It’s the Christmas blockbuster of 2025 that had almost everything.

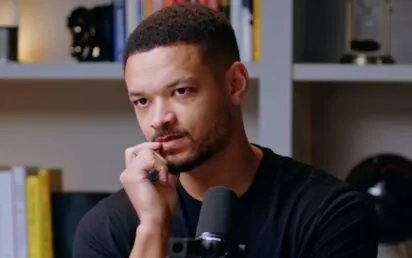

On Christmas Eve – traditionally one of the quietest news days of the year – American AI company Groq confirmed it had entered into a ‘licensing agreement’ with the world’s most valuable company, US chip giant Nvidia.

Nvidia – which was founded in 1993 – became the first company in the world to reach a market valuation of $5tn in October 2025.

The news cemented the celebrity status of its founder and CEO Jensen Huang, who has been dubbed the ‘Taylor Swift of tech’.

Jensen Huang, CEO, Nvidia

The size of the deal hasn’t officially been confirmed but it’s widely speculated to be $20bn, making it Nvidia’s largest-ever deal by some margin.

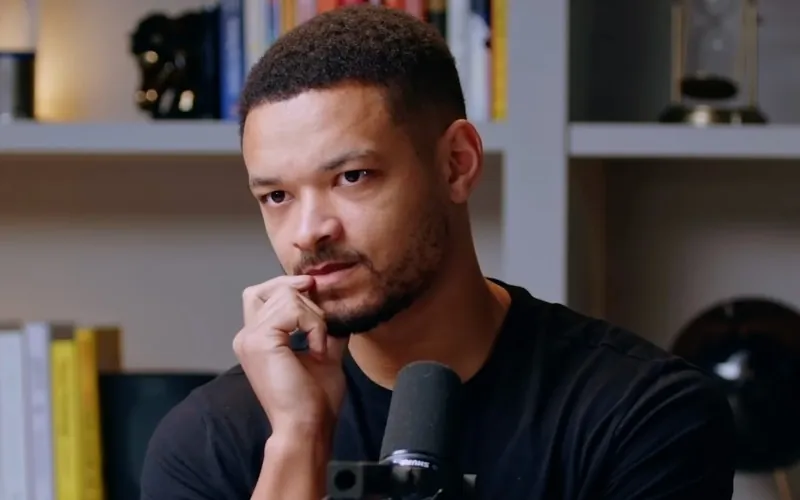

As part of the deal, Groq’s ‘genius’ CEO and founder Jonathan Ross joined Nvidia, along with COO and President Sunny Madra and several members of the Groq team.

If Huung and Ross are the undoubted stars of this Christmas blockbuster, the supporting cast is similarly impressive.

Dragons’ Den star Steven Bartlett – who is sitting pretty having made a seven-figure investment into Groq – described it as ‘absolutely insane’.

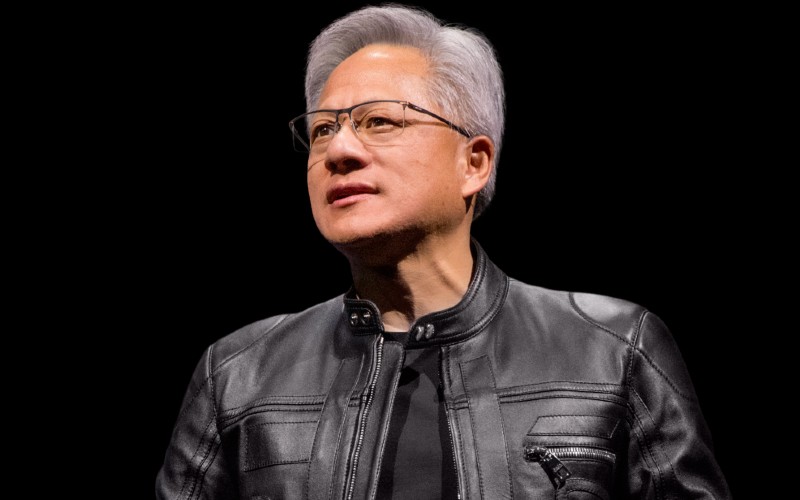

He was persuaded to invest on the advice of his friend – media mogul Scott ‘Scooter’ Braun.

If you haven’t heard of Braun, he’s a famous music executive, entrepreneur, investor and manager behind the careers of global stars like Justin Bieber and Ariana Grande.

He was given the nickname ‘Scooter’ as a kid and it stuck. Unconfirmed rumours suggest he’s dating actress Sydney Sweeney.

As is often the way of these things Braun was interviewed on Bartlett’s Diary of a CEO podcast in June 2025.

Groq might not be a household name in the UK but it has been one of the AI darlings of the US tech scene for a number of years.

Founded in 2016, the company crowded the LPU (Language Processing Unit) and GroqCloud to ensure compute is faster and more affordable.

Given the December 24th timing of the Nvidia/ Groq announcement there’s been a flurry of speculation but I’m going to try and unpick the deal.

