The CEO of troubled MedTech TruSpine Technologies Plc has resigned amid shareholder unrest.

Laurence Strauss, who survived a shareholder revolt last year, has resigned with immediate effect after several investors called for him to go.

However CFO Norman Lott, who has also come under fire for the company’s plummeting share price on the Aquis Exchange and failure to secure an FDA licence to sell into the United States, seems to remain in post.

Lott has served in finance director roles at several AIM-listed companies.

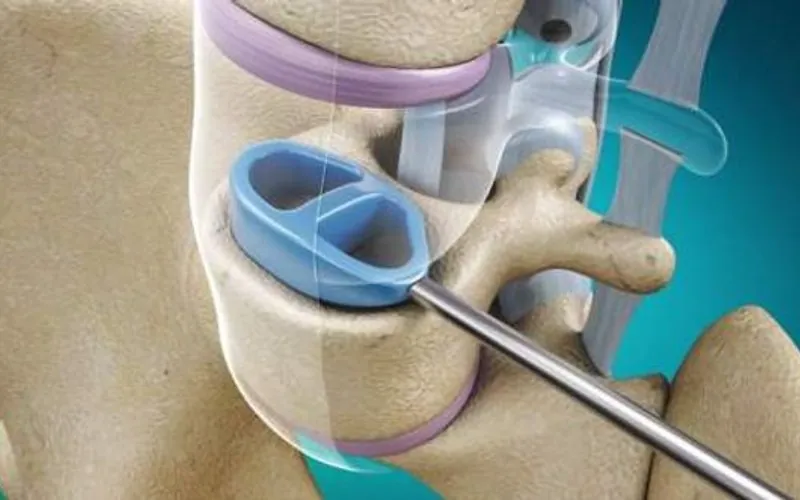

Based at London Gatwick, the medical device company is focused on the spinal stabilisation market. It is aiming to commercialise Cervi-LOK, a screw-free spinal stabilisation system which aims to minimise the risk of vertebral artery injury which can cause brainstem stroke or nerve root and spinal cord injury.

However, supply chain issues and external issues around testing delayed expected FDA clearance in the United States in 2022, leaving it seeking funding to see it through its FDA submission.

Following an emergency loan from former chairman Martin Armstrong early this year, it said in mid-March it had secured potentially life-saving funding of £300,000 through a share placing – with more than a third of these subscribed for by incoming chairman Geoff Miller – and an unsecured convertible loan note to the value of up to £1,500,000.

Miller, co-founder of venture capital company Afaafa Ltd with long experience as a chair and CEO, was appointed chair while Victoria Sena and Samuel Ogunsalu become non-executive directors.

However, shareholders remained unconvinced. A CityAM investigation recently quoted private investor Robert Turner, who put £180,000 into the firm prior to its IPO, as saying: “While the products were compelling, the company structure and finances are proving to be something else.

“Norman Lott, as CFO from the outset, bears responsibility for this and must go. Laurence Strauss was brought in to shore up Lott’s control. The pair of them have to go.”

Marcus Nicholls, another retail investor, also said they “have to go”. He told the publication: “These directors misinform the market at every opportunity; about financing that never arrives and FDA approval that never comes.”

Miller said this morning: “I would like to thank Laurence for the work that he has done to progress the company’s development during the time he has been a director of the company.

“The company has submitted and advanced its FDA application and recently raised further funding providing the company with a more stable financial footing.”

For the year ended 29th March 2023, the pre-revenue company lost £853,000 before tax – compared with £941,000 in 2022 – with an R&D tax credit of £199,000 taking loss after tax to £654,000.

In May 2023 its board survived a shareholder revolt. Strauss, who took over as CEO at the end of February 2023, Lott and non-executive directors Annabel Schild and Nik Patel remained in post despite an effort to replace them with former directors Todd Michael Cramer and Peter Houghton, as well as Anthony Swoboda.

Schild then resigned in June 2023.