Technology giant eBay has swooped to acquire Manchester-based NFT marketplace KnownOrigin.

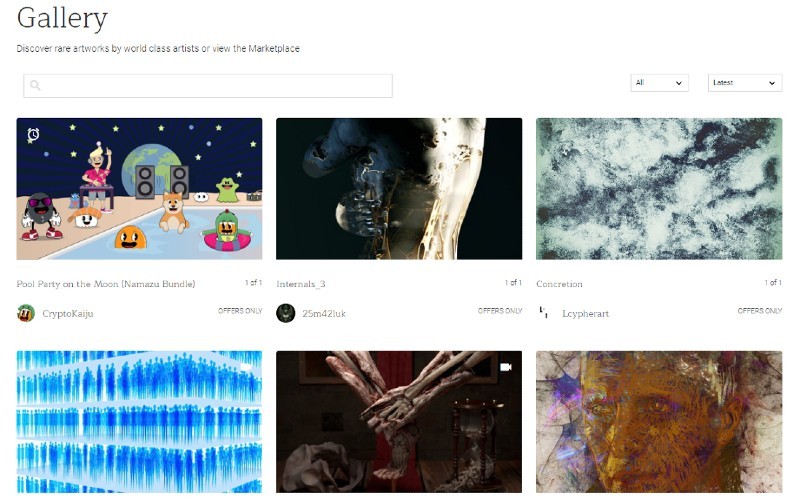

Launched out of a basement in 2018, KnownOrigin enables artists and collectors to create, buy and resell non-fungible tokens via blockchain-support transactions.

KnownOrigin was one of the first NFT art platforms to launch. It showcases and sells digital artwork in the same way as physical pieces.

Built on the Ethereum blockchain, it also serves as a direct link between artists and the NFT space.

It facilitates purchases via its smart contract platform and protocol, allowing the artist to receive instant remuneration. In addition to buying at the asking price, users can bid on artworks, while artists can also control pricing models and gift NFTs.

KnownOrigin has also worked with brands such as Adobe, Adidas and Netflix and developed a royalties system that allows artists to earn money through secondary sales.

Revealing a £3.3 million funding round in February, it said the platform had generated more than £20m in the previous 12 months and seen a tenfold increase in unique collectors and creators.

eBay, which has allowed the buying and selling of NFTs since May 2021, said the acquisition was an important step in its tech-led reimagination – ‘ushering in a new era of digital collecting to the world’s top destination for collectibles’.

“eBay is the first stop for people across the globe who are searching for that perfect, hard-to-find, or unique addition to their collection and, with this acquisition, we will remain a leading site as our community is increasingly adding digital collectibles,” said Jamie Iannone, CEO.

“KnownOrigin has built up an impressive, passionate and loyal group of artists and collectors making them a perfect addition to our community of sellers and buyers. We look forward to welcoming these innovators as they join the eBay community.”

David Moore, who co-founded KnownOrigin with Andy Gray, said: “As interest in NFTs continues to grow, we believe now is the perfect time for us to partner with a company that has the reach and experience of eBay. With more than 25 years building similar communities of passionate individuals, we are excited by the opportunity to bring a whole new audience on this journey.

“This is the start of a new chapter in the KnownOrigin story and we couldn’t choose a better time to focus on building and innovating with the team at eBay. This partnership will help us attract a new wave of NFT creators and collectors.”

The reaction on social media was mixed.

In response to a seven-tweet thread posted by the company which announced the deal, many people criticised the startup for selling out to a corporate company.

@MightyMooseART said: “Will probably be burning all my unsold work. I’m not here to support the eBay’s of the world. We were supposed to be building something different. I’m really sad.”

@barabeke added: “I used you for my 1/1s because I liked your philosophy. Now that you are going corporate there is definitely never going to be any spotlight for me, and perhaps no place… Congrats for the achievement anyway, and I mean it. Great job.”

However the company’s thread had garnered approaching 2,000 likes at the time of writing.

Desdemona, world’s first AI robot frontwoman, plays New York gig

Chinese government warns Bitcoin ‘heading to zero’

The Chinese government has warned crypto investors that Bitcoin prices are “heading to zero”.

The warning was issued via the Chinese national news media agency Economic Daily in an attempt to deter citizens from adopting the use of crypto.

