tickr, an app that empowers customers to positively impact the world through their finances, has raised £2.5m from Ada Ventures, the London-based venture capital fund investing in overlooked founders and markets.

A certified BCorp business which has previously received more than £2.5m in funding, tickr was built by Tom McGillycuddy and his co-founder, Matt Latham, after stints at Barclays and Wellington Management.

Together they set out to demystify investing, showing a new generation that they’re able to grow their money and have a positive impact at the same time.

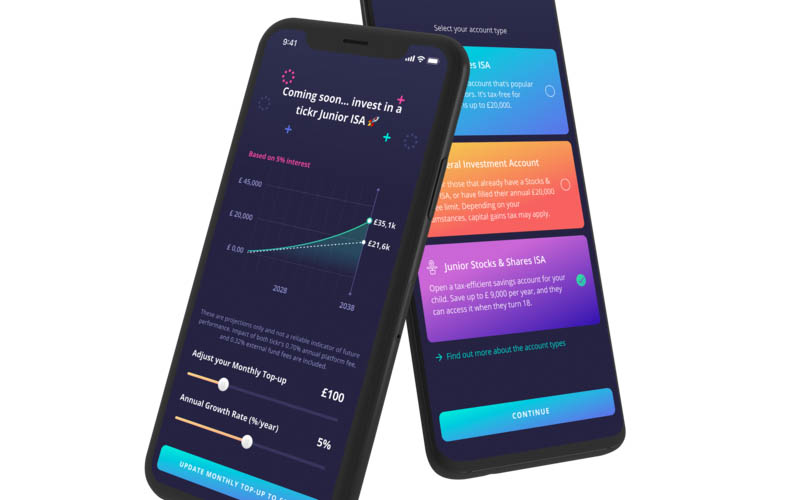

tickr allows people to put their money into specific companies across the themes of: People, Planet, or a mix of the two. The team only offers investments in companies that generate social and environmental solutions; those at the cutting edge of global change.

Now, the platform is expanding to include services that give customers the opportunity to have a positive impact beyond just investing, with the recent launch of a carbon offset subscription service.

“We believe that within the next 5-10 years ‘impact investing’ will just be called ‘investing’. It’s the only way our generation wants to invest, and because of that they’re driving industry-wide structural change,” said McGillycuddy.

“We think this change has only just started, and within the next few years it will completely transform financial services and how people think about their money.

NHS doctors close £7m funding round for digital triage service eConsult Health

“For us, investing is just the beginning. What we truly care about is building a product offering that generates positive impact for our customers and the wider world.

“We think the structural change in attitudes will extend to all areas of financial services, and investing will be seen as one of the key ways our generation can collectively improve the world.

“We’re incredibly grateful to Ada for believing in our purpose and vision for tickr, and their backing will allow us to strengthen our team, accelerate our product roadmap and double down on customer growth this year and beyond.

“I’m so proud of everything we’ve achieved at tickr, despite all the obstacles 2020 threw our way. It really is a testament to the team we’re building here that are bound together by our mission and what we stand for as a business.”

Inspired by Ada Lovelace, the nineteenth-century computer science pioneer, Ada Ventures is a $50m seed fund focused on investing in overlooked founders, who are building companies that focus on underserved customer groups.

Matt Penneycard, founding partner of Ada Ventures, said: “tickr is capturing something powerful and ethereal – a modern investing mindset that wants more say in the second and third degree effects of what happens with our money.

“tickr’s customers (which include both Check and me!) understand the truth that doing the right thing with your money should also be rewarded with the best financial returns. Financial institutions on Wall St and in the City have started to realise this. tickr is democratising access to the same thinking for any individual investor.

“When we first spoke to Tom and Matt in early 2020, this was an interesting idea. A year later, tickr customers have proven their point, which is reflected in the extraordinary growth of the company.”

Earlier this year, tickr became twice carbon neutral through offsetting double the amount of its carbon output, before launching a carbon offsetting subscription for its customers, giving people the power to wipe their emissions off the planet and take matters into their own hands.

The company also works with OneTreePlanted.org, and together they plant a tree for every referral tickr receives from a user.

Despite the challenges of 2020, tickr’s monthly revenue increased 10 times during the pandemic, demonstrating the growing trend of impact investing.

McGillycuddy added: “We want to be the most convenient way for anyone to have a positive impact on the world. The tickr app as you see it today – aligning your investments with companies addressing big problems – is just the beginning.

“Finances should be stacked in favour of the user, whilst benefiting the planet, and that’s what we are setting out to prove.”