S4 Capital has warned that full-year performance will come in below expectations after a weaker third quarter was compounded by worsened trading in October.

In a statement released to the London Stock Exchange this morning, the digital advertising and marketing group said it had reviewed both its October financial results and a revised forecast for the third quarter.

The review showed net revenue falling behind plan, leading to a downgrade to its outlook for the year.

The London-based MarTech now expects like-for-like net revenue for 2025 to be down by “just under 10%”, a step back from the “upper single digits” decline it was guiding to in early November.

The revenue shortfall is also expected to hit profits, with the listed business now targeting operational EBITDA of approximately £75 million, below market consensus of £81.6m.

It said the deficit was mainly due to fewer project jobs, cautious clients and new contracts taking longer than expected to build up.

The downgrade follows a third quarter that was already under pressure.

In its trading update on the 6th November, S4 reported that Q3 billings rose 1.9% year-on-year, or 5.1% on a like-for-like basis, but revenue declined 3.4% reported and 1% like-for-like to £191.7m.

Net revenue fell 6.9% and 4.4% like-for-like to £167m, which management described at the time as a sequential improvement on the second quarter.

Today’s update indicates that the improvement has not continued into the start of Q4.

Geographically, the Americas, which generate more than 80% of S4’s net revenue, returned to modest growth on a like-for-like basis in Q3, up 1.6%.

However, EMEA and Asia-Pacific recorded steep declines of 26.6% and 16.2% respectively, leaving the group reliant on North American business to offset continued weakness elsewhere.

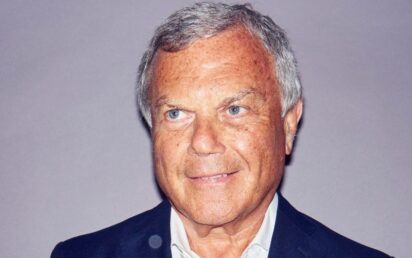

Sir Martin Sorrell, executive chairman at S4, has pointed to the same macroeconomic backdrop throughout 2025.

In the November update he said clients remained cautious amid volatile conditions, with large technology customers in particular prioritising capital expenditure on expanding AI capacity.

This, alongside delayed project work, is feeding through into the revised full-year expectations.

Over the past year, the firm has reduced headcount and focused restructuring on non-billable roles, aiming to bring staff costs closer to industry benchmarks while protecting profitability through a difficult trading period.

The company’s share price has already fallen by 8.4% in just over half an hour of trading today, dropping to 16.21p as of 8:38am.

It floated just under nine years ago with shares then trading at over 170p and now has a market cap of £108.62m.