90-word statement

Just like Charles Dickens’ classic ‘A Christmas Carol’, our story starts on Christmas Eve when Groq decided to release the following 90-word statement: “Today, Groq announced that it has entered into a non-exclusive licensing agreement with Nvidia for Groq’s inference technology.

“The agreement reflects a shared focus on expanding access to high-performance, low cost inference.

“As part of this agreement, Jonathan Ross, Groq’s founder, Sunny Madra, Groq’s President, and other members of the Groq team will join Nvidia to help advance and scale the licensed technology.

“Groq will continue to operate as an independent company with Simon Edwards stepping into the role of chief executive officer.

“GroqCloud will continue to operate without interruption.”

The decision to make the announcement on Christmas Eve certainly got tongues wagging with many interpreting it as a play to attempt to control the narrative and attract less scrutiny.

Tellingly, Nvidia hasn’t issued a statement at all, leading analysts and journalists to attempt to fill the gaps.

Scott ‘Scooter’ Braun

The other thing to say is this isn’t a straightforward deal structure, whereby company A will typically buy company B.

In this case, Nvidia has entered a ‘non-exclusive licensing agreement’ with Nvidia for Groq’s inference technology.

In simple terms, a licensing agreement is a legal contract where one party gives another party permission to use something it owns, without selling it outright.

Reverse-acquihire

At the risk of sounding too technical, I’d like to introduce the phrase ‘reverse-acquihire’ into the mix.

It’s an unofficial term used to describe a deal where a large company gets the key staff and tech it wants, without buying the whole company – and the smaller entity continues to exist.

One recent example involved Google and AI coding startup Windsurf.

Nvidia’s deal for Groq appears to meet all the criteria for a reverse-acquihire.

Writing on LinkedIn, Harris Komishane, general partner of Meach Cove Capital, wasn’t alone in pointing out that Nvidia had acquired Groq’s CEO, CTO and tech without having to buy the company.

Ethan Rasa, an AI sales specialist director of AHEAD, said this deal structure is increasingly being favoured by tech giants like Facebook (now Meta), Apple, Amazon, Netflix and Google – often referred to by the acronym FAANG.

He said: “It does not typically trigger a federal anti-trust law scrutiny for an M&A. Plus the bidder still gets what they need: the tech and select assets and not the entire legal entity of the business.”

All change

In probably the most understated job update in the history of LinkedIn, Jonathan Ross revealed on Sunday (December 28th) that he’d started a new position as chief software architect at Nvidia while Madra is officially Nvidia’s ‘VP Hardware’.

Groq has been quick to stress that it will continue as an independent company with Simon Edwards stepping into the newly vacated CEO chair.

Edwards is being supported in the leadership team by chief legal officer Claire Hart and chief talent officer Allison Hopkins.

But what does the deal mean for investors?

One person who know better than most is Nicolas Sauvage, founder and president of TDK Ventures, which has previously invested in Groq.

Writing on LinkedIn, he said: “It is not an acquisition. It is Nvidia recognising, with a $20bn level of conviction, the inevitability of what Groq has built.

“Groq stayed uncompromising on first principles: deterministic performance, ultra-low latency, and radically better inference economics.

“They did not try to out-GPU the GPU leader. They changed the question entirely.

“Nvidia, for its part, did what great market leaders do. It did not defend dogma. It defended relevance. Acting decisively at scale is not weakness. It is strategic clarity.”

He added: “You do not win by copying giants. You win by being right about something fundamental and staying stubborn long enough for the world to catch up.”

In the money

Somebody else who knows a thing or two about investing is Dragons’ Den star Steven Bartlett, who has invested in around 60 businesses.

One of his best investments to date has been PerfectTed.

He first invested in the UK’s leading matcha brand when they appeared on Dragons’ Den in 2023 and quickly invested a follow-up £1m.

Earlier this year PerfectTed announced a major new round of investment led by Felix Capital, giving it a valuation of £140m.

Through FlightStory Fund and personal investments, Bartlett has backed companies including SpaceX, Huel, ZOE, Whoop, MrBeast and, tellingly, Groq.

33-year-old Bartlett took to Instagram on Christmas Eve to explain how he was first introduced to Groq.

Steven Bartlett spends much of his time in the US

“A while ago Scooter Braun called me and very, very passionately told me I should invest in this company called Groq,” he explained.

“Then I spoke to (AI advisor) Harper Carroll, who vetted the company and told me I should invest.

“So I called the founder (Jonathan Ross) and asked him personally if I could put a 7-figure cheque in. Thankfully he accepted.

“Today the company has been acquired for a staggering $20bn. Absolutely insane. Thank you to Scooter, Harper, Jonathan (CEO) and team Groq.”

As befits a man with more than 24 million social media followers, Bartlett also took to X to provide more details.

Rare genius

“After a call with Jonathan Ross, the founder of Groq, a little while ago, I was absolutely convinced I was speaking to a very, very rare genius.

“Accordingly, I wrote the biggest cheque I could and invested into Groq.

“No surprise to read this headline today. Congrats Jon and team Groq and thank you for letting me back you guys.”

The End (for now)!