Money-saving FinTech Snoop has created an automated and personalised budgeting service for consumers.

Using secure open banking technology, it claims users can be up and running in just two taps with a real-time budget based on average spending across all their finances.

According to the Financial Conduct Authority’s Financial Lives 2022 survey, almost 13 million UK adults now have low financial resilience. There are many combining factors that result in low financial capability and resilience. One of them is not having a budget or having an inaccurate budget.

Snoop, second on our FinTech 50 ranking last year, aims to give consumers a complete view of their finances and provide personalised insights to help them make the most of their money.

The new budgeting service creates a personalised budget for each customer based on their transaction data. This helps them prioritise spending or saving in specific areas, make better financial decisions, and build financial resilience.

Archna Luthra, marketing director at Snoop, said: “A good budget is essential for effective financial management. It can help us achieve our financial goals, avoid debt, and feel less stressed and more empowered when it comes to spending on the things that matter to us.

“However, creating a budget can feel overwhelming. Snoop’s two tap budget feature allows you to quickly set up a personalised budget based on your actual spending, and easily adjust and reflect on it until you find the sweet spot of financial freedom.”

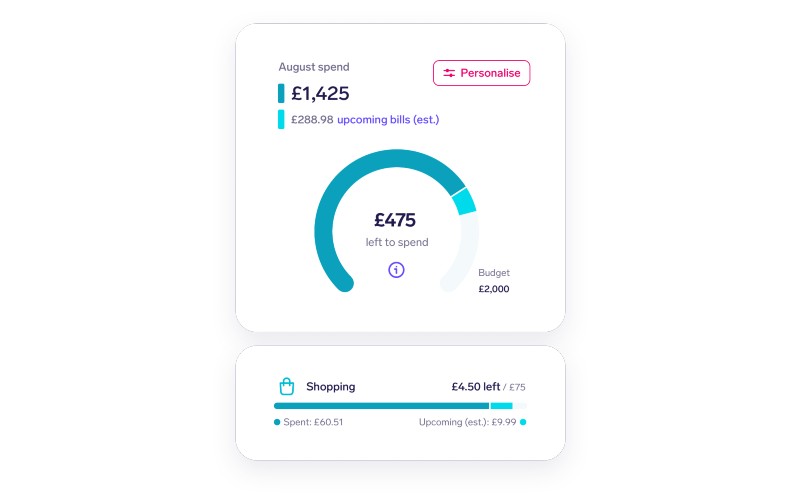

The budgeting service builds an instant budget based on three months of spending, provides users with actual spending patterns to help create bespoke budgets and anchor budget-setting decisions, and includes forecasts of committed spending – such as bills and subscriptions – throughout the month to help avoid overspending.

It also alerts users when they hit 50% and 100% of their budget along with ongoing coaching, alerts, personalised tips and visuals.

FinTech 50 – UK’s most innovative financial technology creators for 2022

Luthra added: “Our new budgeting service comes at a time when people are really feeling the full force of the cost-of-living crisis and may be having to make difficult choices to make ends meet. Higher prices mean you need to be more strategic about finding ways to stretch your income.

“If you love the idea of a budget to keep your spending in check but don’t have the time, energy or expertise Snoop can now create an instant, personalised budget in two taps and help you track your progress – all for free. We hope it will help them spot where they can save based on what’s important to them.”