Every meaningful jump in commerce from coins to paper money, from cheques to cards, from cards to one-click checkouts has hinged on one idea: make paying feel effortless. Cryptocurrency, despite its disruptive promise, has so far missed that mark for most businesses and consumers. Wallet addresses look like alien license plates, gas fees spike unpredictably, and regulatory language feels deliberately arcane. Yet the tide is turning. Simpler user experiences, especially the rise of no-code crypto payment links, are set to push digital assets from speculative sidelines into daily transactions. For fintech leaders and forward-thinking founders, the question is no longer “if,” but “how fast” frictionless crypto experiences will reshape digital commerce.

Payments Have Always Trended Toward Frictionless

Look at history’s payment milestones. In the 1950s, Diners Club condensed a lengthy billing process to a single swipe. In the 1990s, PayPal scrapped international wire delays with an email address. Today, Apple Pay removes even the card swipe, turning a phone tap into a settlement. Each leap addressed a pain point: time, distance, and cognitive load. Crypto sits on the same trajectory; businesses just haven’t felt the same “aha” that sent contactless into orbit yet.

Why? Legacy payment rails run behind slick user interfaces. The card networks still clear funds in T+2 despite near-instant tap confirmations. Crypto flips this, settling close to real time, but its front-end UX has lagged. Improving that immediate experience making a wallet request feel as casual as sharing a Venmo QR or clicking a crypto payment link, unlocks the underlying speed, cost, and global reach that crypto already delivers technically. Simplicity is the missing hinge.

Simplicity as the Missing Link in Crypto UX

If you step back from the jargon and look at why ordinary users still reach for cards or Apple Pay, one theme jumps out: they can complete the transaction in seconds without thinking. Until recently, crypto demanded mental gymnastics, network selection, gas‐fee estimates, and seed‐phrase paranoia. The raw technology was sound, but the human experience was clumsy. Closing that experience gap is now the top priority for wallet designers, payment processors, and the merchants who ultimately carry conversion risk. In other words, whoever makes paying with crypto feel as brain-dead simple as scanning a contactless card will win the next decade of digital commerce.

From Keys to Clicks: Evolution of Wallet Design

Early wallets demanded users copy-paste 42-character strings and triple-check every letter, or risk irreversible loss. Cold storage steps made password resets feel like nuclear launch procedures. Over the last three years, smart-contract wallets and account-abstraction standards (ERC-4337, AA-2) hid seed phrases behind social logins or biometrics. Users can now deploy a self-custodial wallet with Google or Apple authentication, recover access through friends, and set spending limits that mimic credit-card controls. Complexity still exists, just not in the user’s face.

Payment Links: The QR-Code Moment for Crypto

Mobile banking adoption soared once QR codes let consumers sidestep card numbers. Crypto payment links perform the same mental magic: a seller generates a URL or QR that locks in the amount, network, and an expiration timestamp. The buyer clicks, selects any supported wallet, and confirms. No decimal conversions, no typing addresses, no “what chain is that on?” confusion. Behind the curtain, the link’s metadata pings an on-chain oracle; settlement happens in the stablecoin or token of choice; the merchant dashboard updates instantly.

These links are platform-agnostic. Drop one into an invoice, a WhatsApp chat, or a TikTok bio, and you’ve turned every digital surface into a checkout page. For small merchants in high-inflation markets or SaaS firms billing global subscribers, the reduction in integration overhead is enormous. Instead of weeks of integrating card-acquirer APIs, it’s minutes and a copy-paste.

Three Catalysts That Will Accelerate Adoption

With a cleaner UX, adoption does not occur in a vacuum. Markets must be pushed, typically by regulatory green lights, risk controls, or an apparent economic reward. All three have helped the crypto payments stack over the last 18 months. These catalysts are not hypothetical; they are already driving P&Ls and compliance roadmaps, meaning leaders who ignore them are playing catch-up by 2026.

Regulatory Clarity Turns Risk Into Routine

Uncertainty, not technology, has been the real friction. In 2024, the EU’s Markets in Crypto-Assets (MiCA) framework came fully into force, giving licensed “Crypto-Asset Service Providers” a passport across 27 countries. The U.S. followed with the Stablecoin Transparency Act, defining reserve and disclosure standards. APAC regulators from Singapore’s MAS to Japan’s FSA issued parallel sandbox licences. With legal gray reduced to grayscale, compliance teams can now green-light pilots rather than issue knee-jerk nos. When compliance says “go,” product teams sprint.

Stablecoins Solve the Volatility Story

Bitcoin’s price theatrics once made CFOs break into hives. Stablecoins, especially those with audited reserves or algorithmic over-collateralization, answer that critique. They peg to fiat but still ride public blockchains. In 2024, stablecoin transaction volumes experienced significant growth. Reports indicate that stablecoins settled approximately $27.6 trillion in total transactions, surpassing the combined annual throughput of Visa and Mastercard. Volatility is now optional; businesses choose whether to auto-convert receipts into cash or hold tokens for on-chain yield.

Embedded Crypto in SaaS Platforms

Stripe, Adyen, and Shopify each rolled out stablecoin settlement pilots in 2024-25. Accounting suites now ingest blockchain transactions via formatted CSV or direct API. Payroll providers let contractors pick USDC or EURC instead of wires. Once crypto is baked into the same dashboards that teams already live in, training and support costs shrink. Staff don’t care that their PDF invoice sits on IPFS; they care that “Paid” turns green. Embedded integrations mask technical sprawl behind familiar UI, enabling mass onboarding without the drama.

