Shares in global advertising powerhouse WPP took a significant hit last week, falling from 403.8p to 370.8p in just two days.

The drop follows the company’s announcement of a strategic review as it grapples with shrinking profits and flatlining revenues.

The London-based media group, known for owning global names such as Ogilvy and PR agency Burson, revealed that profits had nearly halved in the first half of 2025.

The slump comes after the FTSE 100 constituent lost several of its top-spending clients, delivering a blow to its bottom line.

Revenues had already shown signs of strain in July when WPP issued a profit warning.

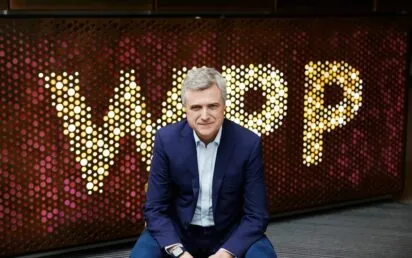

This came a month after CEO Mark Read announced that he would be departing the company after 30 years of service.

Operating profit dropped 48% in the first six months of the year and, in response, WPP is launching a full strategic review spearheaded by incoming CEO Cindy Rose.

The company’s stock is now nearly 80% below its all-time peak of 1,900p, recorded in early 2017.

Read said the figures highlight ‘a challenging first half’ due to ‘pressures on client spending and a slower new business environment’.

“Throughout my seven years as CEO, technological innovation has been a constant and I believe that thanks to our investment in AI we can look to the future with confidence,” he said.

“I would like to thank our clients for their partnership and our people for their dedication and I wish them, and Cindy, every success in the future.”

Read’s exit comes as the group faces mounting pressure from AI disruption and investor concern over its long-term direction.

Having joined WPP in 1989, he spent his first six years at the listed firm as a corporate development manager.

He then rejoined the business in September 2002 as director of strategy after notable spells as CEO of WebRewards and WPP Digital.

In 2006, he became a board member at the company before leaving in 2015 to become CEO of Wunderman.

A third stint at WPP commenced when he rejoined as COO in April 2018, a role which he undertook for six months before becoming CEO.

Since the announcement of his departure at the beginning of June, WPP’s market cap has dropped from £5.9bn to £4bn.