eCommerce giant THG plc has revealed the details of its demerger of tech arm Ingenuity into a standalone private business.

Shareholders have been sent a circular today which reveals that a vote will take place on the move on 27th December at the offices of Clifford Chance in London, with the demerger anticipated to complete on 2nd January 2025.

Should the move go through, THG COO John Gallemore would take up the role of Ingenuity’s executive president, with all other executives at THG and THG Ingenuity remaining in their current roles.

Some £298 million of THG’s financial liabilities would be transferred with Ingenuity, while other facilities of €600m, £109m and £170m would stay with the core retail business.

Shareholders have been given the option to redesignate their shares in the circular.

THG recently raised £95.4m to facilitate the demerger, including £10m from CEO Matt Moulding and £10m from Mike Ashley’s Frasers Group.

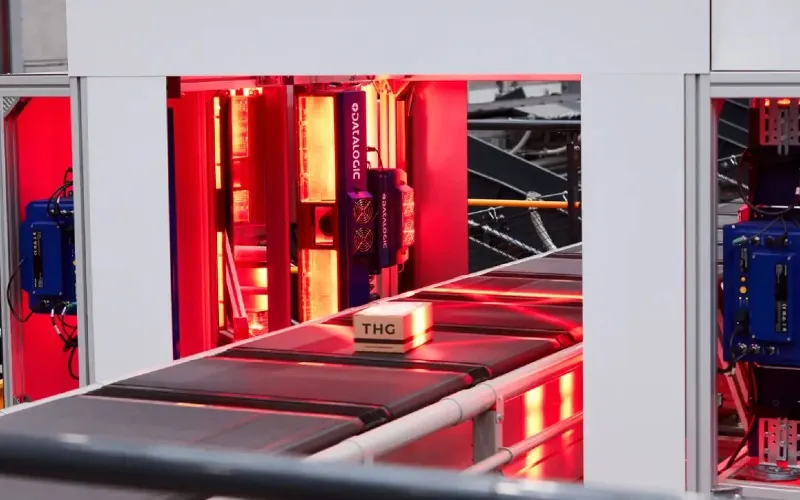

Ingenuity, which provides logistics services to the likes of high street giant Frasers Group – and THG itself, its largest client – has 4,000 staff and 12 distribution centres globally.

Analysts suggest it will take 3-5 years for the capital-intensive company to break even and that it is likely to require significant additional funding. Therefore taking the business private would allow THG to retain the material free cashflow generated by its other operations.

Post demerger, the group would consist of its two consumer businesses THG Beauty and THG Nutrition, which are highly profitable, cash generative and capable of paying dividends.

THG plc has also appointed a sponsor to recategorise its shares on the recently reformed premium segment of the London Stock Exchange.

Transferring its ordinary shares from the equity shares category of the Official List – maintained by the Financial Conduct Authority – to the equity shares (commercial companies) category of the Official List is expected to bolster liquidity in its stock.

Expected to become effective on 6th January 2025, this does not require shareholder approval and would see the core listed become eligible for inclusion in FTSE UK Index Series from March 2025.

THG went public in 2020 at a valuation of over £5 billion but has since seen its market cap drop to around £688 million.

The next wave of AI: What does 2025 hold for evolving technology?