Practical Roadmap for Businesses

Talking strategy is easy; implementing new rails is the real test. Below is a focused blueprint for leaders who want to ride the simplicity wave without drowning in novelty.

Start with Cross-Border Payouts

Outbound, not inbound, often shows the fastest ROI. International supplier and contractor payments guzzle fees and float days through SWIFT. A US-based design agency sending $5,000 to a freelancer in Nigeria spends $120 in bank fees and waits five days. The same transfer in USDC costs under $2 in gas and settles in minutes, even after auto-cash-out via a local exchange. Operational teams witness the advantage directly, no need for splashy consumer campaigns. Once finance approves crypto in one lane, extending it to incoming ecommerce sales feels incremental.

Treat Crypto as a Feature, Not a Strategy

Crypto bull markets breed slide decks promising tokenized everything. Resist. Payments are infrastructure; users care about outcomes, speed, cost, convenience not logos on whitepapers. Experiment with clear, narrow metrics: lower foreign-exchange cost per transaction by 80%, or cut cart abandonment by five points through instant checkout links. Killing blockers, not chasing buzzwords, keeps initiatives grounded and defensible at the board table.

How Simplicity Lifts Conversion and Loyalty

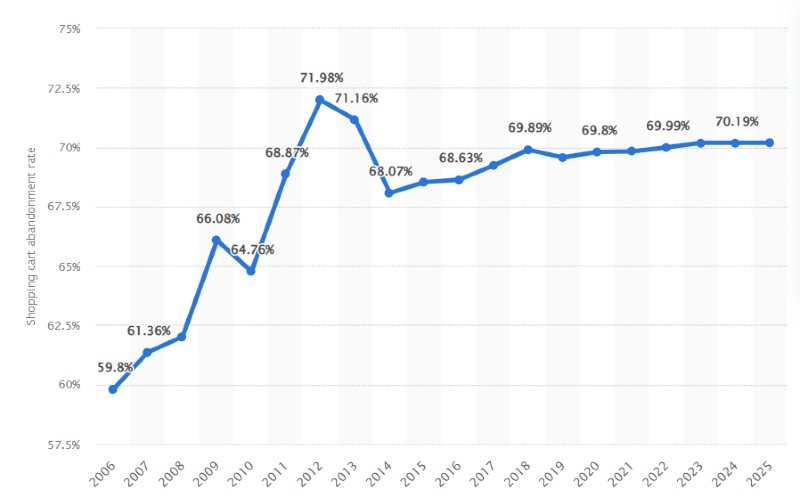

Cart abandonment remains the silent killer of digital revenue. Statista reports an average cart-abandonment rate of 70.19% for online stores worldwide; one in four shoppers blame “long or complicated checkout.”

Crypto payment links shrink the form to one click plus biometric approval no account creation, no CAPTCHA, no card fields subject to 3-D Secure pop-ups. Early pilots by a Latin-American fashion marketplace showed a nine-second median checkout time for USDC links versus 41 seconds for cards, with a 6.4% lift in completed orders.

Simplicity also improves repeat-purchase rates. A saved payment link can double as a “subscribe and save” trigger. Smart contracts schedule recurring transfers, eliminating invoice spam. Customers who never fight a failed payment are less likely to churn, and merchants aren’t stuck chasing dunning emails. In a subscription economy, one-click retention is gold.

Risk Management in a Link-Based World

Reducing friction must never mean adding fraud. Fortunately, on-chain data provides transparent risk signals. Merchant dashboards can query wallet age, transaction history, and sanction lists before accepting a link payment no card-number leaks or chargeback disputes. Smart-contract escrow can even hold funds until delivery confirmation, mimicking PayPal buyer protection without intermediaries.

Still, operational controls matter:

- Set per-transaction limits within the payment link metadata.

- Auto-convert stablecoin receipts to fiat to avoid treasury swings.

- Use allow-listed wallets for high-value B2B transfers.

These guardrails make crypto as boring to read: reliable as ACH.

Looking Five Years Ahead

By 2030, the term “crypto payment” will probably feel quaint. Just as we no longer differentiate “internet business” from business, blockchain-settled currencies will blur into the payment fabric. Networks like Solana, Lightning, and Layer-2 rollups are testing sub-cent fees and sub-second confirmation orders of magnitude improvements over Visa’s 15-cent interchange or SWIFT’s two-day clearing. If regulations keep pace and UI continues to abstract complexity, merchants will choose networks the way they now choose cloud providers: on latency, uptime, and price.

For entrepreneurs, the competitive edge lies in adopting simplicity ahead of the herd. A frictionless checkout is invisible to the end user, but the revenue impact shows up in every KPI dashboard. Those who wait for “mature” standards will enter a market where painless payments are table stakes, not a differentiator.

Conclusion: The No-Brainer Payment

Crypto’s technical advantages have been obvious for years: near-instant settlement, programmable money, borderless reach. What held it back was the human interface. Payment links, smart-wallet abstractions, and embedded SaaS integrations are finally crossing that chasm, turning blockchain from a brainteaser into a background utility.

For fintech leaders plotting the next product cycle, the mandate is clear: audit each payment touchpoint and ask, “Could this be one click lighter?” If the answer is yes, a crypto option is no longer experimental; it’s inevitable. The future of payments belongs to the rails that feel so simple, users forget there is any rail at all.