TalkTalk has agreed a £75 million funding facility with investment giant KKR.

The new facility will give the telecommunications firm access to additional liquidity for a term of approximately three years.

Collateralised by certain accounts receivables originated by TalkTalk and its subsidiaries, it replaces a prior £75m financing facility, which matures in September 2023.

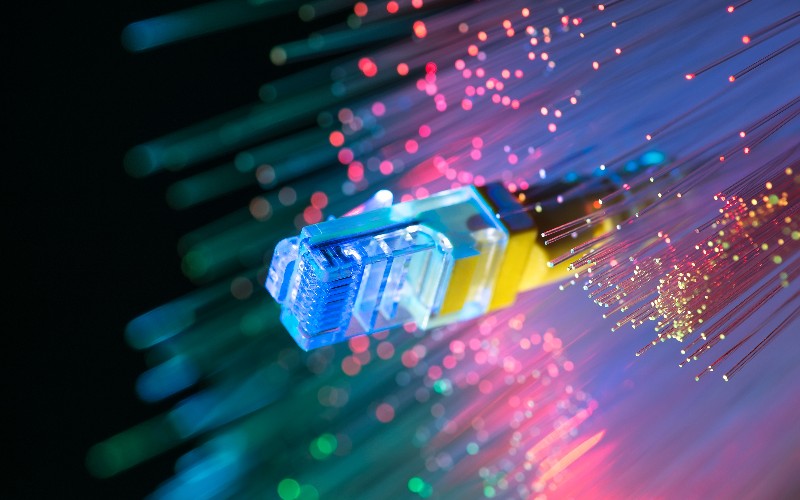

TalkTalk, headquartered in Salford, is delivering full fibre connectivity to businesses and households across the UK.

“We are pleased to use our experience in receivable financing globally to support TalkTalk with capital that will help the company continue to grow and connect consumers and businesses across the United Kingdom,” said Giacomo Picco, a managing director at KKR.

Demica served as advisor to TalkTalk and will act as the reporting and calculation agent for the programme.