Listed FinTech Fiinu massively narrowed its operating loss for FY24, with it dropping from £7.2m in FY23 to just £700,000 this year.

The Surrey-based firm has also successfully cut its monthly expenditure from £600,000 to £45,000 in an attempt to streamline its operations.

The business was recently boosted after a £1.25m equity raise in February this year and it also appointed international finance veteran Dr Feyzullah Egriboyun as group CFO in March.

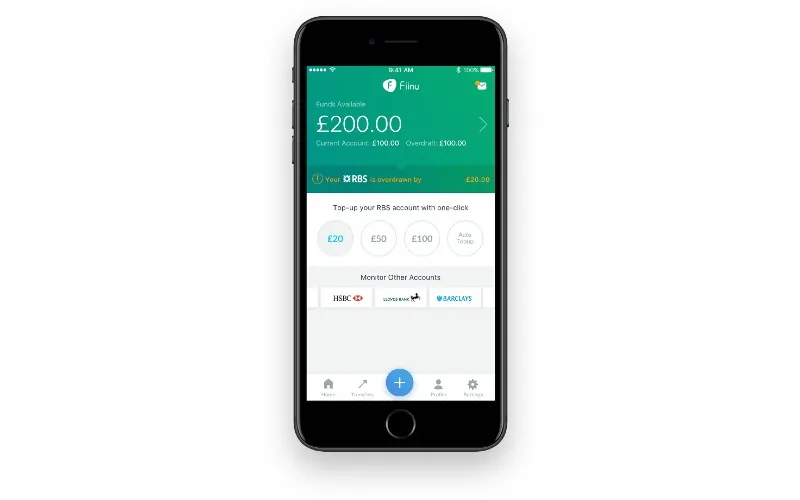

The equity capital raised was said to enhance its platform, Plugin Overdraft, which is set for launch later this year.

“2024 was a year of strategic transformation for Fiinu, defined by the return of our UK banking licence in 2023 and a shift toward a leaner, tech-focused business model,” said Dr Marko Sjoblom, CEO of Fiinu.

“We reduced our monthly burn rate from £600,000 to £45,000, safeguarded our core capabilities, and advanced our Plugin Overdraft technology licensing strategy. A key milestone was the signing of non-binding Heads of Terms with an independent UK bank in January 2025 to white-label our solution.

“Additional discussions are ongoing with other institutions exploring our software for retail and SME segments. These moves affirm growing market interest in our platform’s commercial potential.

“Our strategic lens has expanded to include digitally underserved SMEs and financial institutions across Europe, where our technology can enhance liquidity and customer engagement.

“Alongside this, we completed a £1.25m equity raise in February and secured a £511k R&D tax credit in May 2025, bolstering our financial runway to at least mid-2026. Strong governance remains a cornerstone, underscored by a positive board effectiveness review and key leadership appointments, including a new executive director and CFO in March 2025.

“With product readiness, licensing momentum, and funding in place, we are well-positioned to pursue revenue generation in 2025. We remain committed to building a resilient, innovation-led business that delivers long-term value.”

techUK report urges government to drive investment and growth

David Hopton, chairman of the Fiinu board, also commented that the firm remains committed to seeking funding opportunities despite the setback of returning its banking license.

He added: “Clearly the past financial year has not been an easy one for Fiinu but, with the recent fundraise and the plan to launch a white-labelled version of the Plugin Overdraft before the end of 2025, together with several initial and ongoing meetings with potential investors and with banks interested in licensing our product, the outlook has improved considerably since my last report.

“As we enter 2025, Fiinu stands at the threshold of a new phase, leaner, more focused, and strategically aligned to capitalise on emerging opportunities. With the groundwork laid through product partnerships, renewed investor engagement, and a broader commercial vision, we are cautiously optimistic about what lies ahead.

“Our efforts in licensing, governance, and strategic exploration have positioned us to shift from survival mode to sustainable growth. Finally, I would like to take the opportunity to thank all our shareholders for their patience and support and to reassure them that the board will be working hard to make Fiinu a successful and profitable business whose performance will be reflected in its share price.”

‘$150k Bitcoin price looks cautious’ – DeVere CEO on record price