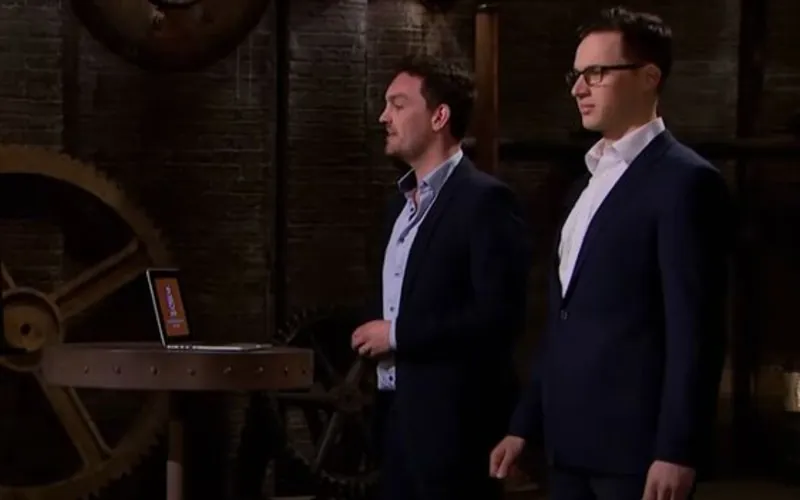

A Dragons’ Den contestant who secured offers from all five dragons has shared his advice for founders looking to raise funds as he grows his second startup.

Jonny Plein, currently a co-founder of YASO, explained how he used the publicity from his TV appearance to successfully exit his first startup, Pouch.

Plein raised £75,000 on Dragons’ Den after becoming only the third founder to get offers from every dragon in 15 years.

That deal later fell away, but Plein used his 15 minutes of fame on TV to continue to grow the eCommerce voucher codes browser extension business until he exited in 2019.

“If we hadn’t gone on the show and got all the free press that came with it, we never would have got lift off in user growth, as well as being able to test the product and negotiate with retailers, so it really did make our business,” he told Vestd’s FounderMetrics podcast.

“We were never that interested in the funding, but we wanted to make the most of the publicity. You never deal with the dragons outside of the filming: as soon as the episode ends you deal directly with their business development team.

“The YouTube video of our pitch has millions of views and probably still generates customers now.”

Speaking to Vestd founder and CEO, Ifty Nasir, Plein explained how the experience from Pouch had enabled him to launch his next venture, YASO, a platform that helps Western brands to sell into the huge Chinese consumer market.

YASO is currently building towards Series A funding and the experience has been different for Plein in his second business.

“With Pouch, I was young and ambitious and probably a bit too cap in hand to investors – whereas, with YASO, we know exactly what we’re doing and what we need to execute.

“The markets are absolutely massive and we can say that you should feel privileged to be getting the opportunity to get on this rocket ship with us. If you want to invest great, if you don’t, that’s fine. That attitude feeds a snowball.”

He also provided some advice for founders who are fundraising.

Focus on learning

“When we launched Pouch, I didn’t have huge expectations of it working. To be honest, I wanted to do a cool startup because I was 24, thought I’d meet some interesting people and learn a lot, but thought there was no way it would work.

“That served me so well because I was there to learn and not worry too much about the money or the stress.

“Equally, when we were acquired in 2019, I stayed with the business for three years. That was because I wanted to be there, rather than had to be there. I genuinely enjoyed growing the product and I learned so much about how a top startup is operated. I could then take those learnings into YASO.”

Prove your founder-market fit

“When you’re raising pre-seed funding the question is always ‘why are you the right person to build this business?’. You have to establish your credibility and that’s where the founder-market fit comes in.

“With YASO, in previous funding rounds we’ve been able to point to 10 years of evidence that we could build the product and understood the market, and I also had my operational experience from Pouch.

“We had to show investors why we’re the people that can grow the business and why it’s hard for other people to do it. Anyone can see that the Chinese market is huge, but we have the unique skillset and experience to do it.”

Prove your traction

“When we were first fundraising with YASO we couldn’t show people the product. We could explain what it was and how it would work but we needed funding to build the solution.

“To counteract this, we had spoken to a lot of brands who we knew would be interested in the YASO solution and got them to say we will sign with them when it’s built.

“This is a massive testament because it’s a third-party endorsement and the smartest thing we did was record the brands, with their permission, to say this is why China is a real challenge for businesses like us and this is why the product will help.”

Ignore the false metrics

“With a lot of SaaS businesses and productivity tools, there are so many false metrics like engagement or improvement. These are useful, but don’t show the true impact of the platform on businesses.

“With YASO, we aren’t a ‘nice to have’, we’re a need to have. If you want to make money in China you need us and the only metric that matters is ‘are we making money?’

“The thing we’re looking for is exactly what brands want and investors want.”

Invest in your team

“I’m fortunate to have achieved the rare accolades of successfully exiting on your first go at a startup and I want other people to benefit from our success.

“Our headcount is currently 16 and it’s important that we reward them all with a share of our success. We use Vestd’s sharetech platform to reward staff in the UK and in China, our team is rewarded with unapproved options.

“We do it with junior people even if they don’t ask for it because it’s the right thing to do, even if they don’t understand what they’re getting. When we exit they will be taken care of.”