Maven Capital Partners has invested £500,000 in Q5D Technologies, a pioneer in robotic additive manufacturing, through the British Business Bank’s South West Investment Fund.

This funding is part of a larger £2 million investment round which aims to support Q5D’s mission to revolutionise wire laying processes across multiple sectors including automotive, aerospace and consumer electronics.

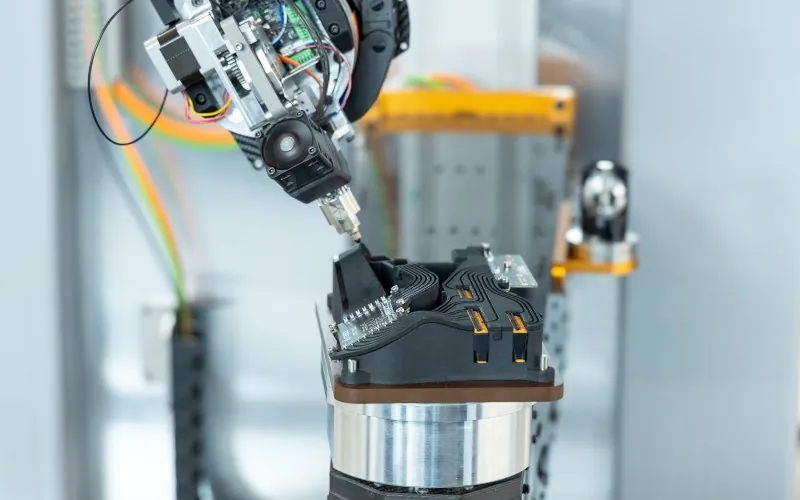

The investment will enhance Q5D’s capacity to scale its innovative 5-axis platform, which automates the complex process of adding wiring and electronics to 3D surfaces. It says this technology offers a faster, more efficient, and cost-effective alternative to traditional manual processes.

Q5D says its platform has gained interest from major industry players, including several of the world’s largest wiring harness companies and some of the largest and most innovative car makers.

The funding will also support the delivery of initial HaaS (Hardware as a Service) contracts and expand Q5D’s technology assessment centre in Portishead near Bristol, which has become a hub for testing and refining the company’s solutions alongside clients.

“We are really pleased to be partnering with Maven and the South West Investment Fund,” said Stephen Bennington, CEO. “Their advice and capital are helping us drive the company’s growth.

“Q5D is already attracting a large number of customers – and growing the support and business development teams is critical.”

Melanie Goward, partner at Maven Capital Partners, added: “We are thrilled to support Q5D Technologies as they scale their operations.

“Their unique approach to additive manufacturing, combined with impressive early traction with major industry players, positions them well for rapid growth.

“We look forward to working closely with Stephen and the team as they look to meet the increasing demand from global leaders in the automotive and aerospace sectors.”

techUK makes 8 recommendations to correct regional imbalances