Tymit has raised £23 million Series A funding to ‘reimagine Buy Now, Pay Later tools for merchants’.

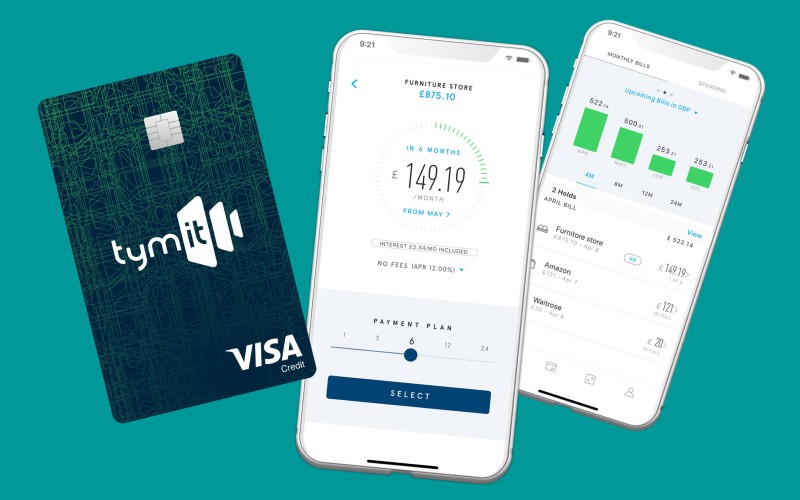

The London company allows merchants to provide Buy Now, Pay Later tools under their own branding for free alongside data insights.

Tymit is authorised by the Financial Conduct Authority (FCA) and Payments Service Regulator (PSR) to provide consumer credit and payment services.

Taking its total investment to date to £33m, the funding is led by Frasers Group, one of Europe’s leading retailers, which provides consumers with access to sports, premium and luxury brands.

Tymit is already live with 40,000 active users and in the last 12 months has processed £75m in transactions.

It says existing BNPL providers’ fees of 2-8% take a big bite out of every basket and drive a wedge between merchants and their customers, chipping away at brand loyalty over time.

“We are really pleased with this strategic investment, which demonstrates Tymit’s disruption of the BNPL market for the benefit of both merchants and consumers,” said Martin Magnone, CEO and co-founder.

“As we worked closely with Frasers Group, it was clear that they share our commitment to pushing the boundaries of traditional retail environments and challenging the status quo.

“With this investment, we can expand our operations, bring new partners on board and continue to help merchants meet customer needs and drive growth.

“The credit providers and banks who dominate our wallets built their products for the bottom line, not for consumers or merchants. High merchant fees of 2-8% might be good for profits, but they hamper merchant growth. This has to stop.

“We’re proud to provide merchants and partners with the instalment program experiences that will help them get closer to their customers without taking a bite out of the basket or squeezing out their brand.”