Stable and consistent revenue streams are necessary to provide financial security and sustainable growth. Among the best ways of achieving this is through recurring revenue models. These models give businesses a steady, long-term source of income.

What is Recurring Revenue?

Recurring revenue is revenue that can be expected by a company on a recurring basis, often through subscriptions, contracts, or repeat-paid services for some time. Unlike one-time sales, recurring revenue is predictable and fixed, which is why it is so attractive to companies, big or small.

Some recurring revenue models include:

- Subscription-based businesses (e.g., SaaS, music streaming)

- Membership clubs (e.g., gyms, exclusive clubs)

- Maintenance or service contracts (e.g., software maintenance, house maintenance)

- Leasing agreements (e.g., rental equipment)

Why Recurring Revenue is a Game Changer

Here are the 5 reasons.

Customer Retention and Loyalty

Recurring models of revenue usually form more sustainable customer relationships. As there are repeated contracts or subscriptions, companies can establish other touchpoints through which they can engage with their customers. Opportunities for customer retention are increased, and brand loyalty is triggered, which is critical in the long run.

Cash Management

With regular payments, firms can better manage their cash flow. Instead of relying on frequent huge payments, firms enjoy a stable cash flow, which they can invest in operations, advertising, and expansion.

Scalability and Expansion

Recurring revenue models are very scalable. As more customers are acquired by companies, the base of revenue continues to grow without the work of continually acquiring new sales. The model leaves space for companies to focus on nurturing current customers and creating opportunities for upselling while still enjoying the benefit of new sign-ups.

Valuation and Investment

Recurring revenue companies are often more valuable than companies that earn one-time sales. Recurring revenue is seen as a stabilizing element and growth potential driver by investors and buyers. It can lead to better capital access and valuation premiums in the process of mergers and acquisitions.

The Role of Crypto Staking in Recurring Revenue

Crypto staking is the process of locking up cryptocurrency in a blockchain network to facilitate its operation and security. For this, stakers receive a reward, typically in the form of additional tokens, as one would get interested on savings money. It is used in Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS) blockchain systems, such as Ethereum (ETH), Cardano (ADA), and Solana (SOL).

How Does Crypto Staking Generate Repeated Revenue?

Here is how:

- Regular rewards. Periodically, the investors are given staking rewards (daily, weekly, or monthly), providing a passive revenue stream.

- Potential for Compounding. The stakers can also reinvest rewards to gain compounded earnings over the long term.

- Less risk than trading. The staking, unlike trading cryptocurrency, does not involve active handling, providing a more stable revenue stream.

- Alternative to traditional investments. Crypto staking earns a higher yield than traditional savings accounts, potentially yielding 5-20% APY based on the network.

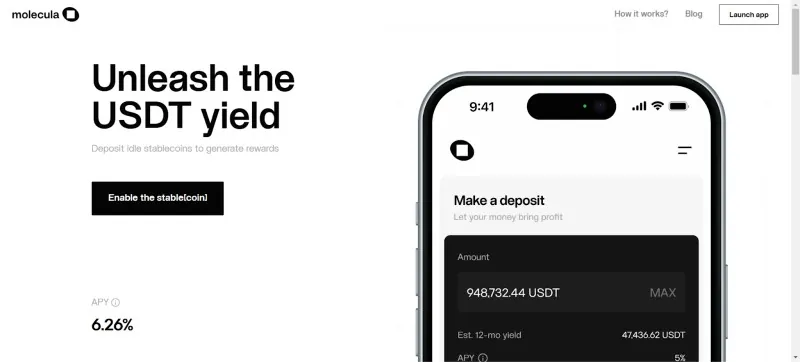

For those seeking financial security, staking offers an additional recurring source of income that complements traditional investments or business incomes. By the way, Molecula can help you with recurring revenue.

Molecula is a yield-generation platform for USDT tokens. It is distributing them between profitable DeFi platforms and RWA. Moreover, Molecula rewards you with internal assets for being a part of its protocol and community. No lock-ups. You can get your USDT back anytime.

How to Unlock Financial Security with Recurring Revenue

So, let’s discuss 7 important steps:

- Find opportunities for recurring revenue. The initial step is to find opportunities within your business that can be converted into a recurring revenue model. This could be through providing subscription services, long-term contracts with customers, or a membership program. Analyze your business and customer requirements to identify where this model will bring value.

- Customer experience focus. A good recurring revenue model is dependent on retaining customers. To do so, businesses must focus on providing better value and customer experience. Providing better customer service, regular updates, customized interactions, and open communication helps build trust and loyalty.

- Diversify revenue streams. Although repeat revenue can be extremely appealing, depending on one type of recurring revenue to build a company on can jeopardize it. Diversifying revenue streams—such as offering various subscription levels or additional services—eliminates some of the dangers and increases the potential.

- Leverage technology. Technology lies at the heart of managing recurring revenue models. Subscription management software, automated billing platforms, and customer relationship management (CRM) platforms can aid businesses in maximizing processes, reducing friction, and offering smooth operations. Automation also facilitates freeing resources to focus on growth activities.

- Evaluate pricing and value propositions. Companies must regularly evaluate their pricing models to be successful in the long run. There must be a balance between being competitively priced and offering value. Customer needs and market trends must be regularly evaluated and redefined so that the products are updated, and new features or services must be introduced that facilitate upselling or cross-selling.

- Build a strong brand. A recognizable and trusted brand is necessary to acquire and retain customers. Your recurring revenue model will be more effective if customers trust your brand and see the long-term value of your products or services. Invest in building your brand’s reputation through marketing, good customer word-of-mouth, and consistent product delivery.

Continuous monitoring of recurring revenue metrics is the most critical means of understanding your business’s financial health. Churn rate (the rate at which customers cancel subscriptions), customer lifetime value (CLTV), and customer acquisition cost (CAC) are good metrics to track. Use this data to make informed decisions and hone your products.

Conclusion

In a time when economic stability becomes unattainable, corporations that adopt recurring revenue models fare better. With the ability to project revenue, retain customers more effectively, and expand easily, it becomes a more stable model for business. Tactically transitioning to or expanding upon a recurring revenue model, corporations achieve the economic stability they need to perform in the long term.