Molo, a FinTech firm which claims to be the UK’s first digital mortgage lender, has raised a further £266m in debt and equity funding, completing its series A equity funding round.

The investment was led by global financial services firm Macquarie Group (Macquarie) and Patron Capital, a pan-European institutional investor focused on property-backed investments.

The equity round was led by Yabeo, an international Venture Capital firm and supported by existing shareholders Andenes Investments, GPS Ventures and others. SpecFin Capital advised Molo.

The capital raise comes after a first tranche of £10m for the Series A round that closed in January 2020.

The new funding will be used to accelerate the company’s growth through additional online lending and investment in its proprietary technology and new product propositions.

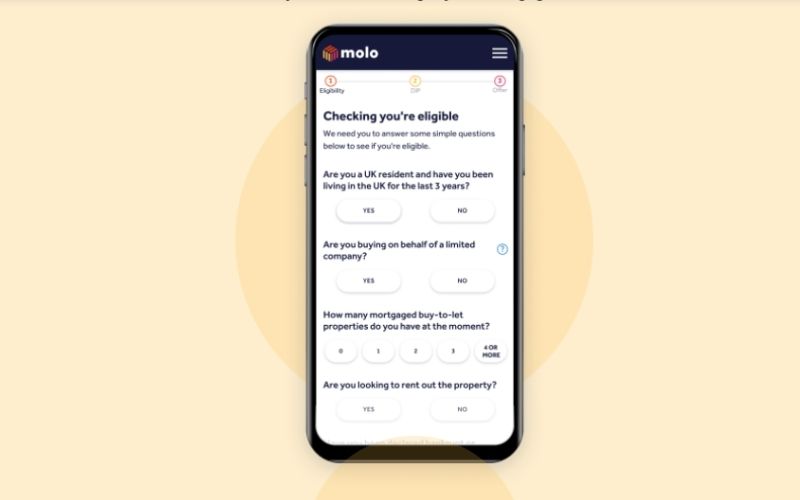

Molo combines automated decisioning and human expertise with an ability to integrate with its partners’ systems to deliver faster and more transparent mortgage loans, directly to its customers.

The company reports it has experienced significantly higher volumes of online mortgage applications post COVID which point to the growing popularity of digital lending. In August and September, Molo’s pipeline of buy to let mortgage applications exceeded £500m.

Francesca Carlesi, CEO and Co-Founder of Molo said: “This additional backing is a sign of trust in Molo, and we are proud to have reputable players like Macquarie, Patron and Yabeo on our team as we seek to revolutionize the mortgage market.”

Gerrit Seidel, MD of investor Yabeo, added: ‘The mortgage markets globally and particularly in the UK, are the largest financial services segments. Dominated still by traditional banking incumbents and brokerage set-ups, the market is ready for accelerated disruption, unlocking significant cost efficiencies and enabling consumer friendly online mortgage solutions. Molo is best equipped to spearhead these developments in the UK.”