety of home entertainment and lifestyle products, such as DVDs, Blu-ray and CDs, as well as lingerie, cosmetics and sports and leisure equipment”.

However, the business pivoted towards beauty and nutrition and in 2011 bought Myprotein from Oliver Cookson for an initial £58m. It’s now the world’s largest online sports nutrition brand.

Today THG Beauty’s burgeoning retail websites include Lookfantastic, Dermstore, Cult Beauty and GLOSSYBOX.

Having two flourishing divisions might satisfy most entrepreneurs but Lancashire-born Moulding is not your typical entrepreneur and saw the opportunity that technology presented – and so THG Ingenuity was born.

“What Matt is good at is financial re-engineering,” said a former THG staffer. “Matt had the nutrition and beauty businesses but he wanted a third arm of the business. He liked the multiples that go with technology.”

One senior analyst, who spoke to me on the condition of anonymity, added: “Matt realised Ingenuity could sell products for other people. It could offer best rates for courier services.

“The reason Matt loves Ingenuity is they take a revenue share of the retail business of their customers.”

He described Ingenuity as “3PL (third party logistics) with bells and whistles”.

It’s at this point that opinions about the potential of Ingenuity vary wildly.

THG founder says building a business is like TV’s Squid Game

The case against Ingenuity was summed up by a former THG staffer.

“If THG was listed as a nutrition and beauty product business it would fly,” he said. “Both businesses are profitable with an EBITDA between 10-15 per cent.

“The issue is THG tried to create a story around Ingenuity. They’re spending millions of pounds on Ingenuity to create a tech platform but Shopify is already out there.

“Ingenuity is burning loads of cash. It doesn’t appeal to investors. 75 per cent of its business comes from Myprotein and the beauty division. They’re so entwined it won’t be straightforward to unpick.

“If you compare Ingenuity to Shopify, Shopify wins.”

A senior analyst admitted: “God knows what the investment capital is in Ingenuity but it’s massive. There’s an argument that if Ingenuity was sold for £1 it would be a good deal. Clearly that’s not going to happen.”

However, there’s plenty of support for Ingenuity.

THG Beauty and THG Nutrition do provide the bulk of Ingenuity’s revenue but they’re both on long-term contracts – thought to be in the region of 10 years.

Of more relevance is THG’s latest client wins and its burgeoning relationship with Norwegian robotics giant AutoStore.

Ingenuity has changed its approach by going after the bigger customers and focusing on the fulfilment element.

As a result its client roster now includes the likes of Nestlé; Coca-Cola; Mondelēz International (owners of Cadbury); L’Oréal; Kraft Heinz; Homebase; Matalan; Holland & Barratt; and Procter & Gamble.

Those successes are underpinned by THG Ingenuity’s tie-up with AutoStore.

Last year THG Ingenuity signed a global distribution partnership agreement with AutoStore to “provide the company’s technology on a pay-per-pick model embedded alongside Ingenuity’s proprietary warehouse management, courier and optimisation software”.

John Gallimore, head of operations at THG, waxed lyrical about the difference AutoStore has made here.

AutoStore is famous for its robotic cube technology, which maximises storage space in warehouses, and received a $2.8bn investment from SoftBank in 2021 for a 40% stake in the business.

The company’s technology has completely transformed THG’s enormous distribution warehouse near Manchester Airport.

THG has partnered with AutoStore

One member of THG Ingenuity’s staff explained: “They can turn 500,000 sq ft of traditional warehousing space into a Rubik’s Cube of modern warehousing space.”

Another analyst added: “It’s a pick and despatch that works almost without people.”

The results have been transformational with a 40% cut in labour costs, a reduction in distribution costs and an extension to the cut-off point for next day delivery – all of which can be offered to customers.

This has fuelled speculation that AutoStore could be about to strengthen its relationship with Ingenuity and the fact that AutoStore chose THG to host its latest Capital Markets Day last week will do nothing to dispel the rumours.

Earlier this year THG embarked on a cost-cutting exercise, announcing a raft of redundancies.

They’ve also had issues with customer retention but one Ingenuity source said things have improved as they’ve understood the market better.

“Ingenuity is capable of handling £14bn of sales,” said the insider. “It’s really starting to hit its straps. The sky’s the limit. Anyone could put their fulfilment through us.

“Shopify is good at the commerce but they rely on partners for the rest of it, unlike Ingenuity.

“Ingenuity is a vertically integrated technology stack. As a brand owner we’ve built it through 20 years of learning.

“Brands can plug and play into Ingenuity and get access to an international footprint which is best in class.

“CEO Richard Ward (who joined in May 2024) has a track record of scaling multiple tech businesses while chairman Alistair Crane is a multi-exited tech founder. The mood is good.”

So does last week’s announcement change anything and what will Moulding do next?

One former THG staffer is unconvinced. “The announcement of the demerger is the news that everybody has wanted to happen,” he said.

“If it’s privatised it doesn’t take the problem away. The real solution would be closing it down and moving everything over to Shopify. That would take a huge amount of cost out of the business.

“It’s a really hard conundrum. Myprotein and beauty are profitable but Ingenuity is going to keep burning cash.

“Shopify is so cheap. If someone can do it for a fraction of the price why wouldn’t you do it?

“If a new CEO came in and shut down Ingenuity you could argue that THG’s valuation will go up to £1.5bn – which is double its current valuation. It will never return to its IPO value (of £5.4bn).”

There’s no timescale for the demerger but analysts suggest it will take between three-five years for Ingenuity to break even.

In an uncertain world the least likely option appears to be Moulding turning his back on Ingenuity.

“Separating the business has always been in the plan but Matt has gone early,” an Ingenuity source told me.

“Personally I thought he’d take the business private first and then do it before floating on the Nasdaq, where they appreciate the value of technology.”

- Chris.maguire@businesscloud.co.uk