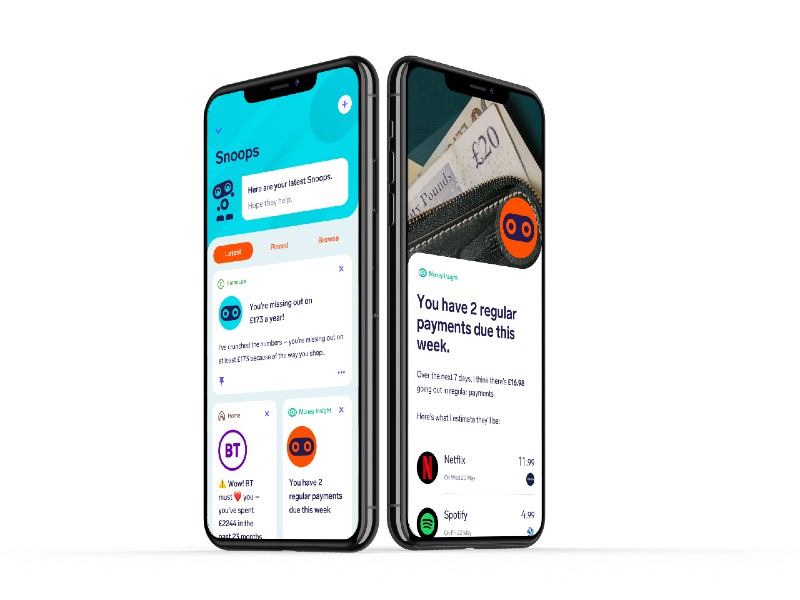

Snoop is a data-driven, award-winning fintech platform designed to help customers save money, make better financial decisions, and navigate the cost-of-living crisis. Founded by a team of former Virgin Money colleagues, Snoop leverages Open Banking and AI to deliver a personalised experience that targets annual savings of up to £1,500 per user. Eight out of ten users find it easier to manage their finances and 93% recommend it to others.

Transforming Money Management

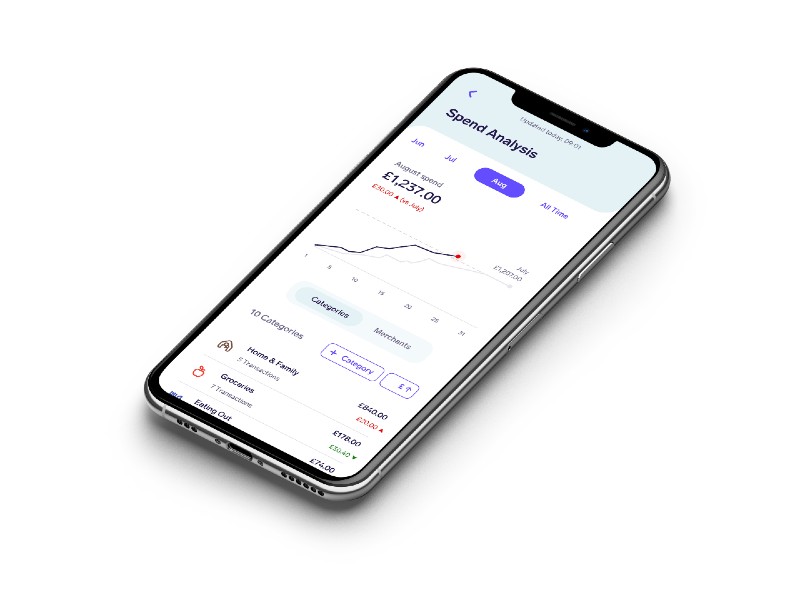

In a challenging economic climate marked by rising costs and financial uncertainty, Snoop goes beyond traditional budgeting tools. The app provides users with actionable insights to set budgets, track spending, save money, and avoid fees. As the first UK app to integrate credit score monitoring within a money management platform, Snoop offers a comprehensive approach to financial wellness, ensuring core features remain accessible to all through its freemium model.

Driving Business Insights with SpendMapper

Snoop also empowers businesses with actionable insights through SpendMapper, a self-service business intelligence platform launched in 2023. Using over £200 billion in real-time spending data, SpendMapper provides instant visibility into consumer behaviour across sectors. Its intuitive dashboard allows businesses to refine products, tailor marketing strategies, and improve customer experiences. Clients already benefiting from SpendMapper include major supermarkets, retailers, media and data analytics firms.

John Natalizia, CEO and cofounder of Snoop, explains: “Snoop is uniquely positioned as both a consumer and business solution. Our app helps individuals save money and build financial confidence, while SpendMapper transforms raw data into meaningful insights for businesses. This dual approach exemplifies our innovative use of technology to create real value in the UK market.”

A New Chapter with Vanquis Banking Group

In 2023, Snoop was acquired by Vanquis Banking Group, a leading specialist bank, to further enhance its mission of empowering financial well-being. The acquisition marked an exciting chapter for Snoop, as it combines its innovative technology with Vanquis’ support for underserved customers and focus on financial inclusion. Together, we aim to deliver even greater value to customers and drive meaningful change in the UK’s financial landscape. Now part of Vanquis Banking Group, Snoop combines cutting-edge technology with a shared mission to empower financial wellbeing, setting new standards in personal finance and making a positive difference for all.