European unicorn Bitpanda has acquired London-based FinTech Trustology.

Trustology, an institutional cryptocurrency custodian wallet provider, will be rebranded as Bitpanda Custody.

It will initially take custody of Bitpanda’s own assets across its retail, institutional and whitelabelling businesses, making it one of the largest digital assets custody providers globally.

“Everything we do is driven by the belief that blockchain technology and digital assets will profoundly transform the financial ecosystem, with the clear outcome that people around the globe will have the power to own their financial futures,” said Eric Demuth, co-founder and CEO of Bitpanda.

“Bitpanda Custody brings us one step closer to building a leading, fully regulated and secure digital investment platform for everyone, new investors and professionals alike.

“We can now provide retail customers with world-class institutional-grade custody security, and institutional clients will benefit from innovative custody solutions in order not to only overcome the challenges they face today, but also thrive in the years to come.”

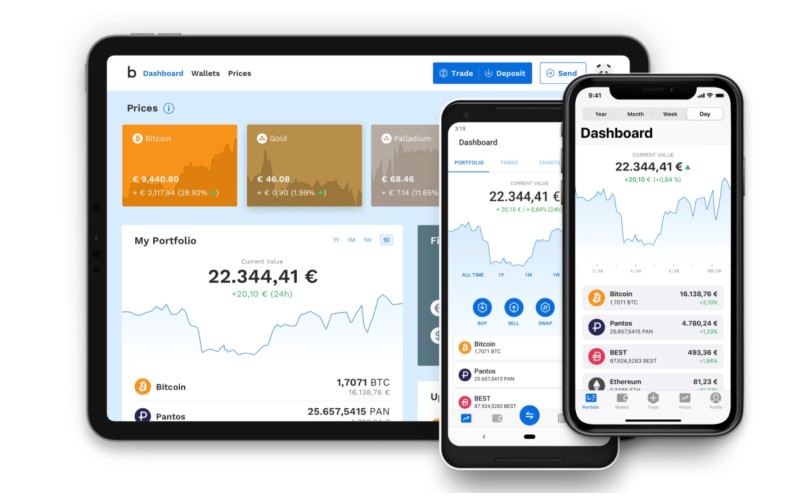

Bitpanda was founded in 2014 by Eric Demuth, Paul Klanschek and Christian Trummer as a crypto-trading company aiming to modernise investments in the era of digital assets.

Since then, the company has grown into a leading European investment platform allowing people to invest in commission-free fractional stocks, cryptocurrencies or precious metals from as little as €1.

Bitpanda Custody will be able to perform custodian services in the United Kingdom alongside Bitpanda’s existing licences in the European Union, while significantly expanding the range of services provided to customers and partners.

Joshua Barraclough, Bitpanda Pro CEO, explained: “Bitpanda Custody is part of our strategy to offer a fully comprehensive set of services to our client base and we can now combine an FCA-registered, institutional-grade custody solution with a leading trade execution venue.

“Recently, we have invested a lot in upgrading Bitpanda Pro exchange as well as boosting our liquidity partnerships, so that we can compete with the largest exchanges on execution capabilities. Now we are looking to massively increase our footprint and bring lots more clients to our venues.

“Importantly we are moving away from an asset under custody pricing model and are not penalising our clients’ growth. We have great plans in the pipeline and are doubling down on bringing new products to market, including building on Trustology’s leading DeFi functionality.“

After the completed acquisition and rebrand, Bitpanda accounts for 700+ employees spread across 10 offices, with its headquarters in Vienna, Austria.

It will now hire extensively for its London office.