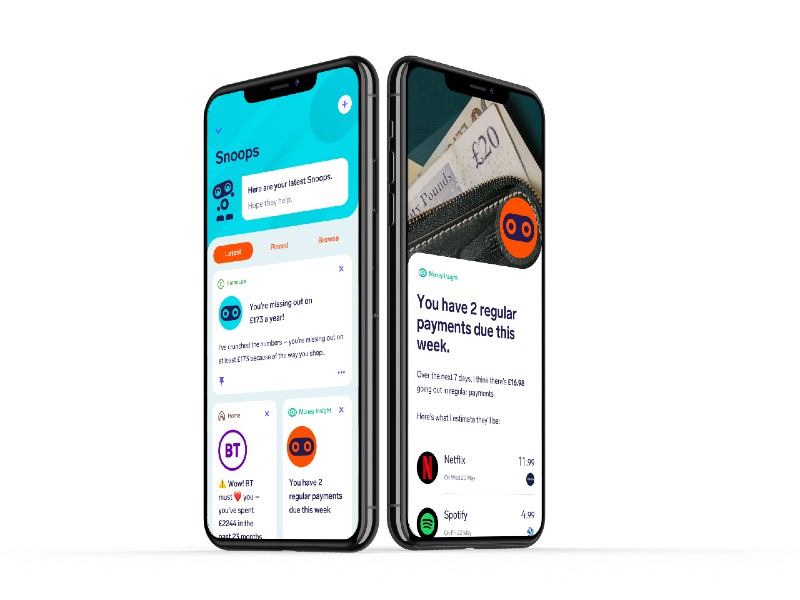

European open banking platform Tink is working with money-saving app Snoop to give UK consumers real-time insights on how to cut their bills, pay off debt, grow their savings and save where they spend.

This summer Snoop passed one million downloads. Together with Tink, the app empowers people to use their own data as a powerful force to save money and take control of their finances.

In helping consumers navigate the very serious challenges presented by the cost-of-living crisis the collaboration is showcasing the significant benefits that open banking technology has enabled.

“Consumers are already having a terrible time of it right now and, with interest rates going through the roof from all-time lows, people with mortgages and debts are facing a very real credit crunch over the coming months,” said John Natalizia, co-founder and CEO at Snoop.

“Our aim is for Snoop to be an essential resource for everyone looking to navigate these turbulent times. Working together with Tink means we can provide contextual money-saving insights and deliver a personalised, fast and accurate customer experience.”

Tom Pope, head of payments and platforms at Tink, added: “With inflation at its highest in over forty years, services like Snoop are invaluable as the cost of living continues to soar.

“By providing proactive money management insights, through data that shows consumers where they can save — this is a collaboration that is demonstrating the real-world value of open banking.”