The report blamed the West for creating a highly-leveraged market “full of manipulation and pseudo-technology concepts… Bitcoin is nothing more than a string of digital codes, and its returns mainly come from buying low and selling high. In the future, once investors’ confidence collapses or when sovereign countries declare Bitcoin illegal, it will return to its original value, which is utterly worthless.”

China is piloting its central bank digital currency (CBDC), the digital Chinese yuan (e-CNY), in many areas and plans to launch it nationwide.

The Communist country banned all cryptocurrency transactions last September, Bitcoin mining last July and foreign crypto exchanges in 2018.

Voyager Digital shares plunge 60%

Shares in New York crypto broker Voyager Digital plunged more than 60% due to its exposure to the collapsing Dubai-based Three Arrows Capital.

Voyager’s exposure to 3AC consists of 15,250 bitcoins ($370m) and $350m in USDC. The company may issue a ‘notice of default’ to the crypto fund, which is facing insolvency, if it fails to make a loan repayment by Friday.

Voyager has taken out a $200m loan from Alameda Ventures to increase liquidity – but users nevertheless said the platform’s withdrawal limit has been reduced to $10,000 per day from $25,000.

3AC had invested over $200m in LUNA tokens in February, now essentially worthless since the Terra ecosystem imploded in mid-May.

Cryptocurrency shorts

The CEO of the Swiss Financial Market Supervisory Authority has called for other regulators to do more to protect cryptocurrency investors from abuse. “There’s much more that can be done,” said Urban Angehrn. “It would seem to me that a lot of trading in digital assets looks like the US stock market in 1928, where all kinds of abuse, pump and dump, are now in fact frequently common [leading to the Wall Street Crash]. Let’s also think about the potential of technology to make it easy to deal with the large amounts of data and to protect consumers from trading on abusive markets.”

NFT project Doodles has hired top music producer Pharrell Williams – the driving force behind the Neptunes and N.E.R.D – as its chief brand officer.

Bybit and KuCoin have each been fined more than C$2 million in Canada for operating unregistered trading platforms in the state.

Swiss watch maker Hublot has followed Tag Heuer in allowing customers to pay for watches in crypto via BitPay.

Crypto prices

The overall market cap of the more than 19,900 coins is at $900.6 billion at the time of writing (7am UK), a 0.1% increase in the last 24 hours.

Market leader Bitcoin – the original cryptocurrency created by the mysterious Satoshi Nakamoto – is down slightly to around $20,330. BTC is 7% down in a week.

Ethereum, the second most valuable crypto coin – created as a decentralised network for smart contracts on the blockchain – lost 1% to $1,085. ETH is 9% down over the course of a week.

Binance Coin is a cryptocurrency created by popular crypto exchange Binance to assist its aim in becoming the infrastructure services provider for the entire blockchain ecosystem. Its BNB token gained 2% to $221, leaving it 3% down over seven days.

Cardano is an open source network facilitating dApps which considers itself to be an updated version of Ethereum. Its ADA token, designed to allow owners to participate in the operation of the network, remained at 47 cents and is 8% down over the course of a week.

The XRP token of Ripple, a payment settlement asset exchange and remittance system, acts as a bridge for transfers between other currencies. XRP gained less than 1% to climb above 32.5c while its price is 3% down on seven days ago.

Solana is a blockchain built to make decentralised finance accessible on a larger scale – and capable of processing 50,000 transactions per second. Its SOL token grew 3% to $35.94 and is 7% up compared with a week ago.

Meme coin DOGE was created as a satire on the hype surrounding cryptocurrencies but is now a major player in the space. DOGE remained around 6.4c, leaving it 7% up in a week.

Polkadot was founded by the Swiss-based Web3 Foundation as an open-source project to develop a decentralised web. Its DOT token, which aims to securely connect blockchains, gained slightly to $7.60 and is 5% down on its price a week ago.

Avalanche is a lightning-quick verifiable platform for institutions, enterprises and governments. Its AVAX token added 3% to $17.01 and is 3% down in a week.

To see how the valuations of the main coins have changed in recent times – and for round-ups of recent cryptocurrency news developments – click here.

For valuations of the top 100 coins by market cap in US dollars, plus 24-hour price change, see below.