Primer has closed a Series B funding round that values the payments infrastructure startup at more than £300 million only 20 months after it was founded.

Primer was founded in early 2020 by ex-PayPal/Braintree employees and employs more than 70 people across 20 countries, with plans to triple that next year. It claims to have built the world’s first automation platform for payments.

The £36m fundraise was led by ICONIQ Growth, a San Francisco-based investment firm that has backed global tech companies such as Adyen, Marqeta, Snowflake and Datadog.

Existing investors including Accel, Balderton Capital, Seedcamp, Speedinvest and RTP Global all participated in the round.

Roy Luo, partner at ICONIQ Growth, will join the company’s board.

“Over the past two decades, the pace of new payment solutions entering the market has been accelerating dramatically to support global consumer demand for trends like mobile payments, digital wallets, 1-click checkout, buy now pay later, and so on,” he said.

“However, no one payment solution is close to accommodating all the changes and innovations that merchants need to keep up.

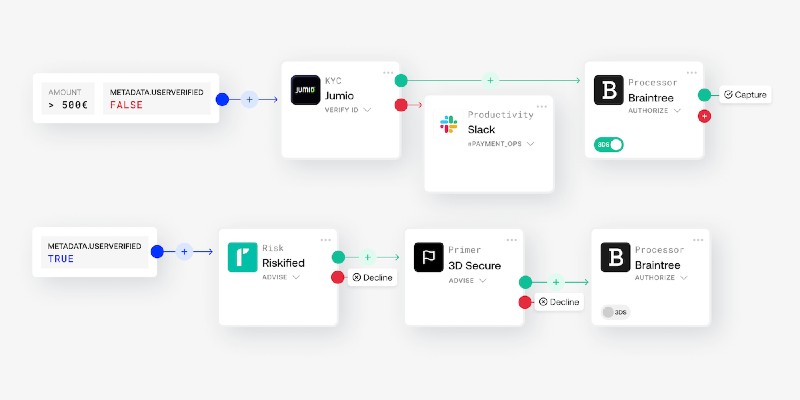

“So, for merchants’ payment and engineering teams, this dynamic forces immense technical complexity in tying together multiple payment methods, gateways, fraud detection, and more.

“Primer is a team 100% focused on solving that one enormous problem. That’s a quality we look for in businesses we back. We love uncovering such single-minded focus on fixing an important technical challenge.

“What the team has done to learn from hundreds of merchants while building its technology at pace and scale over the last 20 months is nothing short of phenomenal. We believe Primer’s poised to become the most disruptive force in payments for years and the category leader for payments automation.”

The ‘smart’ checkout experiences allow merchants to connect and control their entire payments stack and build their ideal payment flows autonomously from scratch.

“Our past experience running hundreds of deep-dive technical workshops with some of the biggest online companies like Uber, Spotify and Airbnb, has given us unique insight into the deeply-rooted technical fragmentation that exists in global payments,” said founder Paul Anthony.

“Primer offers all the underlying infrastructure for merchants to create new, better buying experiences for their customers. But, we’ve barely scratched the surface of how payments automation will disrupt payments for good.

“Our mission is to make payments a first-class product area in any business. ICONIQ Growth shares our expansive vision, so it’s hugely rewarding to add them to our Board as a trusted, experienced partner and advisor.”

https://businesscloud.co.uk/blog/2021/10/19/78m-funding-sees-brazilian-fintech-pismo-launch-bristol-base/

Co-founder Gabriel Le Roux added: “With teams established and merchants live across Europe, Asia and North America, we’re primed to use this investment to expand our already global footprint.

“We have people deployed in 20 countries but need to grow our teams even more quickly to support the demand we’re seeing among both merchants and the third party services across multiple countries and sectors that want to work with us.”

Alex Naughton, head of UK and Ireland at Klarna, one of the first payment methods to connect to Primer in early 2021, added: “Smooth payments are at the core of what we do and Primer is supporting us in delivering the best payment and shopping experience to our customers.

“We have been able to minimise integration time and bring our flexible and convenient payment solutions to even more consumers.

“We are excited about the opportunities ahead and look forward to integrating Primer across more retailers and geographies.”