In the modern economy, financial transactions rarely stop at national borders. From businesses paying international suppliers to individuals supporting families abroad, moving money across countries has become a routine necessity. Yet despite technological progress, many still face complexity, hidden fees, and delays when sending or receiving funds internationally.

Global Business in a Connected World

Understanding the mechanics of international money transfer is essential for anyone managing global payments — whether for commerce, investment, or personal use. The new wave of fintech-driven solutions is making these transfers faster, cheaper, and more transparent than ever before.

How International Money Transfers Work

The Traditional Banking Model

Historically, international transfers operated through the SWIFT network, where funds move from one bank to another via a chain of intermediaries. While secure, this system often incurs multiple fees, inconsistent exchange rates, and slow settlement times.

The Modern Fintech Model

Fintech platforms have transformed this landscape. Instead of relying on multiple banks, they connect directly to local payment networks worldwide. This infrastructure allows instant clearing in local currencies, transparent exchange rates, and minimal transaction costs.

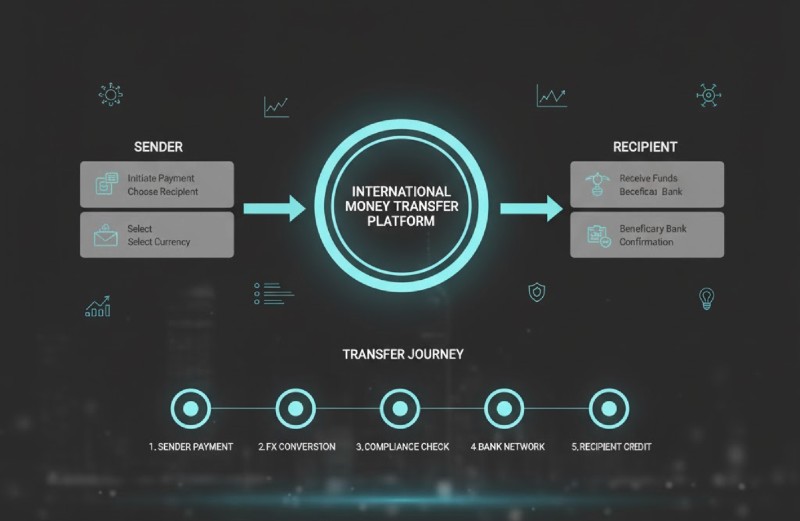

The Process in Simple Terms

1. A sender initiates a payment in their local currency.

2. The system converts it at the current FX rate.

3. Funds are delivered to the recipient’s account through a local payment rail.

The entire process can take seconds — not days — depending on the provider and destination country.

Common Challenges in Cross-Border Transfers

Hidden Fees and Exchange Rate Margins

Many traditional providers charge both a service fee and a hidden FX markup. A transfer that appears low-cost at first can end up significantly more expensive after conversion.

Limited Transparency

Without real-time tracking, businesses often don’t know when funds will arrive. This uncertainty complicates supplier relationships and cash flow management.

Compliance Barriers

Each country enforces different rules for anti-money laundering (AML), taxation, and reporting. Noncompliance can result in delays or transaction rejections.

The Benefits of Modern Transfer Solutions

Speed and Accessibility

Digital-first platforms offer near-instant transfers using real-time clearing systems. Even complex multi-currency operations can now be completed in minutes.

Transparent Costs

Users see total fees and conversion rates before confirming transactions. This transparency improves predictability and budgeting accuracy.

Automation and Integration

For businesses, many fintech solutions integrate directly into ERP and accounting platforms, allowing automatic reconciliation and payment tracking.

Regulatory Compliance

Automated KYC and AML systems simplify verification, ensuring every transaction meets legal and regulatory standards.

Key Considerations When Choosing a Transfer Method

Destination and Currency

Some platforms specialize in specific regions or currencies. Always check local coverage and settlement times.

Transfer Volume

High-frequency or large-volume transactions benefit from providers offering batch payments and lower FX spreads.

Security Standards

Look for encryption protocols (e.g., ISO 27001, PCI DSS) and regulation by recognized financial authorities.

Integration Options

API and accounting integrations are critical for businesses handling multiple global transactions daily.

Regulatory Framework and Security

Global Oversight

Leading transfer providers operate under financial authorities such as the FCA (UK), MAS (Singapore), or FinCEN (US). These licenses ensure adherence to strict security and compliance standards.

Data Protection

End-to-end encryption and tokenization safeguard user data and transaction details, maintaining confidentiality throughout the process.

Fraud Prevention

AI-based monitoring systems detect suspicious activity and prevent unauthorized access, adding a layer of trust to every transaction.

Frequently Asked Questions (FAQ)

1. What is an international money transfer?

It’s the process of sending funds from one country to another, involving currency exchange and settlement between financial institutions or fintech networks.

2. How long does an international transfer take?

Traditional bank transfers may take 3–5 days, while digital platforms can complete transactions within minutes, depending on destination and currency.

3. Are international money transfers expensive?

Costs vary widely. Banks typically charge multiple fees and add FX margins. Fintech platforms usually offer transparent pricing and lower costs per transaction.

4. What documents are needed to send money abroad?

Most providers require identity verification (passport, business registration, etc.) for compliance with AML/KYC regulations.

5. How do I ensure my transfer is secure?

Always use licensed providers with clear data protection policies and strong encryption. Avoid sending funds through unverified intermediaries.

6. What are the main risks of international transfers?

Potential issues include currency volatility, regulatory noncompliance, or delayed processing. Choosing a regulated platform minimizes these risks.

7. Can businesses automate global payments?

Yes. Many fintech platforms offer API integration, allowing companies to automate recurring payments like payroll, invoices, and supplier settlements.

8. What’s the difference between SWIFT and fintech transfers?

SWIFT relies on traditional bank intermediaries; fintech transfers use direct network connections, making them faster and cheaper.

The Future of International Money Movement

Instant Global Settlement

Next-generation systems are moving toward real-time international clearing, reducing settlement times to mere seconds.

Digital Currencies and CBDCs

Central Bank Digital Currencies (CBDCs) and blockchain-based technologies will further streamline global transfers and reduce dependency on intermediaries.

Predictive Financial Management

AI will soon forecast currency fluctuations and automatically optimize transfer timing, helping businesses save on FX exposure.

Final Insights

International money transfers are no longer the bureaucratic, opaque processes they once were. Today’s fintech-driven solutions make it possible to move money globally with unprecedented speed, transparency, and efficiency.

Understanding how these systems work — and how to choose the right one — allows both individuals and businesses to operate confidently in a truly borderless economy.