Aligned Assets, a public sector software business, has been acquired by listed firm Idox.

ldox is a supplier of specialist information management software and solutions to the public and asset-intensive sectors.

The acquisition, for an initial cash consideration of £7.5 million and potentially rising to £10.5m through earn-outs, enhances Idox’s offering to local authorities.

The size of earn-out is dependent on progress against targets associated with retention of existing recurring revenues, winning new revenues, and delivery of technical advancements and integrations with the existing Idox Group product set.

The consideration will be funded from Idox’s existing financial resources, which were bolstered by the disposal of its Content division in March 2021.

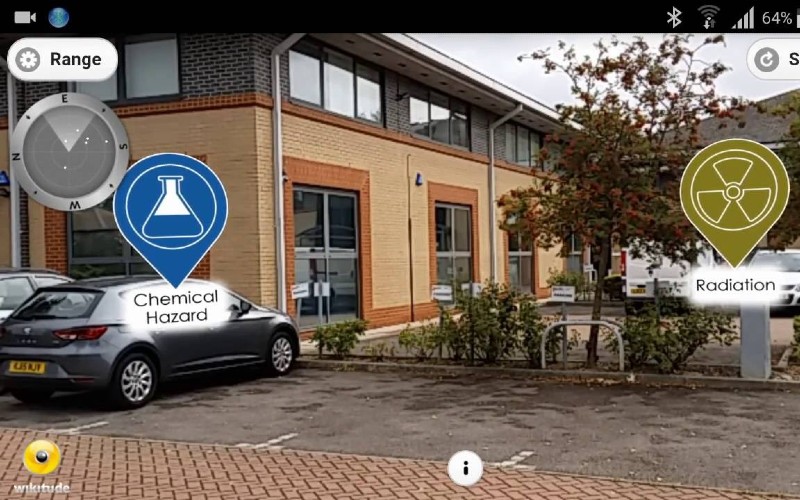

A well-established software business with high levels of recurring revenue, Aligned Assets provides cutting-edge solutions ranging from high-speed matching and cleansing, to sub-second predictive searching, as well as solutions for managing, sharing and viewing address data including in augmented reality.

For local authorities, the business provides specialist cloud-based solutions for creating and managing Local Land and Property Gazetteers (LLPG) and Local Streets Gazetteers (LSG), as well as street naming and numbering.

Aligned Assets is based in Woking with 24 employees. For the year ended 31 March 2020, it reported revenues of £2.2m and PBT of £0.8m.

As part of the acquisition, both Aligned Assets directors will continue in their current roles as part of the Idox Group.

David Meaden, CEO of Idox, commented: “This is a valuable acquisition for Idox that builds on our public sector software focused growth strategy.

“Having recommended Aligned Assets to existing customers to use alongside our own built environment software, the acquisition will enhance and optimise our current offering and is a natural fit.

“We look forward to welcoming the Aligned Assets team to Idox and are confident that the combination will drive value for the customers of both organisations and for shareholders.”