London FinTech Updraft, which describes itself as an all which is ‘part lending, part credit report, and part financial planning’ has secured £16m in funding.

Its app is designed to tackle escalating consumer borrowing, and help its member’s avoid unnecessary credit card and overdraft charges.

The funding arrives in the form of equity and debt, with specialist investment firm Quilam Capital leading on the debt side, and the UK Government’s Future Fund participating via their convertible loan note alongside a group of high-net-worth investors.

Updraft was founded by financial services executive Aseem Munshi, former Head of Cards and Unsecured Lending for HSBC, UK.

With over 15 years’ of experience in banking, Munshi realised that consumers drift into borrowing more and more each month without noticing. Consumers will pay over £10b in fees and interests for overdraft and credit cards in 2020 alone, the company reports.

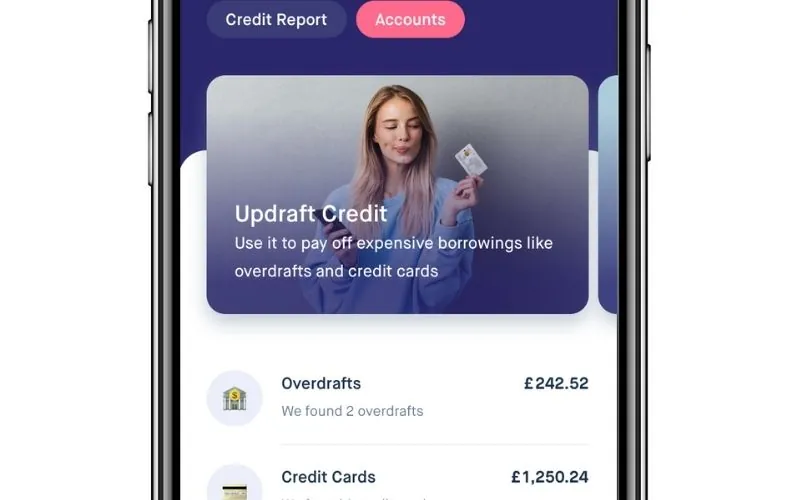

The firm hopes to use its app to help customers get rid of spend-linked borrowings such as credit cards, overdrafts and ‘buy now pay later’ schemes often found on eCommerce sites.

Using open banking and credit report data, Updraft builds a picture of a user’s spending and borrowing and provides a series of interventions designed to lift the consumer back into the black.

Where expensive borrowing is detected, users can get ‘Updraft Credit’ to pay off these high-interest-rate debts with a lower-cost loan, potentially saving them thousands of pounds in charges.

The company says it has already refinanced millions of pounds of borrowings using their own balance sheet and a typical Updraft member has been able to reduce their borrowing charges by up to 50%.

Alongside Munshi are co-founders David Yalland, its Chief Product Officer and Matt Millar, its Chief Technology Officer.

Greg Detre, the former Chief Data Scientist at Channel 4 is heading up data science for Updraft; whilst Andrés Castaño, previously of Starling Bank, leads mobile.

Its board of advisors includes Mat Braddy, Brand Founder of Just Eat, Philip George, founder of Shawbrook Bank and Sanjiv Sud, ex Head Retail Bank HSBC India, and Global exec at HSBC.

CEO Munshi said of the funding: “We are thrilled by this vote of confidence from a respected institution like Quilam. This funding gives us the fire power to take on the UK’s spiralling consumer borrowing.