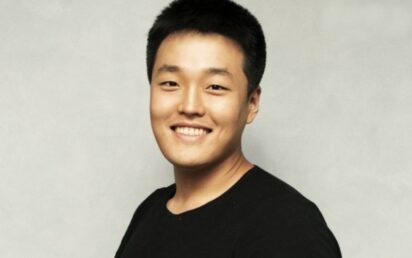

Do Kwon, the man accused of causing the $40bn cryptocurrency crash in 2022, has pleaded guilty to two criminal counts of fraud in the US.

Kwon is the former boss of Terraform Labs, which included the Luna cryptocurrency and ‘algorithmic’ stablecoin TerraUSD (UST).

Stablecoins are pegged to the value of a fiat currency such as the US dollar, serving as a relatively stable cryptocurrency somewhat sheltered from the potentially wild fluctuations of other cryptos.

Kwon had claimed that UST was pegged 1-to-1 to the dollar by means of an algorithm, automatically maintaining this value. However, when in 2021 UST’s price fell 10 cents below its $1 ‘peg’ and was not quickly restored, US authorities said this spelled ‘doom for the entire Terraform ecosystem, given that UST and LUNA had no reserve of assets or any other backing’.

Terraform Labs persuaded an unnamed US trading firm to buy UST to restore the peg, in exchange for Luna tokens – but the US alleges that the company and Kwon himself began to make materially misleading statements about how it was restored.

“Specifically, Terraform and Kwon emphasised the purported effectiveness of the algorithm underlying UST in maintaining UST pegged to the dollar – misleadingly omitting the true cause of UST’s re-peg: the deliberate intervention by the US trading firm to restore the peg,” the suit alleged.

The complaint also alleges that Kwon and Terraform falsely told their customers that Chai, the Korean electronic mobile payment app, used the Terraform blockchain to process payments.

The 2022 industry-wide sell-off triggered by the scandal led to an estimated $40bn losses for investors. Kwon and five other people went on the run and months later the CEO was one of two people arrested at an airport in Montenegro.

The duo was attempting to board a plane to Dubai with forged Costa Rican and Belgian passports, while reports said three laptops and five mobile phones were taken from them. Kwon was subsequently extradited to the US.

The Alan Turing Institute: behind the unrest at the AI powerhouse

The US is accusing Kwon and Teraform of “orchestrating a multi-billion dollar crypto asset securities fraud”. Now Kwon has admitted to making false and misleading statements.

“In 2021, I made false and misleading statements about why [TerraUSD] regained its peg,” he said in court on Tuesday. “What I did was wrong and I want to apologise for my conduct.”

Kwon had originally pleaded not guilty to nine counts – including securities and wire fraud, and money laundering conspiracy – and faced up to 135 years in prison if convicted.

As part of the plea deal, prosecutors have agreed to refrain from seeking a sentence longer than 12 years. However judge Paul Engelmayer has said he is entitled to impose a longer sentence of up to 25 years if he wishes to.

Kwon will forfeit up to $19.3m plus interest as well as several properties, and also pay restitution. He will be sentenced on 11th December.

He still faces charges in South Korea.

Revolut and Wise veterans raise £2.2m for startup Riva Money