Listed Nottingham-based eCommerce business Huddled Group plc has signed an agreement to partner with THG Ingenuity to help accelerate its growth plans.

It has also accepted an offer of a £1.5m cash injection – at the current market price – from asset manager Shard Capital Partners.

Huddled Group, which earlier this week saw a leadership reshuffle with founder Martin Higginson becoming executive chairman, buys surplus stock from manufacturers and retailers before selling it online at a fraction of the usual price through its brands DiscountDragon, Nutricircle and BOOP Beauty.

It claims to have saved 5.7m items from being unnecessarily wasted, while it has donated and distributed 500,000 items to food poverty charities in the UK.

Huddled Group said it had seen continued growth in both order numbers and revenue across all three brands in Q2 2025.

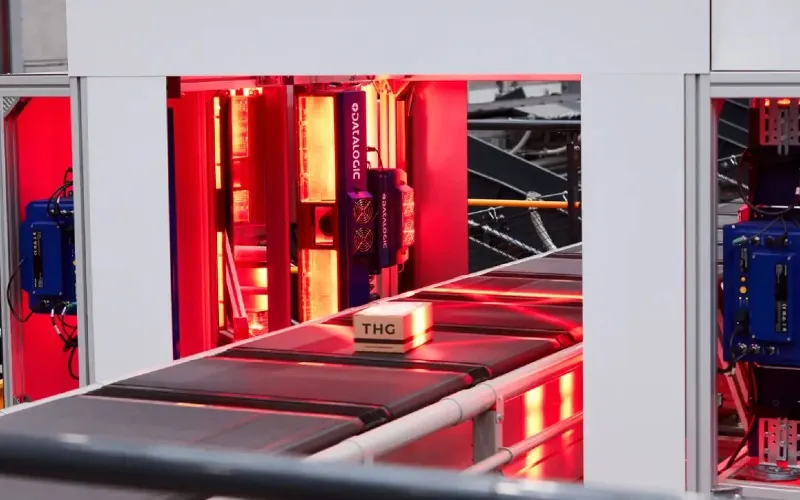

“THG Fulfil facilities are highly scalable and highly automated fulfilment centres, thus best placed to support Huddled’s growth ambitions,” it added. “With facilities able to process over 2m units per day, capacity constraints are effectively removed.

“THG Fulfil will allow us to take orders up to 1am for same-day delivery, which we anticipate will improve our marketing conversion rate as well as customer satisfaction. Huddled will work closely with THG Ingenuity to help clients unlock surplus stock challenges.”

The relationship also allows it to use THG Studios facilities to deliver more frequent live sales broadcasts.

It is anticipated that the migration of stock and fulfilment operations will be completed before the end of Q3 2025, allowing us to be fully operational going into Q4 2025.

Higginson commented: “This partnership represents a step-change in our ability to deliver circular economy solutions at scale. THG Ingenuity’s fulfilment capabilities rival Amazon’s – something we’ve aspired to since we started this business. The ability to process orders until 1am for same-day delivery is a dream for any eCommerce retailer.

“We knew to fulfil this vision, and accelerate our growth plans we would need more capital, and to be approached by Shard Capital Partners LLP regarding a potential investment from a major institutional investor came at exactly the right time.

“Their belief in our mission is a testament to our model and the growth we have shown to date, as well as the growth potential this THG Ingenuity deal will unlock. To take this money into the Company at the current market price demonstrates confidence in both the business and its potential.”