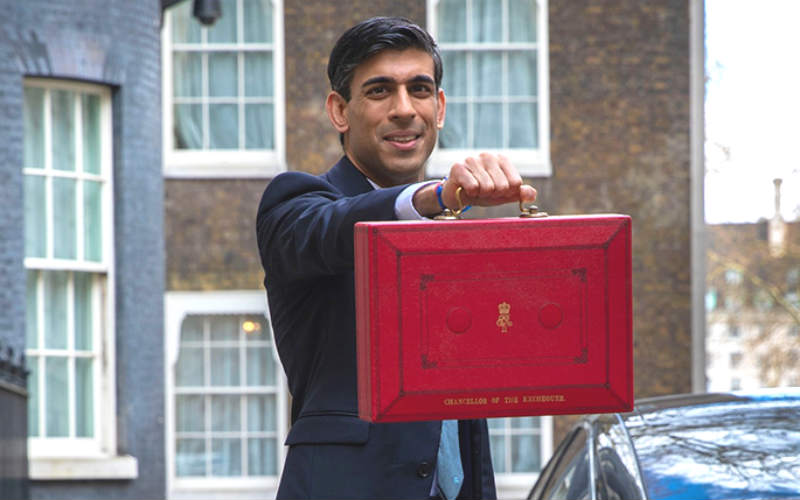

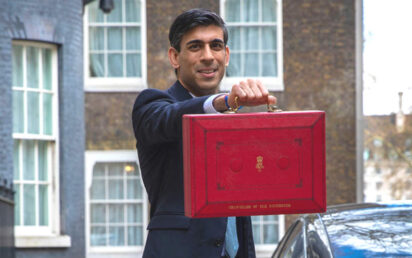

Rishi Sunak’s third Budget outlined the government’s plan to ease the nation out of COVID-19.

The Chancellor revealed plans for digital health and tech skills investment, R&D changes, space industry funding and a cash pot for regional angel investors.

What did the tech sector make of the government’s fiscal plans?

Digital health investment

The government pledged £2.1 billion over the next three years to support digital technology to connect hospitals and other care organisations. This will be paid for by a new Health and Social Care Levy, along with an increase to the rates of dividend tax, which will raise around £13bn per year for spending on health and social care across the UK.

“All too often in recent years we have seen government pledges of digital transformation in our health service fail to have any meaningful impact on the quality of patient care,” said Tom Bianchi, VP marketing, EMEA at Acquia.

“An obvious example is with the NHS Track and Trace programme, which the Public Accounts Committee has criticised as being a waste of taxpayers’ money that did not achieve its objectives. However, the success of online vaccination bookings and the COVID pass proves what can be achieved with digitalisation, and should be emulated with this new funding.

“For the investment to be successful, it is also critical that initiatives leverage open source to optimise efficiencies and mitigate developer skills shortages. With the country experiencing a severe developer skills crisis, open source will enable the health service to tap into resources from the world’s best developers and accelerate digitalisation strategies, rather than waste precious time and resources coding from scratch.”

R&D changes

Sunak plans to increase public investment in UK R&D to £20bn by 2024-25, representing an increase of around a quarter in real terms.

He said the government will also support private R&D investment by increasing funding for core Innovate UK programmes, reaching circa £1 billion per year by 2024-25, over £300 million more per annum than in 2021-22.

The government also plans to reform R&D tax reliefs to support modern research methods.

“The government’s investment towards R&D and innovation is welcome but there needs to be encouragement at the early stage investment level in order to ensure this innovation results in growth,” said Sarah Barber, CEO of Jenson Funding Partners. “Entrepreneurs and businesses need to be assisted on their journey – making sure they are supported and are receiving the right amount of funding.”

Moray Wright, CEO at Parkwalk: “It’s great to see the continued commitment to R&D spending, which will help the UK maintain its position as a world leading innovator and university powerhouse, and the investment is attempting to translate more of this innovation into value back to UK plc, rather than taken overseas.”

Skills investment

The government intends to double the available scholarships for AI and Data Science Master’s conversion courses with a £23 million investment for under-represented groups.

The Chancellor said he will also raise spending on skills and training by £3.8bn over the parliament, an increase of 42%.

“Apprenticeships are key to closing the digital skills gap in the UK. They offer individuals the opportunity to earn while they learn, democratising entry into the digital labour market,” said Claudia Harris OBE, CEO of Makers software bootcamp.

“For companies they provide the opportunity to hire talent trained to a standard created by industry – so job-relevant by design. We welcome the government’s continued backing for apprenticeships and digital skills training and are delighted to see ever more companies using the levy to bring extraordinary and diverse talent into their tech teams.”

