The next few years will see exponential use of self-serve and hybrid advice as the financial services industry takes advantage of developments in technology and consumers feel increasingly comfortable using digital services.

In understanding how hybrid advice can fit into an advice firm’s business model and provide a route into advice for more consumers, it’s helpful to distinguish between self-serve and hybrid advice.

Self-serve advice enables streamlined, simplified guidance and advice for areas like pension top-ups and ISA investing and is an effective way of narrowing the advice gap. It’s a highly cost-effective way of onboarding new clients, performing initial fact-finding, and encouraging people to improve their overall financial situation, particularly for retirement planning.

Hybrid advice is led by machine learning, based on a firm’s advice policy, that can accurately direct the best advice route for an individual client’s needs e.g. for retirement planning and pension guidance.

Here are five ways that self-serve and hybrid advice can increase the number of clients you can serve, profitably, and increase your revenues. The data comes from one of our large wealth business clients.

By using a multi-channel approach to attract and onboard new clients

Digitally onboarding new clients takes them through an automated, self-serve financial ‘health check’ to understand their financial commitments and retirement income goals via an interactive chatbot.

The client is then presented with a series of recommendations to help them achieve these goals. The platform also identifies how much the client needs to save into their pension each month to achieve their desired retirement income and lifestyle.

If they don’t already have a pension, a chat bot provides guidance on pension types and can refer the client to a human adviser for fully regulated advice, if required.

The self-serve platform can also provide guidance on areas such as ISA allowances, investments and savings, without having to speak to an adviser or customer service agent. It can provide fully regulated advice on ISAs and pension accumulation.

This multi-channel approach provides the client with choice and flexibility. They can interact digitally at any time that suits them or arrange to see an adviser face-to-face during office hours, providing the client with convenient, flexible 24/7 oversight of their finances.

By reducing time spent on key advice processes

Hybrid advice can very successfully handle repetitive administrative processes, which can free up staff to carry out more valuable work. For example, our client data reveals that 95% of clients who have been sent fact-finding elements digitally to pre-complete, prior to a planned meeting, do so in time. This saves between 30-45 minutes of adviser facing time, which is better spent focused on the client’s financial goals and building the relationship with them.

Also, firms can spend up to 6-7 hours compiling suitability reports – almost a full working day. This time could be better spent by the paraplanner or adviser focusing on the client relationship and objectives. By using data and personal objectives which have already been inputted into the fact find, we’ve designed our hybrid advice platform to create suitability reports within 35 minutes.

One of our wealth business clients recently timed their average at-retirement process at approx. 35 hours per case – from receiving the initial lead through to business submission.

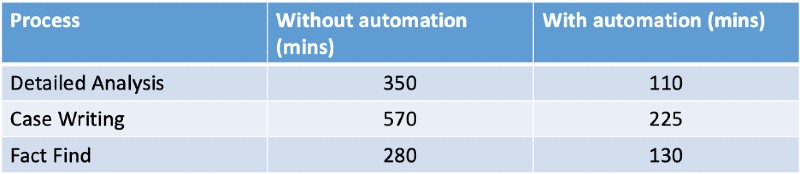

Fact Finds were taking on average 280 minutes and case writing was consuming around 570 minutes, so there was a clear need to reduce the time spent on these key, but time-consuming areas of the process.

To take some of the ‘heavy lifting’ out of the process, we implemented a series of automated functions via Turo, our hybrid advice platform which included:

- Automated reviewing and validation of data

- Automated fund recommendation

- Integration with relevant systems to retrieve data, quotes, and graphs

- Automating production of the suitability report

By increasing client retention levels

Hybrid advice enables financial advice firms to enhance their offering. They can offer quick, smooth, digitally enabled advice for those who have simple requirements and simply need guiding through a process to save into a pension or invest. And for clients with more complex circumstances or higher wealth levels, they can offer an automated approach but with the human touch of personal face-to-face advice from a financial adviser being introduced at the right time for the client and the business.

Importantly, once a client has been attracted and successfully digitally onboarded, they are likely to feel inclined to continue with hybrid advice at other key intervals, such as annual reviews, consolidation, or changes in circumstance. Full advice is retained for where it is truly needed.

So key advice processes can be accurately streamlined with a hybrid approach, and because every action is recorded by the platform, there’s no need for re-keying data and the compliance trail is exact and readily accessible.

By building or changing your advice platform piece-by-piece

Procuring new technology in the advice sector has traditionally been regarded as costly and complex, but thankfully this is changing for the better.

Technology advancements, driven by APIs, now allow for a modular approach to adopt new ways of working, using the best technology. In simple terms, this means wealth firms can pick and choose the modules that work best for them at any given time – anywhere in their processes.

Onboarding of new technology has also become far simpler. Wealth advisory firms can have their own in-house technical teams integrate the modules into their own ecosystem or use a vendor’s implementation experts.

This ‘plug and play’ approach ensures the technology is adaptable to every business’ advice needs and sits with its advice permissions at any given point.

By scaling to significantly increase your revenues

Hybrid advice can help a business scale and therefore increase revenues.

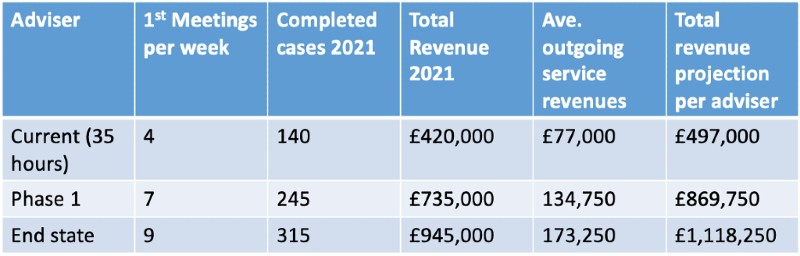

Working with the same wealth business client, we tracked the productivity of one of its advisers using Turo, our hybrid advice platform, for the ‘at-retirement’ process.

Over the course of Quarters 1 and 2 in 2021, we recorded the following results:

The results were highly encouraging with key highlights including a 225% increase in projected completed cases and total revenues projected per adviser.

Adviser productivity also showed encouraging results. Using automation, the proposed hours spent per case was reduced from 35 to 11 – a saving of 24 hours per case. Based on average adviser salaries, 260 working days per year and 7.7 hours per day, the savings per case are projected at £800.

Summary

The hybrid advice model is gaining significant momentum as advice firms seek to manage existing clients needs more efficiently, and on-board new clients cost effectively, enabling them to access guidance and advice in a way that works for them, and for you.

If you would like further information on how our self-serve and hybrid advice platform can benefit your business, please contact [email protected] for further insight