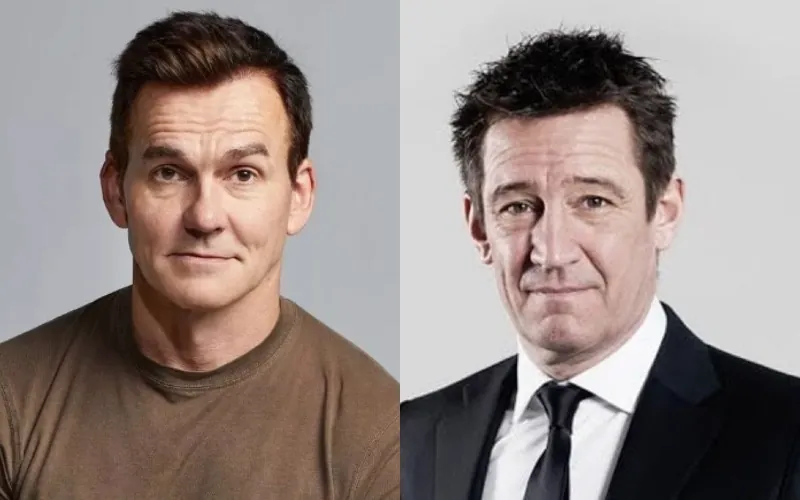

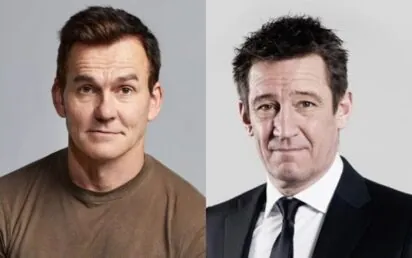

Former NCC CEO Rob Cotton and THG founder Matt Moulding have been embroiled in an extraordinary war of words on social media.

Cotton stepped down as the chief executive of Manchester-headquartered cyber security group NCC in 2017 following two profit warnings.

He took to LinkedIn this week to accuse Moulding of ‘single-handedly’ overseeing the ‘destruction’ of THG’s share price from 500p at its IPO in 2020 to around 25p.

Cotton was responding to an article in BusinessCloud, which reported research by Retail Gazette comparing the pay of the UK’s top retail CEOs.

Cotton calls truce in Moulding row – but is the damage done?

According to the publication, Tesco CEO Ken Murphy topped the table with an eye-watering £9.2m pay package – around 288 times more than bottom-placed Moulding, who picked up £32,000.

Moulding was also reported to have waived £726,972 of his salary and his entitlement to participate in the business’ annual bonus plan.

Back in March, 53-year-old Moulding revealed he’d waived around £15m in in salary and expense payments since 2020 when he took his Manchester-based business public.

Career break

However Cotton, who says he’s currently on a ‘career break’, described the article as ‘absurd’ in a strongly-worded post.

“Please explain why a comparison to Tesco, whose size and scale are incomparable and whose share price has gone from 274p to 394p is relevant,” he wrote. “I’m not sure that anybody would think that performance was worth £15m over three years!!”

Moulding responded with the following message (complete with laughing emoji): “@Rob Cotton this made me chuckle. Clearly a sensitive topic for you given the noise around your NCC plc exit 🤣.”

Cotton, who describes himself as a highly experienced CEO and chair with ‘significant success on FT250 and all share main and AIM markets’, hit back.

“@MatthewMoulding glad to be of service as you can’t have much to chuckle about TBF,” he posted.

“No sensitivity around my departure but then I was not overseeing a SP (share price) that had fallen to 5 per cent of its IPO price and market cap, in what should be, if well run, a hugely successful business. The article was absurd and the comparison made me laugh too! 🤣.”

Skin like a rhino

The row didn’t end there as Moulding accused Cotton of having ‘skin like a rhino’ if he wasn’t sensitive around his departure before making a number of other allegations that BusinessCloud has chosen not to report.

Cotton, a big Man Utd fan, refused to back down and posted: “Nice deflection and great work of fiction but hey, don’t let the truth great in the way of a good story. How utterly absurd.”

Moulding replied: “Rob, the scandal around your tenure as CEO of NCC is legendary. I’m used to criticism, and no doubt a poor share price performance means some of it is deserved. Although I’m not aware of you posting similar criticism to the CEOs/founders of ASOS, Ocado, Boohoo, Future, S4 Capital and countless others whose share prices have performed similar to THG, each of which have been paid the appropriate salary packages.

‘Good luck finding another CEO role’

“I’m good with taking criticism from most people, but puh-lease! For you to criticise any CEO, let alone founders who’ve started businesses from nothing into global giants, is beyond insulting. Good luck finding another CEO role 🤞🏻.”

Before he exited NCC, Cotton had been one of the North West’s highest profile chief executives.

A snappy dresser with a reputation for speaking his mind, he stepped down suddenly in 2017 after coming under increasing pressure after two profit warnings.

At the time NCC’s market cap was £339m – a far cry from its peak of around £1bn in 2016. The cyber security firm’s market cap has recovered to £514m.

Cotton had been at NCC Group for 17 years – including 14 years as CEO – steering it through its move to the London Stock Exchange’s main market in July 2007, following admission to AIM in July 2004.

Cotton ceased to be a director of NCC on March 1st, 2017, and was put on gardening leave, initially for 12 months but reduced to eight months by mutual agreement.

Reimbursed NCC £19,596 in expenses

During his garden leave he received salary, pension and car allowance payment totalling £399,600. In addition, Cotton reimbursed the company with a cash sum of £19,596.70 in relation to expenses claimed.

Cotton’s LinkedIn profile describes him as a ‘successful investor, coach and consultant to private companies and private equity’.

THG’s market cap is currently just £358m – compared to its IPO valuation of £5.4bn in 2020.

It’s one of the reasons why THG slipped out the FTSE 250 in June – just three months after it was included

Moulding has an estimated personal fortune of around £573m.