A London startup aiming to connect users with fairer loans at lower costs has raised £108 million of funding.

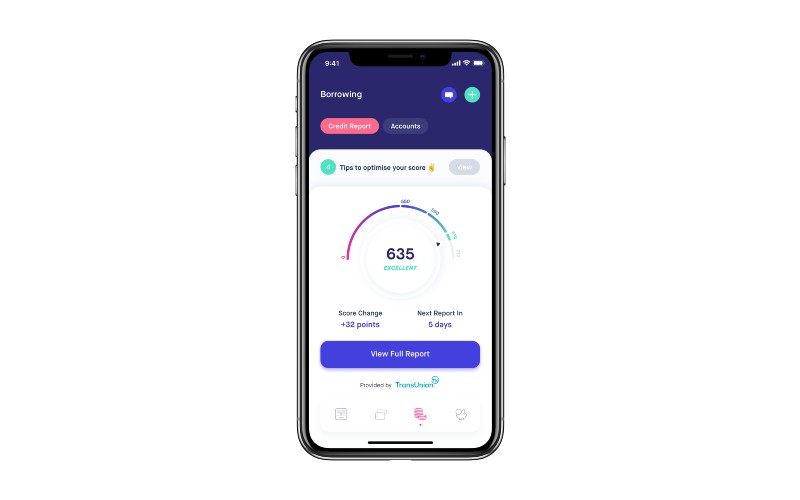

Updraft combines smart algorithms, open banking and credit reference data to offer bespoke personal loans to its customers.

A senior debt funding round of £100 million was led by NatWest to help create a £160m senior debt facility for the business.

Meanwhile an £8m equity fundraise was led by Auluk Investment and New Delhi-based LC Nueva.

The FinTech is eyeing expansion to markets in Europe and Asia.

“We have big ambitions planned for 2023, and this recent fundraiser puts us in a great position to help even more people,” said CEO Aseem Munshi, head of HSBC’s unsecured lending division prior to founding Updraft in 2017.

Rob Lamont, NatWest’s relationship director, said: “As a leading bank for financial capability, NatWest is pleased to be supporting a business that improves financial outcomes for consumers in the UK, and Updraft does just this.

“Supplementing succinct user and lending growth strategies with the use of best-in-class risk models that outperform bureau-based credit risk models, we are confident with Updraft’s growth momentum.”