The founder of WeWork has raised $70 million for a blockchain startup focused on carbon.

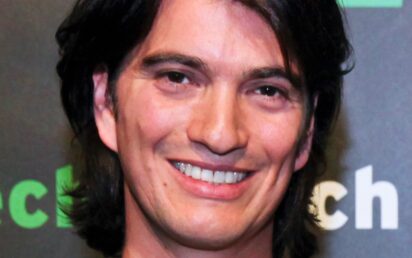

Billionaire Adam Neumann and his wife Rebekah are among the founders of Flowcarbon, which intends to tokenise carbon credits and build an on-chain market.

Neumann was ousted as CEO of the co-working giant three years ago when a failed flotation highlighted serious issues of governance at the company.

The funding round was led by a16z crypto and also includes General Catalyst, Samsung Next, Invesco Private Capital, 166 2nd, Sam and Ashley Levinson, Kevin Turen, RSE Ventures and Allegory Labs.

Other participants in the token sale include Fifth Wall, Box Group and the Celo Foundation.

Flowcarbon’s mission is to drive billions of dollars directly to projects that reduce or remove carbon from the atmosphere by creating the first open protocol for tokenising live, certified carbon credits from projects around the globe.

Demand for carbon credits has surged in recent years among corporations that use them to offset carbon emissions, but the ability to scale the volume of credits available has been limited. Flowcarbon says its protocol allows project developers to access a marketplace of buyers interested in their credits by bringing them onto the blockchain.

Buyers are then able to purchase live carbon credits directly from project proponents.

“There are powerful economic incentives to destroy and degrade critical natural landscapes around the world, but the voluntary carbon market is a brilliant financial mechanism that creates a counterbalancing incentive to reforest, revitalise and protect nature,” said Dana Gibber, CEO and co-founder.

“We have a big vision and the stakes are high. We are thrilled to be partnering with the most thoughtful investors in the world, who bring a combined expertise in web3 and key market categories including manufacturing, technology, entertainment and real estate.”

Flowcarbon says its Goddess Nature Token (GNT) is backed by a bundle of certified credits issued over the last five years from nature-based projects, tracking popular corporate demand criteria and offering widespread exposure to corporate-quality credits.

Each token can be retired as an offset, sold, used for borrowing and lending, or redeemed for an underlying real-world credit.

“The carbon market is extremely opaque and we believe demand for offsets is rapidly outpacing the speed at which supply can be increased, especially for nature-based projects,” said Arianna Simpson, general partner at a16z crypto.

“Tokenisation is an obvious solution. We’ve explored the on-chain carbon space extensively and feel confident that Flowcarbon’s team and model are best in breed.”

Actor Seth Green goes Ape over NFTs

Seth Green, creator of Robot Chicken and star of comedy films, may have to put an animated TV series on hold following the theft of NFTs which star in them.

Green, who played Dr Evil’s son Scott in Austin Powers and voices Chris Griffin in Family Guy, says four of his Bored Ape Yacht Club NFTs had been stolen in a phishing scam.

White Horse Tavern is an animated series featuring characters from NFTs owned by Green. The incident raises questions over whether he can still air the series despite losing ownership of the apes, which were sold to an unwitting third party.

He has said he is willing to go to court to recover ownership.

Cryptocurrency shorts

Exchange Coinbase has become the first cryptocurrency company to break into the Fortune 500, a ranking of the biggest US companies by revenue.

Ripple CEO Brad Garlinghouse says the crypto industry “needs to be more transparent”. Speaking from the World Economic Forum in Davos, he told Fox Business: “There’s no question that regulation around crypto is still trying to find solid footing and finding the right posture for the United States… the US has really been behind other G20 markets [including the UK].”

Mastercard’s VP of new product development and innovation Harold Bossé says adoption of crypto is accelerating. He told an Avalanche webinar: “They are early adopters and new adopters, but we have switched toward mass markets [and] that will be a very important aspect for financial institutions to move into the space… [however] no one will use digital assets on blockchains unless they’re absolutely certain this money is good money.”

South Korea is planning more regulatory scrutiny around crypto, focused on policing the way that exchanges list and delist coins, following the Terra LUNA and UST bloodbath.

Crypto prices

The overall market cap of the more than 19,500 coins is at $1.28 trillion at the time of writing (7am UK), an increase of 1.5% in the last 24 hours.

Market leader Bitcoin – the original cryptocurrency created by the mysterious Satoshi Nakamoto – gained 3% to around $30,125. BTC is less than 1% up in a week.

Ethereum, the second most valuable crypto coin – created as a decentralised network for smart contracts on the blockchain – added 1% to again top $2,000. ETH is 2% down over the course of a week.

Binance Coin is a cryptocurrency created by popular crypto exchange Binance to assist its aim in becoming the infrastructure services provider for the entire blockchain ecosystem. Its BNB token gained 2% to $334, leaving it 11% up over seven days.

The XRP token of Ripple, a payment settlement asset exchange and remittance system, acts as a bridge for transfers between other currencies. XRP lost 0.5% to drop towards 41 cents and is 4% down over seven days.

Cardano is an open source network facilitating dApps which considers itself to be an updated version of Ethereum. Its ADA token, designed to allow owners to participate in the operation of the network, gained 1% to approach 53c. It is 7% down over the course of a week.

Solana is a blockchain built to make decentralised finance accessible on a larger scale – and capable of processing 50,000 transactions per second. Its SOL token lost 0.5% to $49.79 and is down 10% compared with a week ago.

Meme coin DOGE was created as a satire on the hype surrounding cryptocurrencies but is now a major player in the space. DOGE dropped slightly but remains around 8.4c, leaving it 6% down in a week.

Polkadot was founded by the Swiss-based Web3 Foundation as an open-source project to develop a decentralised web. Its DOT token, which aims to securely connect blockchains, added 2% to top $10 yet is 4% lower than its price a week ago.

Avalanche is a lightning-quick verifiable platform for institutions, enterprises and governments. Its AVAX token shed 1% to $29.08 and is 14% down in a week.

To see how the valuations of the main coins have changed in recent times – and for round-ups of recent cryptocurrency news developments – click here.

For valuations of the top 100 coins by market cap in US dollars, plus 24-hour price change, see below.