Challenger credit card Yonder has raised £12.5 million in equity and £50 million in debt following a Series A funding round.

The round was co-led by Northzone and RTP Global alongside angel investors Joseph Moore, founder of Crust Bros, and Cred founder Kunal Shah, who join a host of existing investors including Sharmadean Reid, Matt Robinson (GoCardless) and Rio Ferdinand.

The funding has resulted in a post-money valuation of more than £70m.

Yonder plans to use the investment to accelerate its growth by doubling its team, expanding its credit rewards offering into new verticals and launching in new UK cities, as it aims to transform the credit market for young professionals.

Since launching publicly in March 2022, Yonder has aimed to attract millennial and Gen Z consumers to credit cards through its rewards-based offering. Its mission is to help young professionals to build more secure financial futures through responsible use of credit.

ClearScore alumni Tim Chong, Harry Jell and Theso Jivajirajah launched Yonder after being unable to find appealing credit options available for expats in the UK. Securing FCA authorisation in just nine months, Yonder is one of the UK’s only credit cards that uses Open Banking to evaluate credit suitability.

It says this builds a more nuanced, personalised picture of its customers’ spending habits based on transaction data, instead of relying on traditional credit checks alone.

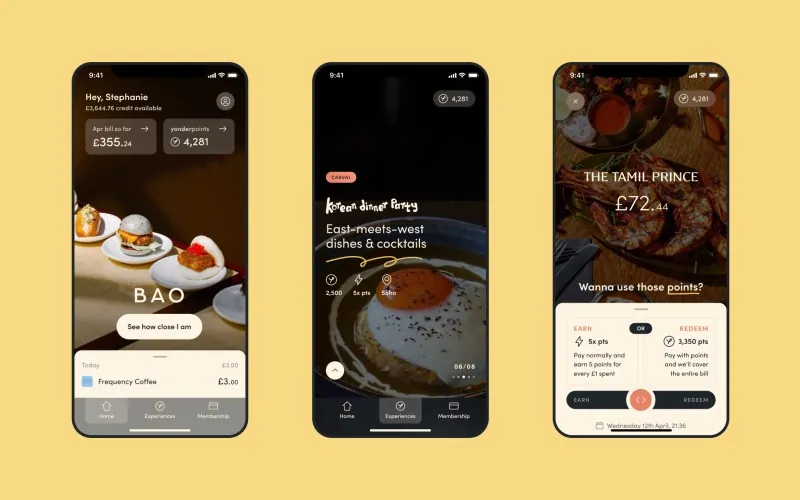

Members can redeem points with carefully selected and monthly changing partners including the likes of Kricket, Lina Stores and BAO. In addition to reward experiences, Yonder offers its customers no-excess worldwide travel insurance and no spending fees abroad.

“Securing this funding is a real achievement in the current climate, and we feel incredibly fortunate to have the backing of investors who believe in Yonder’s vision,” said co-founder and CEO Tim Chong.

“We’ve built Yonder as a key to the city for young professionals, which encourages responsible use of credit while helping them to unlock more value from their spending. The response so far has proved to us that we’ve built something that consumers really want, and signals a shift in the way consumers want to use and engage with credit.

“Yonder is a social-first business, so being able to expand to other UK cities and to grow our rewards proposition into other verticals like sport, fitness and theatre as a result of this funding is a huge step, and will mean we can offer our adventurous members more ways to experience more of their city.

“The credit market needs a rebuild, and we firmly believe change happens through intuitive products designed to help customers with their best interests at heart, not just blog posts on a website.

“This investor support will help us on our journey to completely rebuild consumer relationships with credit and show that Yonder is a company they can trust. We can’t wait for more people to experience credit the way it should be.”

Chong, Jell and Jivajirajah say they have built a diverse team from the outset, with two non-white co-founders, and 50% of staff and 30% of the leadership team being female.

The latest round of funding will enable Yonder to double in size, with plans to finish the year as a team of 35.

Northzone Partner Jeppe Zink added: “We are thrilled to continue to be part of the Yonder journey as young professionals eagerly seek a cutting-edge digital credit card that delivers not only enhanced customer convenience but also genuine relevance.

“Yonder addresses this need by establishing an exclusive membership club for a community of like-minded individuals. The impressive early engagement metrics are a testament to the exceptional potential Yonder holds.”

Yonder is extending its round with a crowdfund open to both members and non-members, now open for pre-registration.