AIM-listed MedTech Polarean Imaging has announced that it is considering delisting from the London Stock Exchange as part of a broader strategic review.

The board said it was assessing all available options to maximise long-term shareholder value, including a potential cancellation of its AIM admission.

The review comes amid what the London-based company described as a ‘highly challenging’ market for small-cap MedTech firms, marked by low liquidity, persistent undervaluation and high costs of maintaining a public listing.

Polarean, which is behind hyperpolarised Xenon MRI lung imaging, noted that its shares often trade below their intrinsic value and that limited market activity makes it difficult for investors to execute trades efficiently.

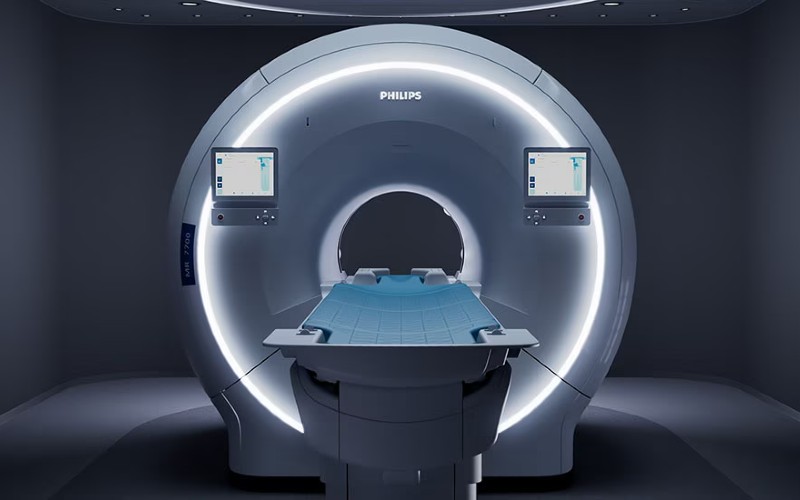

The company also requires additional capital to continue developing and commercialising its functional lung imaging technology, which uses hyperpolarised Xenon gas in MRI scans to provide highly detailed insights into lung function.

Since its IPO in 2018, it has seen its share price drop majorly from 72.64p – currently standing at 0.28p with a market cap of £3.45 million.

The board said a move to a private structure could, under certain conditions, reduce operating expenses, offer greater strategic flexibility and give the company access to capital on more favourable terms.