Cryptocurrencies which had entered a downward spiral rebounded in the last 24 hours as the altcoins outperformed Bitcoin.

All major coins increased in value, including BTC after it briefly dropped below $40,000.

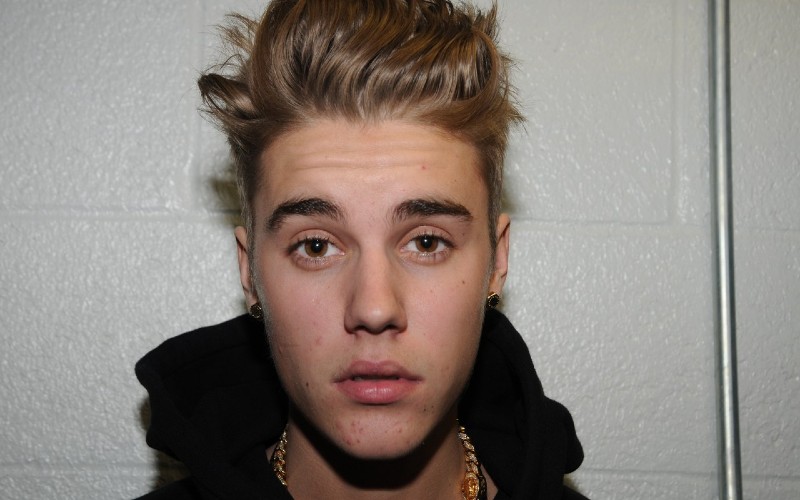

Crypto payments startup MoonPay, led by CEO Ivan Soto-Wright – whom we interviewed last year – raised $87 million from more than 60 high-profile investors including singer Justin Bieber, rapper Snoop Dogg, former tennis player Maria Sharapova and actors Bruce Willis, Gwyneth Paltrow, Matthew McConaughey and Ashton Kutcher.

The Miami-headquartered firm said the investments are part of the firm’s mammoth Series A round, revealed in November 2022, which valued the company at $3.4 billion.

Soto-Wright said MoonPay, which lets users buy and sell cryptocurrencies and non-fungible tokens using conventional credit cards, bank transfers and mobile wallets such as Apple Pay and Google Pay, expects content creators to increasingly use NFTs to market their work and engage with fans.

Will MoonPay NFT solution bring next billion people into crypto?

Meanwhile Circle Internet Financial, issuer of stablecoin USDC, has raised $400 million in a funding round featuring BlackRock, Fidelity, Marshall Wace LLP and Fin Capital.

BlackRock, the world’s largest asset manager, said the strategic partnership would explore capital market applications for USDC.

Circle is going public through a SPAC (special purpose acquisition company) merger.

The overall market cap of the more than 18,800 coins is at $1.87 trillion following a 1.2% rise in the last 24 hours.

Market leader Bitcoin – the original cryptocurrency created by the mysterious Satoshi Nakamoto – is just below $40,200 at the time of writing (7am UK) following a slight gain. BTC is 11% down in a week.

Ethereum, the second most valuable crypto coin – created as a decentralised network for smart contracts on the blockchain – added 2% to around $3,065. ETH, set for a huge upgrade soon, is 9% down over the course of a week.

Binance Coin is a cryptocurrency created by popular crypto exchange Binance to assist its aim in becoming the infrastructure services provider for the entire blockchain ecosystem. Its BNB token rose 3% to $420, leaving it 5% down over seven days.

The XRP token of Ripple, a payment settlement asset exchange and remittance system, acts as a bridge for transfers between other currencies. XRP gained 2% to top 72 cents, which leaves it 12% down over seven days.

Solana is a blockchain built to make decentralised finance accessible on a larger scale – and capable of processing 50,000 transactions per second. Its SOL token added 2% to $105 and is 17% down on its price last Wednesday morning.

Cardano is an open source network facilitating dApps which considers itself to be an updated version of Ethereum. Its ADA token, designed to allow owners to participate in the operation of the network, rose 1% to 96c. It is 17% down over the course of a week.

Terra, described as a programmable money for the internet, gained 2% to $86.19. Its payment token LUNA is 26% lower than its price a week ago.

Avalanche, a lightning-quick verifiable platform for institutions, enterprises and governments, came out of nowhere months ago to break into the top 10 currencies. Its AVAX token climbed 0.5% to $77.72 and is 14% down in a week.

Meme coin Dogecoin was created as a satire on the hype surrounding cryptocurrencies but is now a major player in the space. DOGE added 1% to return above 14c and is 13% down over seven days.

Polkadot was founded by the Swiss-based Web3 Foundation as an open-source project to develop a decentralised web. Its DOT token, which aims to securely connect blockchains, rose 1% to $17.88 and is 18% lower than its price a week ago.

To see how the valuations of the main coins have changed in the last few days, click here.

For valuations of the top 250 coins by market cap plus 24-hour price change and volume traded, see below.

[clpti-crypto-widget id=82728]