Social lender Moneyline has partnered with payments FinTech Ordo for its fully managed VRP sweeping service.

Moneyline, already using Ordo for individual customer repayments as well as secure initial loan payouts, is now extending that partnership to pilot the white-labelled Sweeping solution.

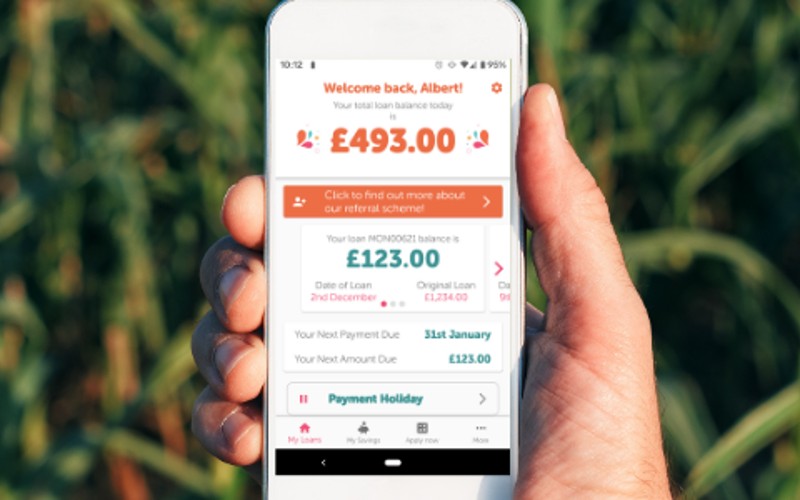

Sweeping will allow Moneyline to offer its borrowers a single authorisation for all the repayments they need to make from their bank while staying in control of every payment.

Borrowers will be able to be more dynamic with their repayments, juggling them to match their income without having to authorise every payment.

Moneyline helps people – many of whom do not have access to bank overdrafts – to gain access to affordable credit. Its customers can pay using Ordo, third on our FinTech 50 ranking, from more than 98% of the UK’s banks, without any app download or registration needed.

“We are pleased that Moneyline has been able to so quickly and easily pilot our new managed VRP service to enhance their customer offering,” said Ordo CEO Craig Tillotson.

The future of Direct Debit is here – and it’s a once-in-a-generation chance

“Our aligned vision for making money easier to manage for end users and lower cost and quicker for businesses means we are changing the way short-term loans are made and repaid, making it better for everyone.

“And because we do all the hard work in our managed service, providing simple business level APIs to set up secure mandates, collect real-time payments, and provide ongoing customer control, it means businesses can get up and running without any of the time, effort and specialist skills required to build the sophisticated user interfaces and complex operational controls of the special banking APIs needed to deliver VRP.

“It’s an immediate reduction in business cost, and a quick and easy win in terms of business rollout.”

Shiona Crichton, CEO at Moneyline said: “We’re delighted to further extend our partnership with Ordo and to be able to trial offering Sweeping capability to our borrowers.

“We decided to partner with Ordo because it meant there was very little development for us to do. Ordo has developed, and hosts, the whole white-labelled payment journey, from keeping a history of borrower and repayment activity to customer screen development, and all with fantastic customer UX.

“With a cost-of-living squeeze upon us, demand for our services will be high, so being able to pass cost savings, from day 1 of offering Sweeping functionality, on to our customers is essential for us.

“With this partnership, we can focus on the needs of our customers, not the complexities of technology delivery, improving financial management for our users, and make our lending, collections and reconciliation incredibly efficient.”