Beauty Tech Group, the Cheshire-based parent company of CurrentBody, has confirmed the price range for its planned float on the London Stock Exchange, which could value the company at up to £320 million.

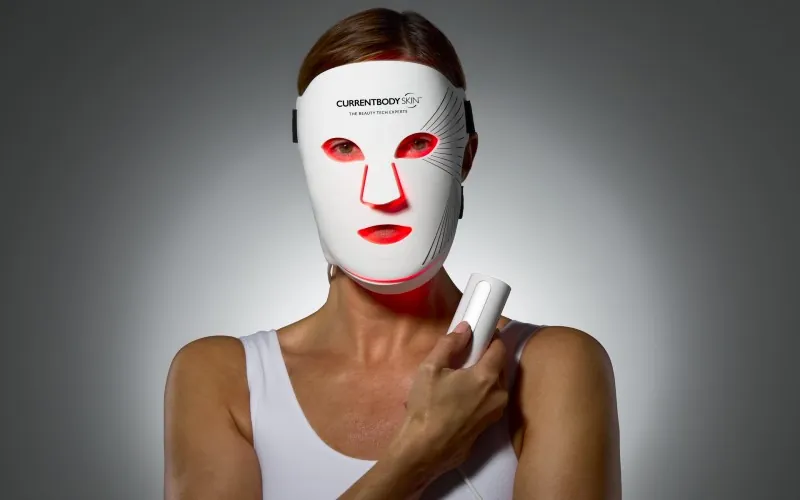

The group owns brands including CurrentBody Skin, ZIIP Beauty and Tria Laser, which are used by stars such as Serena Williams and Kim Kardashian.

It will raise around £29m in primary capital through the issue of 11.5m new shares.

The business says that the proceeds will ensure a debt-free position at IPO and provide working capital, while up to 29.3m existing shares may also be sold by current shareholders.

The offer, priced between 251p and 291p per share, would give Beauty Tech Group an estimated market capitalisation of £280m-£320m, with admission expected next month.

The company is also making shares available to retail investors via an intermediaries offer with a £500 minimum application.

Signal AI raises £122m as Battery Ventures acquires majority stake

Founders Laurence Newman and Andrew Showman, who appeared on BusinessCloud’s Northern Leaders list in 2024, could see their stakes valued at £23m and £25m respectively if the top valuation is achieved.

Other investors include On the Beach founder Simon Cooper and eCommerce group eComplete, co-founded by ex-MyProtein CEO Andrew Duckworth, which invested £50m for a majority stake in 2021.

Founded in 2009 as CurrentBody.com, the business reported EBITDA of £22.9m on revenues of £101.1m last year, with global markets accounting for 22% of sales.

Its IPO comes amid a slow year for London listings, marking one of the first significant floats of the quarter.

“Founded with the ambition to bring clinically proven, professional-grade beauty technology into everyday use, I am extremely proud of the Beauty Tech Group’s achievements to date,” said Newman.

“There are significant opportunities ahead… and an IPO on the London Stock Exchange will provide us with access to capital and enable us to raise awareness and incentivise staff to take the business to the next level.”