TruSpine Technologies Plc is eyeing a ‘new future’ after shaking up its board and securing potentially life-saving funding.

A month ago TruSpine secured a temporary lifeline in the form of a £50,000 interest-free loan from former chairman Martin Armstrong as it fought for survival.

The company has now raised almost £300,000 through the issue of more than 19 million new ordinary shares – priced at 1.5 pence per share – with new chairman Geoff Miller subscribing for around 7.5m of these.

It has also approved an unsecured convertible loan note to the value of up to £1,500,000, with Miller subscribing for around £137,000 of this.

In aggregate, the company has raised gross proceeds of approximately £427,000 through the fundraise and CLN.

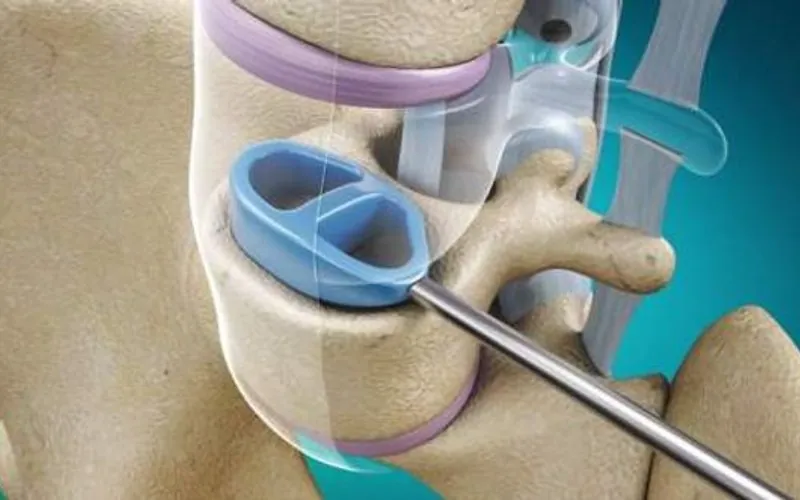

Based at London Gatwick, the medical device company is focused on the spinal stabilisation market. It is aiming to commercialise Cervi-LOK, a screw-free spinal stabilisation system which aims to minimise the risk of vertebral artery injury which can cause brainstem stroke or nerve root and spinal cord injury.

However, supply chain issues and external issues around testing delayed expected FDA clearance in the United States in 2022, leaving it seeking funding to see it through its FDA submission.

For the year ended 29th March 2023, the pre-revenue company lost £853,000 before tax – compared with £941,000 in 2022 – with an R&D tax credit of £199,000 taking loss after tax to £654,000.

It stated late last year: “The group is reliant upon FDA approval subsequent sales and/or further financing to meet its working capital needs… a material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern.”

In May 2023 its board survived a shareholder revolt. Laurence Strauss, who took over as CEO at the end of February, CFO Norman Lott and non-executive directors Annabel Schild and Nik Patel remained in post despite an effort to replace them with Todd Michael Cramer, Peter Houghton and Anthony Swoboda.

BenevolentAI’s new CEO reports restructured firm’s 2023 results

Last week Miller, co-founder of venture capital company Afaafa Ltd with long experience as a chair and CEO, was appointed chair while Victoria Sena and Samuel Ogunsalu become non-executive directors.

Sena founded Cherrybank Consulting Limited in 2019 to assist clients in the areas of governance, operations, risk and compliance. Earlier in her career, she spent eight years at the Bank of England in the authorisations, banking and insurance divisions, and completed a secondment to the Treasury Committee of the House of Commons.

Ogunsalu has over 20 years’ experience in technology commercialisation, licensing, and business development.

“I am delighted to announce that we have completed this second step towards a new future for TruSpine, the first being the changes to the board announced last week,” said Miller.

“On Friday we will take a further step forward by providing all shareholders with an opportunity to meet with the board at the previously announced AGM. I look forward to updating shareholders.”