Raspberry Pi has revealed its cornerstone investors and confirmed it will list on the main market of the London Stock Exchange next month.

In a boost for the UK public markets, the Cambridge firm – behind low-cost miniature computers used extensively in education – said it will IPO sometime in June.

It will raise more than £31 million by listing, with the funds to be used “for engineering capital expenditure, to enhance its supply chain resilience and for other general corporate purposes”.

Chipmaking giant Arm has committed to purchasing around £27.5m worth of shares, while Lansdowne Partners will buy more than £15m.

Immediately following admission, the company expects that it would be eligible for inclusion in the FTSE UK indices.

“With a shared vision to lower barriers to innovation and make computing accessible for everyone, Arm and Raspberry Pi are natural collaborators – and as demand for more compute and AI at the edge grows, Raspberry Pi’s solutions will continue to drive the adoption of high-performance IoT devices,” said Paul Williamson, senior vice president and general manager, IoT line of business at Arm.

“Following our strategic investment in the business last year, we look forward to increasing our stake as Raspberry Pi steps into this new exciting chapter.”

Cazoo, once valued at £5bn+, to collapse into administration

Peter Davies, partner & head of developed markets strategy at Lansdowne Partners, added: “We are delighted to continue to support Raspberry Pi in its IPO. Since our initial investment three years ago, we have been incredibly impressed by the team and everything they have achieved with the business, and we are very excited about both the commercial and social impact they can continue to deliver in the future.”

Sony – which manufactures the Pi computer boards at its factory in south Wales – and Ezrah Charitable Trust are among its other existing investors. The Raspberry Pi Foundation – a charity founded to empower young people through computing and digital technologies – holds a majority stake in the business.

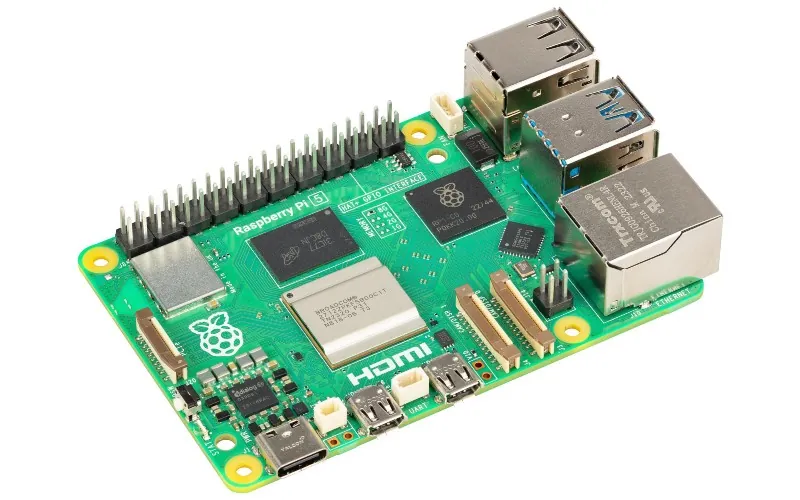

Launched to the market in 2012, Raspberry Pis – now in their fifth generation – are used widely in education and also have many other applications, such as powering retro gaming systems.

Founded by computer scientist Eben Upton, Raspberry Pi employs almost 100 people. In 2022 it generated £154m, with operating profit of £16m.

The company originally planned to list in 2021 but that decision was delayed due to worsening market conditions and global chip shortages.

Martin Hellawell, non-executive chair of Raspberry Pi, said: “We are delighted to confirm our intention to float on the London Stock Exchange, underscoring our confidence in the UK as the home for innovative and growing global businesses.

“Raspberry Pi is a British computing success story, and this marks the next stage in the evolution of the company. Through the team’s dedication to excellence in high-performance, low-cost, general-purpose computing, Raspberry Pi has been transforming the global computing landscape since its first product was launched in 2012, successfully marrying a social agenda with commercial focus.

“The company’s strong financial track record has enabled it to distribute $50m to the Raspberry Pi Foundation to further their global educational mission, while providing affordable and exceptionally versatile computing platforms to support innovation by countless professional design engineers and Raspberry Pi enthusiasts around the world.

“We greatly appreciate the long-term support of our cornerstone investors, Arm and Lansdowne, and look forward to widening our shareholder base as we take the next steps in our journey.”