American company FatBrain AI has moved to acquire London-based FinTech Predictive Black.

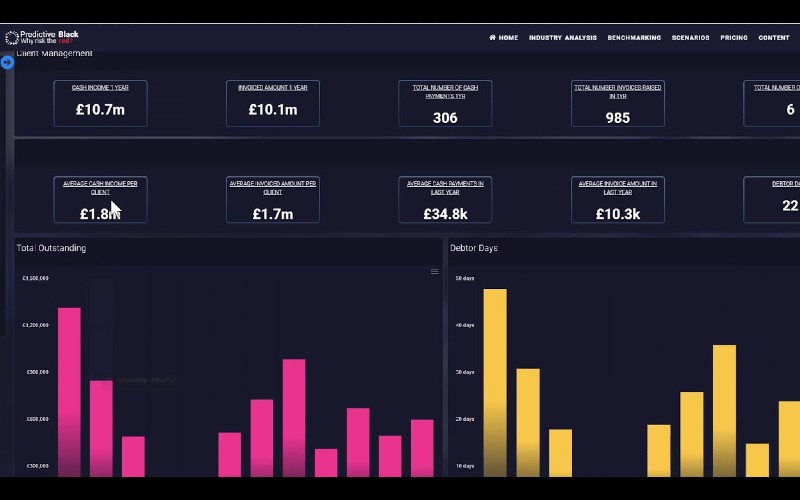

The latter is a SaaS platform which allows SMEs to forecast revenue, costs and cash by connecting and scoring its clients’ financial signals from banking data and accounting software.

Its intelligence dashboards are organised by relevant, adjacent product and service sectors as well as by postal code.

“Maximising cash flow across growth needs, product mix and pricing demands is a hard problem for most businesses, and especially SMEs,” said Peter B. Ritz, co-founder and CEO of FatBrain AI.

“With the Predictive Black subscription, any business can quickly and easily wargame critical decisions on price, product and revenue cycles. Play out the worst to best scenarios and optimise for profit – all while grounded within the context of outcome dynamics realised by their market peers.”

FinTech 50 – UK’s most innovative financial technology creators for 2022

FatBrain’s subscription model allows all companies to deploy its advanced AI solutions quickly and easily, securely utilising them on premises behind their firewalls or via cloud. Its global footprint includes design and development centres in the US, India, Kazakhstan and the UK.

“We take the hassle and stress out of financial forecasting, giving all businesses quantitative confidence over their financial future,” said Zitah McMillan, CEO and co-founder of Predictive Black, which is FCA-regulated.

“Our regional, national and multinational banking partners are motivated to distribute Predictive Black SaaS to thousands of their SME customers, enabling accelerated credit delivery, risk selection and risk appetite optimisation.

“The framework enables policy makers at the regional, national and multinational levels with greater clarity and visibility for attainable, growth-boosting, responsible regulation.”

Predictive Black is an alumni of the Creative Destruction Lab at Oxford University.

Silicon Valley? Tech sector reacts to Chancellor’s Autumn Statement