For over 100 years, Rolls-Royce has been a byword for quality and British engineering prestige.

In recent years and under its new boss, however, the company is chasing a new kind of status.

Since Tufan Erginbilgic took over as the firm’s CEO, its share price has rocketed ten-fold and it is now aiming to become the UK’s number one company.

The plan centres on a bold shift into nuclear power, with small modular reactors designed to fuel the booming world of AI.

It is a far cry from the initial foundations of the iconic British business, but so far it has been effective.

Excellence in engineering

Founded in 1906 by Charles Rolls and Henry Royce, Rolls-Royce began life as a luxury car manufacturer before branching into aircraft engines during the First World War.

Over the decades, its name became synonymous with the peak of British engineering, even as the automotive arm was sold to BMW in the 1990s.

The modern Rolls-Royce Holdings is a very different business to its early incarnation.

Today, it is a global powerhouse in aerospace propulsion, defence engineering and, increasingly, nuclear energy.

Rolls-Royce unveils Space Micro-Reactor model for Moon exploration

For much of the early 2020s, however, the company’s once-polished image had begun to dull.

Mounting debt, thinner profit margins and widespread redundancies left the group struggling to convince investors.

When Erginbilgic took over as chief executive in January 2023, he described the company as ‘a burning platform’.

The former BP chief inherited a business with a 12% cost of capital and just a 4% return on investments – a combination that meant ‘every time we invested we destroyed value’.

The turnaround

Fast-forward to 2025, and the transformation is striking, with Rolls-Royce expecting annual profits to top £3bn.

Debt has also been slashed and its share price has climbed more than 1,000% to 1084p since Erginbilgic’s arrival.

That surge has turned the FTSE 100 stalwart into one of the UK’s most closely watched growth stories, outperforming both the wider market and many of the world’s tech giants over the same period.

The rebound owes much to a post-pandemic boom in commercial aviation, where the firm dominates the market for wide-bodied aircraft engines, along with a rise in European defence spending.

Erginbilgic’s laser-focus and willingness to pursue high-value new markets have benefited the business and taken it to new heights.

Although early moves such as job cuts drew criticism from trade unions, with Unite boss Sharon Graham accusing the company of ‘appeasing the markets and its shareholders while ignoring its workers’, overall headcount has grown from 43,000 to 45,000 since 2023.

Industry insiders now credit him with a third of the company’s revival, alongside favourable market conditions and groundwork laid by his predecessor Warren East.

Small modular reactors

The company’s boldest pivot lies in nuclear energy.

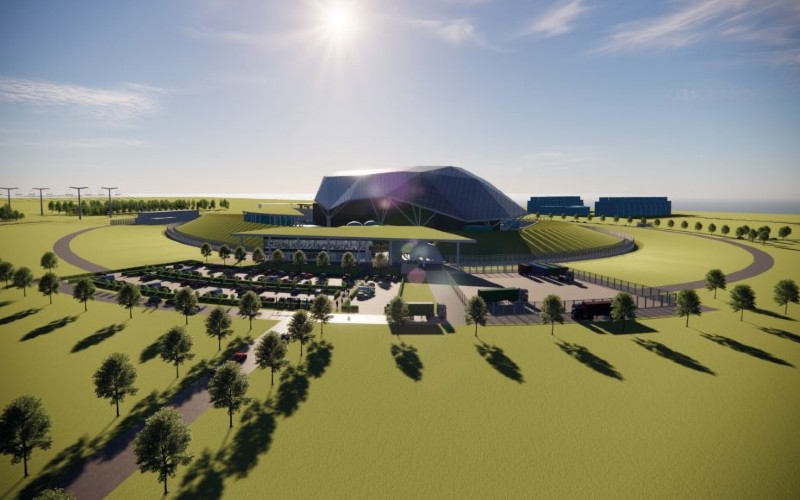

Rolls-Royce has long supplied the reactors powering the UK’s nuclear submarine fleet, but is now adapting that expertise for civilian use through small modular reactors (SMRs).

These are compact nuclear plants designed to be faster to build and cheaper to operate than traditional large-scale reactors.

Erginbilgic told the BBC: “Rolls-Royce’s plan to power AI with its nuclear reactors could make it the UK’s most valuable company.

“There is no private company in the world with the nuclear capability we have.

“If we are not market leader globally, we did something wrong.”

The company has already secured deals to build six SMRs for the Czech Republic and three for the UK.

Globally, Erginbilgic estimates the need for around 400 SMRs by 2050, each costing up to £2.2bn and making it a potential trillion-dollar market.

Similar agreements in the US have already seen tech giants like Google, Microsoft and Meta commit to sourcing future SMR power for their data centre operations.

The Alan Turing Institute: behind the unrest at the AI powerhouse

Nuclear power meets AI’s energy demands

The move into SMRs aligns with the UK’s wider push to expand nuclear capacity.

The government’s £14.2bn commitment to the Sizewell C nuclear plant, the first major build of its kind since the 1990s, is representative of this shift, with the project expected to power 6m homes and create around 10,000 jobs.

Beyond meeting domestic electricity needs, nuclear power is increasingly seen as a solution to the huge energy demands of AI.

Since the technology’s surge in popularity from 2022 onwards, its appetite for electricity has drawn both environmental and practical concerns.

Data centres already account for roughly 2.5% of UK power usage, a figure projected to rise to as much as 6% by 2030.

The government’s AI Opportunities Action Plan includes £25bn for new data centre infrastructure, as well as initiatives to link AI growth directly to secure energy sources like SMRs.

Without such measures, high electricity costs and grid constraints risk undermining the UK’s ambition to become a global AI hub and compete with the likes of the US.

Competition in the skies

While nuclear energy could majorly impact Rolls-Royce’s future, the company is also pushing into the competitive arena of narrow-bodied aircraft engines.

This market, nine times larger than that for wide-bodied planes, is currently dominated by CFM International, a joint venture between GE Aerospace and France’s Safran.

Rolls-Royce is a minor player here, but Erginbilgic has called it ‘the single biggest opportunity for the UK for economic growth’, insisting that no other domestic prospect can match its scale.

From recovery to rewards

From a near-existential crisis just two years ago to becoming the fifth-largest company on the FTSE 100, the company’s turnaround has already become an eye-opening one.

However, the brand’s CEO has faith in it reaching the summit of the prestigious index.

“We are now number five in the FTSE,” he noted.

“I believe the growth potential we created in the company right now, in our existing business and our new businesses, actually yes – we have that potential.”