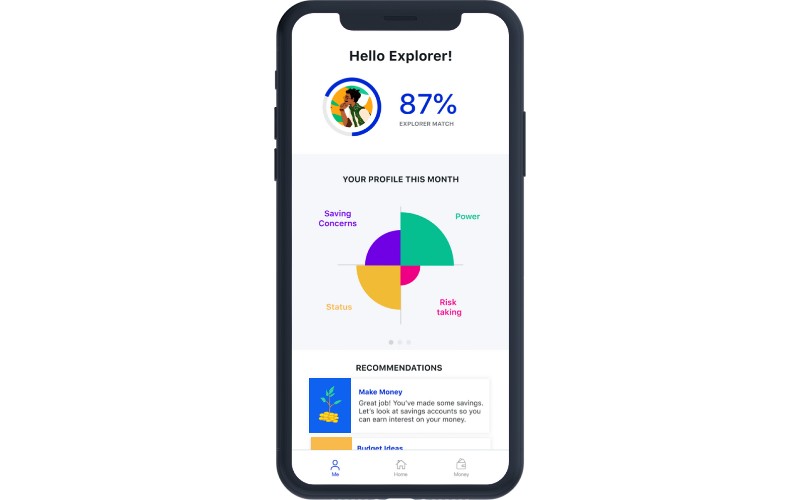

A start-up app which helps people manage their money according to their personality has raised £300,000.

London-based Quirk uses unique personality testing to deliver tailored financial advice to young professionals.

The pre-seed funding comes from SFC Capital and angel investors and will be used to grow its team and expand its product offering.

The tests are based on accepted psychological principles. For instance, Quirk has identified that men are three times more likely than women to enjoy buying expensive products to impress others, and that people who score high in neuroticism/emotionality tend to make more money but will also save less.

With support from expert psychologists, Quirk says it uses the latest behavioural research to deliver a personalised product experience with educational content and insights about users’ spending habits.

It also gives users access to data about their money by connecting their bank accounts, tracking subscriptions and setting up ‘spending goals’.

More than 10,000 people have taken Quirk’s “money personality test” since launch in April last year.

Quirk currently has more than 1,000 beta users using the app, with a further 5,000 people on the waiting list.

Both iOS and Android versions are available for beta testers through the Quirk website, and the apps will launch publicly on app stores in March 2021.

Co-founders Nafeesa Jafferjee and Nikos Melachrinos

“There is no ‘one size fits all’ answer when it comes to managing your finances,” said Nafeesa Jafferjee, chief of product.

“What should I do with my savings? What’s the difference between good debt and bad?

“A lot of young people we talked to felt there was a lot of information out there, but it lacked context on their financial situation and advice on what tangible actions they should take.”

Ed Stevenson, investment executive at SFC Capital, said: “Financial planning has become more important than ever, with the cost of living and asset prices skyrocketing.

“We were impressed by the Quirk team’s ability to design a product that would appeal to Millennials and Gen Z, and ultimately help put them on a path to financial independence.

“Users gain control over their personal finances in a simple, fun and engaging way, all the way from their first pound in the bank through to retirement and beyond.”