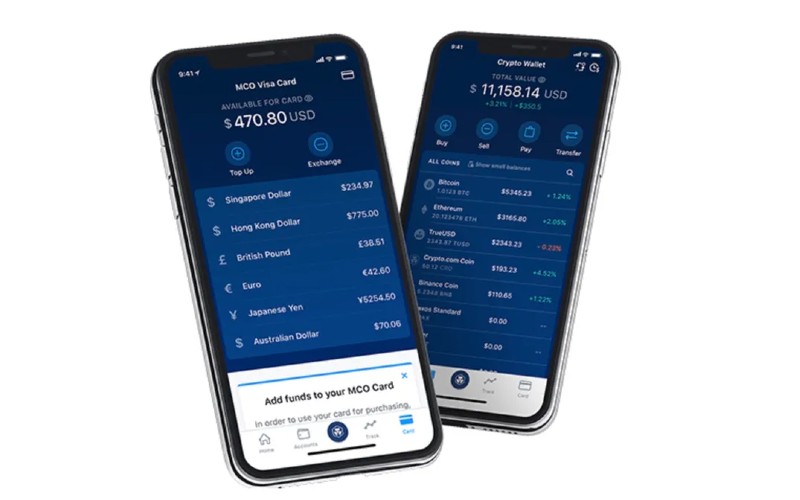

Crypto.com has been granted a licence to operate in the UK by regulator the Financial Conduct Authority.

The cryptocurrency exchange has been given the green light to provide ‘certain cryptoasset activities’, according to an entry in the FCA’s Financial Services Register.

It also gives the firm Money Laundering Regulation Status.

The register references Singapore-based Crypto.com, which has 50 million customers, by its UK trading name FORIS DAX UK LIMITED.

Crypto.com and the FCA are yet to reveal details of the licence.

According to FCA, ‘cryptoasset activity’ includes exchanging cryptoassets and money in both directions; exchanging cryptoassets for other cryptoassets; and automating a machine to do this.

The licence is therefore likely to allow users to legally buy cryptocurrency using fiat currency such as pounds sterling; sell crypto for fiat currency; or exchange crypto for a so-called stablecoin.

In recent days Crypto.com has revealed details of regulatory approval in both Canada and the Cayman Islands.

Cryptocurrency shorts

Dragonchain is being sued by the Securities and Exchange Commission. The US regulator alleges that the cryptocurrency firm engaged in the illegal sale of unregistered securities during its 2017 initial coin offering, and subsequent sales of its DRGN tokens, totalling $16.5 million.

US banking system The Federal Reserve has issued additional guidance for banks considering activities involving cryptocurrencies, including having systems in place to ensure the volatile assets do not threaten safety and soundness or consumer protections.

Far fewer people have fallen victim to cryptocurrency scams so far in 2022 than during the same period in 2021. The Chainalysis report says falling asset prices and the exit of inexperienced crypto users from the market mean total crypto scam revenue year-to-date is $1.6 billion, a 65% decline.

Murasaki, a game studio building decentralised games on the blockchain, has raised a €1.5 million seed round led by Japanese VC Incubate Fund.

Crypto prices

The overall market cap of the more than 20,500 coins is at $1.16 trillion at the time of writing (7am UK), a 1.7% increase in the last 24 hours.

Market leader Bitcoin – the original cryptocurrency created by the mysterious Satoshi Nakamoto – gained 2% to $24,300. BTC is 6% up on a week ago.

Ethereum, the second most valuable crypto coin – created as a decentralised network for smart contracts on the blockchain – rose 4% to $1,900. ETH is 16% up over the course of a week.

Binance Coin is a cryptocurrency created by popular crypto exchange Binance to assist its aim in becoming the infrastructure services provider for the entire blockchain ecosystem. Its BNB token grew 2% to $323, leaving it 2% up over seven days.

Cardano is an open source network facilitating dApps which considers itself to be an updated version of Ethereum. Its ADA token, designed to allow owners to participate in the operation of the network, rose 5% to 58 cents and is 14% up in a week.

The XRP token of Ripple, a payment settlement asset exchange and remittance system, acts as a bridge for transfers between other currencies. XRP gained 5% to 38.9c, with its price 8% up on seven days ago.

Solana is a blockchain built to make decentralised finance accessible on a larger scale – and capable of processing 50,000 transactions per second. Its SOL token grew 4% to $44.60 and is 13% higher than its price a week ago.

Meme coin DOGE was created as a satire on the hype surrounding cryptocurrencies but is now a major player in the space. DOGE gained 12% to 8.8c and is 30% up over seven days.

Polkadot was founded by the Swiss-based Web3 Foundation as an open-source project to develop a decentralised web. Its DOT token, which aims to securely connect blockchains, gained 5% to $9.13 and is 6% up on its price a week ago.

Avalanche is a lightning-quick verifiable platform for institutions, enterprises and governments. Its AVAX token rose 2% to $28.13 and is 3% up in a week.

Polygon aims to securely connect blockchains as a sort of decentralised internet. Its MATIC token gained 2% to 96c, while it is 9% up in a week.

For valuations of the top 100 coins by market cap in US dollars, plus 24-hour price change, see below.