Listed MedTech TruSpine has secured a temporary lifeline in the form of a loan from former chairman Martin Armstrong.

TruSpine Technologies Plc has entered into a £50,000 convertible loan note agreement with Armstrong. The loan has zero interest, with a maturity date of 31st January 2025, and is unsecured.

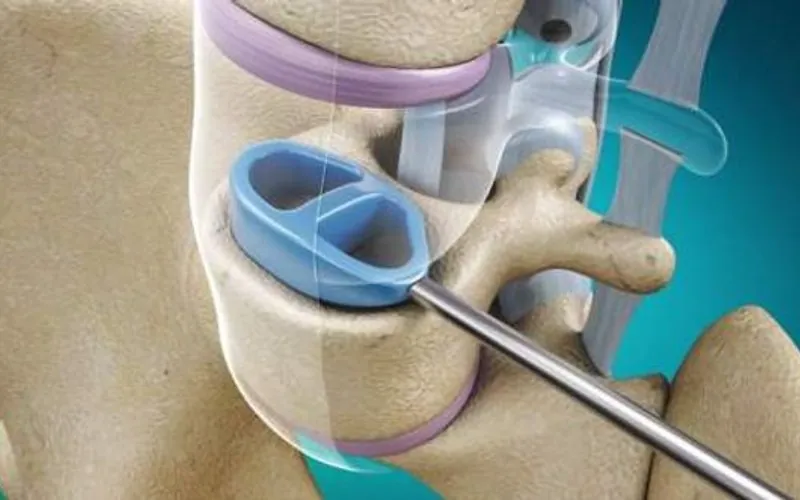

Based at London Gatwick, the medical device company is focused on the spinal stabilisation market. It is aiming to commercialise Cervi-LOK, a screw-free spinal stabilisation system which aims to minimise the risk of vertebral artery injury which can cause brainstem stroke or nerve root and spinal cord injury.

However, supply chain issues and external issues around testing delayed expected FDA clearance in the United States in 2022, leaving it seeking funding to see it through its FDA submission.

For the year ended 29th March 2023, the pre-revenue company lost £853,000 before tax – compared with £941,000 in 2022 – with an R&D tax credit of £199,000 taking loss after tax to £654,000.

It stated late last year: “The group is reliant upon FDA approval subsequent sales and/or further financing to meet its working capital needs… a material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern.”

In May 2023 its board survived a shareholder revolt. Laurence Strauss, who took over as CEO at the end of February, CFO Norman Lott and non-executive directors Annabel Schild and Nik Patel remained in post despite an effort to replace them with Todd Michael Cramer, Peter Houghton and Anthony Swoboda.

Should the company wish to convert Armstrong’s loan into shares, it must have received FDA clearance for Cervi-LOK.

In early January, TruSpine agreed a £30,000 loan from Schild, which it is yet to repay.

“The company has limited working capital resources at present and continues to carefully manage its weak cash position,” it stated today.