Three established financial technology companies have combined to bring AI-powered digital banking to the UK and US.

Fintilect brings together ieDigital, Connect FSS and ABAKA, which have a combined heritage of over 50 years, under one brand.

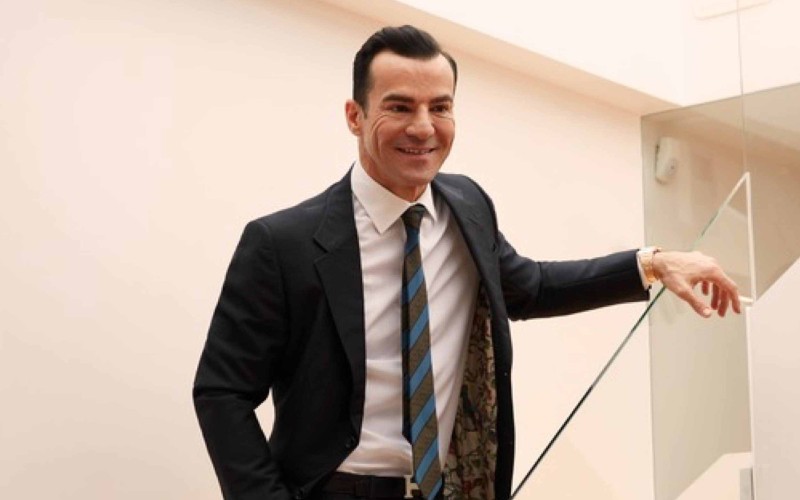

Aiming to enable regional and global financial services institutions to deliver hyper-personalised, AI-driven digital banking experiences, Fintilect is a portfolio company of Parabellum Investments, the family office of Rami Cassis.

Cassis is its CEO while Grant Parry, founder of Connect FSS, becomes Fintilect’s chief strategy officer, and Fahd Rachidy, founder of ABAKA, becomes director, AI global sales.

Fintilect claims to provide clients with the ability to recognise – and communicate – with their customers as unique individuals, leading to vastly improved engagement levels and higher conversion and upselling rates.

It does this by harnessing AI and machine learning to study a customer’s lifestyle and financial habits, together with demographic data such as hobbies, leisure activities and aspirational insights.

This rich data set is then analysed in real time to predict which action will resonate best with a customer, as well as the channel and phrasing of communication most likely to achieve a successful outcome.

“Today’s members and customers expect to be understood as individuals, with their specific life goals, ambitions and aspirations fully considered,” said Cassis.

“By using reliable and consistent execution, backed up by sensible pricing and open communication, Fintilect provides these hyper-personalised insights to banks, building societies, credit unions and other providers, enabling them to grow their market share through closer engagement with customers using an innovative blend of AI and digital functionality.”