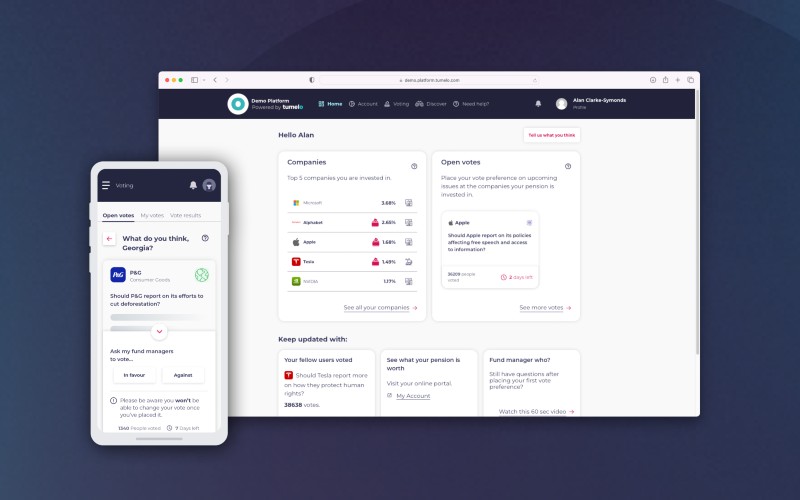

Shareholder voting FinTech Tumelo has brought together a trio of partnerships to deliver pass-through voting to the institutional and retail clients of fund managers.

Tumelo provides the ‘tech pipes’ for the votes while the proxy advisors it has partnered with – Glass Lewis, Pensions & Investment Research Consultants and As You Sow – provide the advice and recommendations.

Policymakers at the Treasury, DWP and FCA have been releasing recommendations to better hold fund managers to account with respect to stewardship. In 2021 the Taskforce on Pension Scheme Voting Implementation Report published a series of recommendations for tightening up the voting relationship between asset managers and asset owners.

Bristol-based Tumelo, fourth on our FinTech 50 ranking, says the tie-ups will give both retail and institutional clients access to high-quality proxy research to better make decisions at the point of voting.

Fund managers will also be able to display their vote intentions to their investors ahead of the vote, the company adds.

Tumelo’s technology means investors can vote at scale across their investment holdings on the issues they care about, while fund managers can continue to vote on any shares on which their investor clients have chosen not to exercise their own preference.

Will Goodwin, co-founder at Tumelo, said: “This partnership allows Tumelo to solve two big problems for our customers. Investors across the network are now provided with the same high-quality advice as fund managers, helping them to make informed decisions.

“We can also now show investors how their fund managers intend to vote in the fund ahead of it happening, allowing for greater transparency.”

Dan Concannon, chief commercial officer at Glass Lewis, added: “Glass Lewis has developed a suite of thematic proxy voting policies to meet the varying needs of investors. For example, we have a Climate Policy for those investors who wish to prioritise the mitigation of climate risk in their investments.

“We also recently launched the Governance-Focused Policy which ensures that boards of directors are appropriately positioned to devote the time and attention necessary to fulfil their fiduciary duty to shareholders. Our important partnership with Tumelo will widen the access to our policies and enable more investors to vote in alignment with their goals.”

FinTech 50 – UK’s most innovative financial technology creators for 2022

Tom Powdrill, head of stewardship, PIRC Limited, said: “All of us at PIRC are very excited to be working with Tumelo on this ground-breaking initiative to empower investors. For too long asset owners have been frustrated by their inability to apply their voting policies when they invest through pooled funds.

“We also understand the challenges asset managers face in accommodating increasingly divergent client views. Tumelo has developed a great solution to these problems and we are already talking to a number of clients about how they can use it. This is a real breakthrough for effective stewardship.”

Andrew Behar, CEO of As You Sow, a US-based shareholder advocacy non-profit, said: “Our ESG-aligned voting platform called As You Vote has, to date, only been available for institutional investors. Tumelo has empowered pension holders and individuals with their savings in mutual funds and ETFs to subscribe to our guidelines and align their proxy voting with their values.

“Making proxy voting more democratic will enable every person who is saving for their retirement to send a strong signal to company management and their boards that they want to see accurate disclosure of material information, reduction of risk, and the implementation of policies and practices to achieve a just and liveable planet for themselves and their children.”