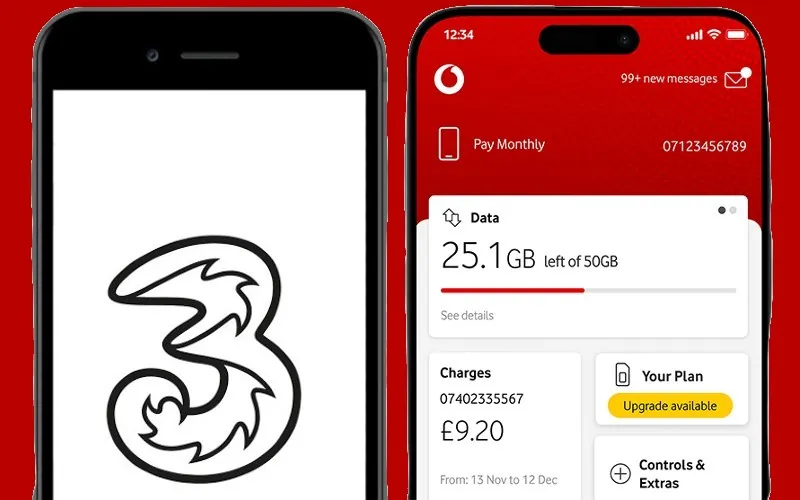

The £16.5 billion merger of Vodafone and Three has been thrown into doubt after an investigation by the Competition and Markets Authority provisionally found competition concerns.

The investigation, led by an independent inquiry group, provisionally concluded that the merger would lead to price increases for tens of millions of mobile customers, or see customers get a reduced service such as smaller data packages in their contracts.

The CMA has particular concerns that higher bills or reduced services would negatively affect those customers least able to afford mobile services, as well as those who might have to pay more for improvements in network quality they do not value.

The CMA has also provisionally found that the merger would negatively impact ‘wholesale’ telecoms customers – Mobile Virtual Network Operators (MVNOs) such as Lyca Mobile, Sky Mobile and Lebara – which rely on the existing network operators to provide their own mobile services.

The merger would reduce the number of network operators from four to three, making it more difficult for MVNOs to secure competitive terms, restricting their ability to offer the best deals to retail customers.

Vodafone and Three issued a statement to disagree with the CMA’s findings. “By all measures, the merger is pro-growth, pro-customer and pro-competition. It can, and should, be approved by the CMA,” they said.

The CMA also said the merging of their networks could improve their quality and bring forward the deployment of next-generation 5G networks and services, as claimed by Vodafone and Three.

However the CMA currently considers that these claims are overstated, and that the merged firm would not necessarily have the incentive to follow through on its proposed investment programme after the merger.

As a result, the CMA has provisionally concluded that the merger would lead to a substantial lessening of competition in the UK – in both retail and wholesale mobile markets.

£3.75bn data centre announced as government moves to protect ‘critical infrastructure’

“We’ve made a significant commitment to an £11 billion investment,” Vodafone UK CEO Ahmed Essam told BBC Radio 4’s Today programme.

“We’re willing to make sure that this is legally binding, and we undertake a commitment to deploy this.”

The CMA will now consult on its provisional findings and potential solutions to its concerns. It says it will retain the option to prohibit the merger, should it conclude that suggested remedies will not address its competition concerns effectively.

“We’ve taken a thorough, considered approach to investigating this merger, weighing up the investment the companies say they will make in enhancing network quality and boosting 5G connectivity against the significant costs to customers and rival virtual networks,” said Stuart McIntosh, chair of the inquiry group leading the investigation.

“We will now consider how Vodafone and Three might address our concerns about the likely impact of the merger on retail and wholesale customers while securing the potential longer-term benefits of the merger, including by guaranteeing future network investments.”

Kester Mann, analyst and director of consumer and connectivity at outsourced tech firm CCS Insight – which has worked with Vodafone before on its strategic planning – said: “Many of these [concerns] had been outlined previously, notably the potential for higher prices and likely impact on the wholesale market.

“The main knockback to the merging parties is that the CMA considers claims of superior network quality post integration to be ‘overstated’.

“Crucially, [the CMA] appears willing to consider ‘behavioural remedies’ such as enhanced network access for virtual providers or safeguards for retail customers.

“This is significant as many had feared that more onerous ‘structural remedies’ – such as selling assets or supporting a new entrant – would be required. In this sense, Vodafone and Three should be encouraged by the tone of the CMA’s report which appears more open to the merger than I was expecting.”

“The next three months may prove to be the most pivotal in the history of the UK telecoms sector.”

The CMA is inviting responses to its provisional findings by 4th October 2024 and its notice of possible remedies by 27th September 2024. It will then issue its final report by 7th December 2024.