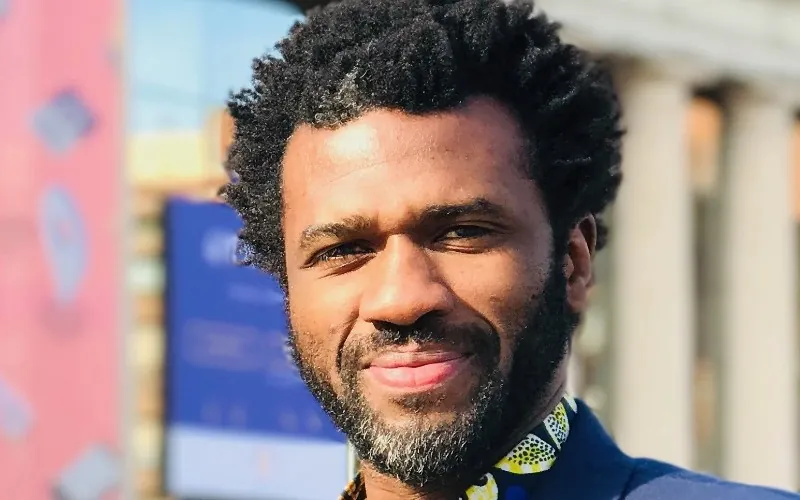

The founder and CEO of White Label Loyalty is targeting further expansion in the United States and Middle East in the coming months.

The Leeds-headquartered firm, which has worked with the likes of PepsiCo and Burger King, has onboarded more industry giants in the last year and successfully entered new markets.

White Label Loyalty is disrupting the loyalty industry by moving away from a system which purely rewards transactions. Its flexible, modular, ‘events-based’ system allows scaling companies to reward customers for all activity – for example spending time in an app, referring friends or even performing physical activity.

It records every customer interaction as an event, effectively gamifying the experience. The White Label Loyalty engine can then use that data to generate a reaction – for example, sending them a voucher.

“We’re very proud to have onboarded more industry giants such as British American Tobacco, Daikin – a leader in HVAC manufacturing – and US-based personal finance company NerdWallet in the last year. Each are renowned in their respective markets,” Achille Traore tells BusinessCloud.

“These clients prove our expertise in delivering powerful loyalty solutions that drive growth, solidifying our position as a tech industry leader.

“One notable achievement in the past year has been our successful entry into new markets, particularly in the US and Middle East. These expansions mark a strategic move aimed at diversifying our business portfolio and tapping into new areas… [the latter] gained momentum with the development of Tickit, a loyalty app for Dubai Holding.”

Global team

White Label Loyalty serves its global clients from its UK headquarters, with support from a small team in the United Arab Emirates, which manages projects across the Middle East. It also has team members in North and South American time zones.

“As our US client base expands, we’re committed to appointing dedicated project managers to cater specifically to their needs,” adds Traore. “This approach ensures we maintain high-quality service and support for our growing global clientele.”

The firm was sixth on our MarTech 50 innovation ranking this year and featured again on the Yorkshire Tech Climbers list for 2024.

“Our business strategy has developed to align with market demands and emerging trends,” Traore answers when pressed on any changes in its approach. “While our platform still supports any industry’s use case, we’ve shifted focus towards key sectors such as manufacturing and FinTech. These industries increasingly turn to our product to achieve their goals.

“To cater to these sectors, we’ve created tailored packages to address their specific needs and challenges. These solutions position us as the preferred loyalty solution provider in these industries.”

Growth plans

Its growth plan for 2024 and beyond will focus on growing its sales team and expanding its reach through strategic partnerships, says Traore.

“We have plans to onboard talent in these areas to ensure we continue to win key global contracts and solidify our position as a leading loyalty provider,” he says. “We’re incredibly excited about the journey ahead and remain committed to innovation, growth, and delivering value to our clients worldwide.

“This year we are set to win more contracts from big players across different industries. The spotlight on loyalty is intensifying as businesses recognise its pivotal role in understanding customers, building relationships, and cementing brand loyalty.”

Members-only pricing

Leading supermarkets Tesco and Sainsbury’s now have around 20 million loyalty card customers apiece, driven by members-only pricing – where holders of the cards can access labelled discounts in-store not available to other customers.

The Competition & Markets Authority has launched an investigation into whether such schemes are of detriment to the majority of consumers and reduce the amount of competition in the market, among other concerns.

“The investigation has raised questions about the authenticity and transparency of loyalty programme benefits,” is Traore’s view. “Consumers are questioning whether the savings offered are genuine or inflated to create a perception of value.

“However, the majority of loyalty programmes genuinely offer valuable discounts, perks and rewards that benefit the end user and enhance the customer experience.

“Big supermarkets focus on customer acquisition by providing instant rewards at the point of sale. Although this is effective, retailers must maintain transparency and integrity in their pricing practices to build trust with customers and ensure the long-term success of their loyalty programmes.”

Data concerns

Both Tesco and Sainsbury’s have reportedly built huge data businesses on the back of this, based on the sale of insights.

“It’s not surprising that both have developed extensive data banks, as this is often a primary objective behind most loyalty initiatives,” reflects Traore. “However, retailers must balance offering tangible value in exchange for consumer data and loyalty.

“This includes personalised offers and rewarding experiences that truly resonate with customers, an area needing significant improvement.

“Transparency about data practices is essential to building and maintaining trust. Customers want to know how their data is used and protected. Retailers must be forthcoming about their data collection methods, storage practices and usage policies.

“Striking the right balance between leveraging consumer data for insights and respecting privacy concerns is crucial for maintaining customer trust and support.”