Updated 16/10/25: the article was amended to reflect Sachin Dev Duggal’s denial that there was little-to-no automation in its Natasha neural network

Corporate spies are among more than 200 creditors of collapsed ‘artificial intelligence’ firm Builder.ai, a bankruptcy filing in the US has revealed.

The scandal-hit London firm claimed to have built a neural network named Natasha which would make building an app ‘as easy as ordering a pizza’.

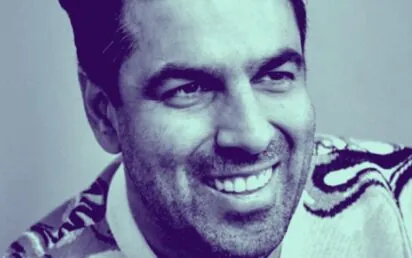

Founder Sachin Dev Duggal (pictured) raised more than $450m from the world’s biggest investors including the Qatar Investment Authority, Microsoft and SoftBank, handing Builder.ai a $1.5bn valuation and coveted unicorn status in 2023.

After the firm entered insolvency proceedings in the UK late last month – two months after Duggal was replaced by Manpreet Ratia, a managing partner at Asia-focused investor Jungle Ventures, as CEO – it was reported by dozens of news outlets that Natasha was, in fact, 700 Indian programmers responding to requests from clients in real-time.

This claim was denied by Duggal’s legal representative.

He told BusinessCloud: “These allegations deliberately overlook the publicly known hybrid architecture of Builder.ai’s human-in-the-loop platform, wherein skilled software engineers work alongside proprietary automation tools and large language model (LLM) integrations… the model integrates proprietary machine-learning architecture with the skill and oversight of experienced human engineers.”

There are also widely reported claims that Builder.ai and Indian social media giant VerSe Innovation engaged in a practice known as ‘round-tripping’ from 2021–2024: in effect, each company billed one another $180m for non-existent services such as ‘AI licensing’ and ‘market research’.

This financial fraud was disputed by Umang Bedi, VerSe’s co-founder, who told Bloomberg that it was “absolutely baseless and false” that his company would have inflated revenues.

Builder.ai scandal: How ‘chief wizard’ Sachin Dev Duggal was outed as another Oz

Now the firm’s main US holding company has filed for Chapter 7 bankruptcy protection in Delaware, with more than 200 creditors listed.

Among them is an Israeli private intelligence firm, Shibumi Strategy, which was embroiled in a spying scandal in 2022 when the Financial Times reported that financier Lars Windhorst had employed it to smear German football club Hertha Berlin’s former chair Werner Gegenbauer.

Despite initially denying the allegations, Windhorst later told the FT that he “had a legitimate reason to ask professionals to help me investigate” Gegenbauer.

American legal firm Quinn Emanuel, named the ‘No.1 most feared law firms in litigation’ in research by BTI Consulting Group for several years, is also a creditor.

Quinn Emanuel challenged the FT’s reporting last year after it published an article containing testimony from former Builder.ai employees complaining at Duggal’s leadership style, company culture and its ability to deliver on time.

Another high-profile creditor is Sitrick Group, an LA-based public relations firm specialising in crisis communications.

Sitrick was appointed following reports that the Indian Directorate of Enforcement had named Duggal as a suspect in a warrant application related to a money-laundering investigation into Videocon, an Indian firm that went bankrupt in 2018.

The directorate said Duggal did not appear following a 2022 summons to explain alleged ‘unexplained transactions’ between Builder.ai and Videocon. After the directorate changed his designation from ‘witness’ to ‘suspect’, it obtained the warrant from a Delhi court.

Duggal is appealing against the warrant and denies any wrongdoing.

Tech companies including Amazon and Microsoft are also among the creditors, according to the US court filings. Builder.ai listed liabilities of up to $100m and assets of less than $10m.