Paramjit Uppal, CEO and Founder of AND Digital: “The whispers of a ‘skills revolution’ appear to still be channelled towards young adults aged 16-19, with Sunak dedicating £1.6bn towards the new ‘T-levels’ initiative which includes digital production as well as design and development.

“This is a step in the right direction. However, I would like to see more going into the software design and development skills. The UK needs more skilled people who can build software and data solutions for every organisation – the gap in the needs of large and small, private and public sector organisations and the availability of talent is the single biggest competitive threat to the UK over the next 3-5 years.”

Kirstie Donnelly MBE, CEO of City & Guilds Group: “We need more clarity over whether the Chancellor’s commitments to the sector are new, or merely a rehash of funding that was already allocated and sold to us as something ‘new’.

“Undoubtedly, some solid foundations have been put into place in terms of T Levels and apprenticeships, but make no mistake there is still significant work to be done. For starters, if T Levels are to succeed they will need young people to choose to study them.

“This will require a significant amount of support from government over the next few years to promote them to young people, their parents and teachers alike, and convince them of the life changing benefits they could bring.”

Nic Redfern, finance director of NerdWallet: “This government has long since promised to ‘level up’ and close the UK’s skills gap – and it’s positive to see the government reinstating its commitment to this rhetoric.

“Brexit has imposed recruitment pressures on businesses across the UK… an additional £3bn to invest in upskilling both existing and future workforces certainly sends a positive message that the UK is prepared to prioritise home-grown talent, post-Brexit.

“As is always the case with such policies, the devil will be in the detail. The government must commit to a transparent process when it comes to fund allocation to ensure that funding is evenly distributed amongst industries, and indeed individuals who would benefit the most. Otherwise, there runs the risk of the employment gap widening even further within certain sectors.”

Angels network

Sunak confirmed that £1.4bn will be set aside for a Global Britain Investment Fund to help lure in foreign investment whilst also confirming a £150m cash pot for regional angel investors.

“Whilst we welcome the money for regional angel investors, why allocate 10x more funding to attract foreign investments when you still have so much untapped potential internally?” Stephen Page, founder and CEO, SFC Capital, responded.

“For example, boosting the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) within the UK would encourage greater investment here at home. Foreign investments are great but they also mean that future profits & returns will go outside the UK to overseas investors eventually.”

Luke Davis, CEO of IW Capital: “The spending announced in the Budget today will be welcomed by the small businesses in the regions, but more should be done to support what is a vital section of the economy. I believe that the success of the SMEs of the UK and the economy as a whole are inexorably linked, especially over the next few years.

“With this in mind, we would have liked to see successful schemes such as the Enterprise Investment Scheme expanded to increase private investment into small, growing firms in the UK.

“There is a huge amount of talent and ambition in Britain’s entrepreneurial ecosystem and helping them to grow and innovate should be high on the government’s agenda.”

Nayan Gala, co-founder of startup investment bank JPIN VCATS: “The UK’s startup ecosystem in the regions will be pleased to see the increased funding for angel investors in the areas outside of London as this is a key area that is often overlooked, especially in the early stages.

“We were hoping, however, to see further support for this section of the economy which creates an enormous amount of jobs and wealth for the UK treasury, creating unicorns at a rate of roughly one a week.”

Connectivity pledge

The government promised grants worth £1.4bn which will be given to ‘internationally mobile’ companies to invest in UK infrastructure.

“With eCommerce coming to the fore, it’s great to see a commitment to improving networks, which will in turn allow this sector to embrace digital transformation,” said Sarita Runeberg, business development director at Reaktor.

“From greater personalisation to tempt specific customers through to understanding best practice to improve sustainability and minimise waste – data holds the answers.”

Space race

Funding will be made available for the UK to become the first country to launch a rocket into orbit from Europe in 2022, with the aim of becoming a leader in commercial small-satellite launch.

This has previously been set out in the National Space Strategy.

Global Talent Network

A new UK Global Talent Network will work with businesses and research institutes to identify and attract the best global talent in key science and tech sectors.

Russ Shaw CBE, founder of Tech London Advocates and Global Tech Advocates, said: “Doubling Innovate UK’s annual budget to £1bn, launching the Global Talent Network and incentivising R&D domestic spending are eye-catching policies for the tech sector – although it is a real shame that the Chancellor has thrown cold water on the R&D proposal by delaying it for two years.

“London has been a global tech hub for some time now – but the Chancellor’s commitment to making the UK a ‘science and tech superpower’ is an extremely promising step towards cementing the entire country’s position as a true international digital leader.”