A free credit score service and personal finance app has raised £9 million in growth funding through existing investors in the UK and the US.

TotallyMoney focuses on ‘underserved’ people who are just about managing and find it hard to plan their finances, estimated at around 25 million adults in the UK.

With financial pressures due to COVID-19 and a developing cost of living crisis driven by a hike in interest rates, rising inflation and growing food and energy bills, the situation does not look likely to improve any time soon.

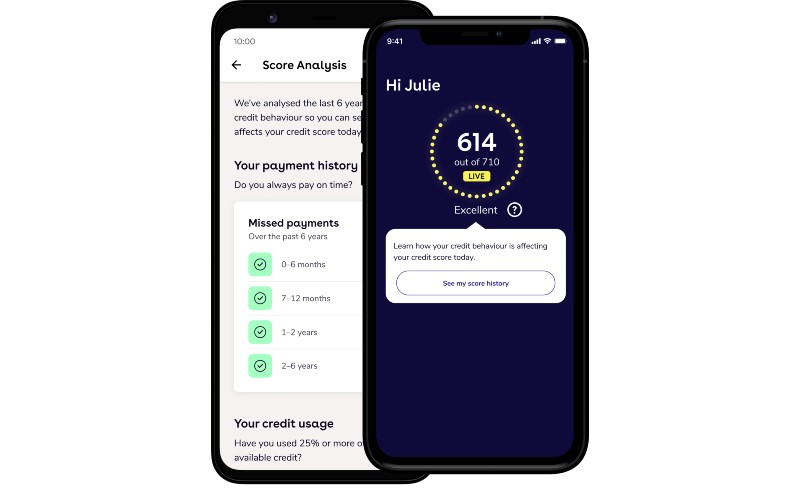

TotallyMoney uses multiple data sources to help customers understand, track and improve their credit score, offering tailored solutions and making personalised recommendations.

The firm, which has almost four million customers, works closely with lenders to develop new features and ensure customers are pre-qualified and matched with the right product.

The latest funding will be used by the business to drive product development and support digital and TV advertising, as well as building a team to launch future propositions – including harnessing open banking partnerships to further build its data capability.

“The number of people ‘just about managing’ with their finances is on the rise and millions are still underserved by the financial sector,” said CEO Alastair Douglas.

“We believe that people’s financial data should work for them, not against them. Our service provides our customers with the tools they need to understand their credit score and unlock more opportunities.

“Central to that is addressing a credit market that is not fit for purpose, and there is huge potential if we can collaborate across the industry to get that right. We’re excited about the next stage of this mission and delivering for our customers.”